Whether you're borrowing money or providing a loan to someone else, a Promissory Note is usually the best way to establish a record of the transaction and make sure that repayment terms, for example, are clear and fair.

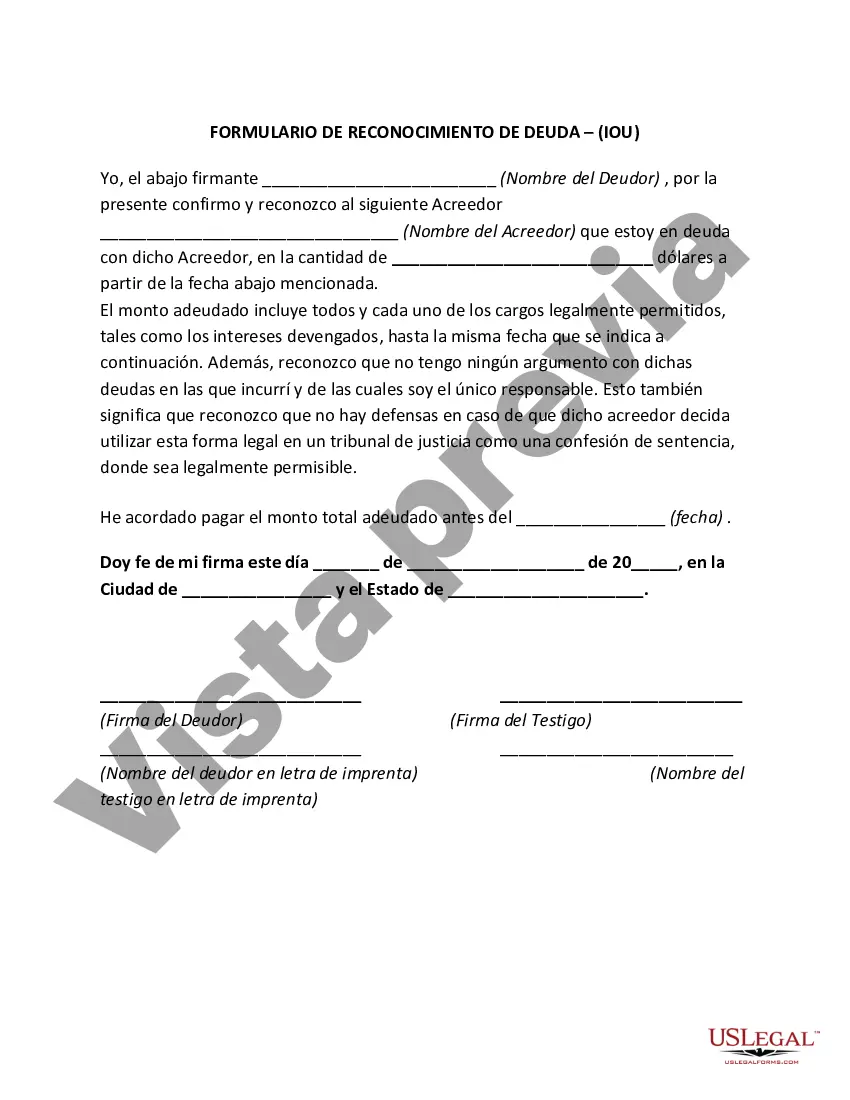

However, an “IOU†is generally regarded as only an acknowledgment of a debt, not a promise to pay the debt. However, this form is a written promise to pay a debt.

Cuyahoga Ohio Debt Acknowledgment — IO— - I Owe You In Cuyahoga County, Ohio, a Debt Acknowledgment, commonly referred to as an IOU (I Owe You), is a legal document used to formalize and recognize a debt owed by one party to another. This document serves as evidence of a financial obligation and outlines the specific terms and conditions agreed upon between the borrower, known as the debtor, and the lender, known as the creditor. The Cuyahoga Ohio Debt Acknowledgment — IO— - I Owe You typically contains the following key information: 1. Parties Involved: The names, addresses, and contact information for both the debtor and the creditor are mentioned. 2. Amount of Debt: The IOU clearly states the exact amount owed by the debtor to the creditor, including any applicable interest, fees, or charges. 3. Date of Agreement: The date when the debt acknowledgment is created is specified, ensuring a proper record of the agreement. 4. Payment Terms: The document lays out the repayment terms, such as whether it will be a lump sum payment or installments, the due dates, and any penalties for late or missed payments. 5. Interest and Charges: If interest is applicable, the IOU will indicate the interest rate and whether it is fixed or variable. Additionally, any late payment fees or other charges are mentioned in this section. 6. Signatures: The debtor and creditor must sign the document to certify their acknowledgment of the debt and agreement to the terms established. Different Types of Cuyahoga Ohio Debt Acknowledgment — IO— - I Owe You: 1. Personal Debt Acknowledgment: This type of IOU covers debts between individuals, such as loans between friends or family members. 2. Business Debt Acknowledgment: In cases where a business borrows money from another business or an individual, a business debt acknowledgment is used to establish the financial obligation. 3. Promissory Note: While not specifically an IOU, a promissory note is another form of debt acknowledgment. It is a legally binding document that contains a promise to repay a specific amount of money by a certain date or according to a predetermined schedule. Promissory notes often include additional legal provisions to safeguard the rights of both parties. It is important to note that Cuyahoga Ohio Debt Acknowledgment — IO— - I Owe You documents should be created, executed, and interpreted based on the specific laws and regulations of Ohio. Seek legal advice or consult professional resources to ensure compliance and validity of such agreements in your particular jurisdiction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.