Whether you're borrowing money or providing a loan to someone else, a Promissory Note is usually the best way to establish a record of the transaction and make sure that repayment terms, for example, are clear and fair.

However, an “IOU†is generally regarded as only an acknowledgment of a debt, not a promise to pay the debt. However, this form is a written promise to pay a debt.

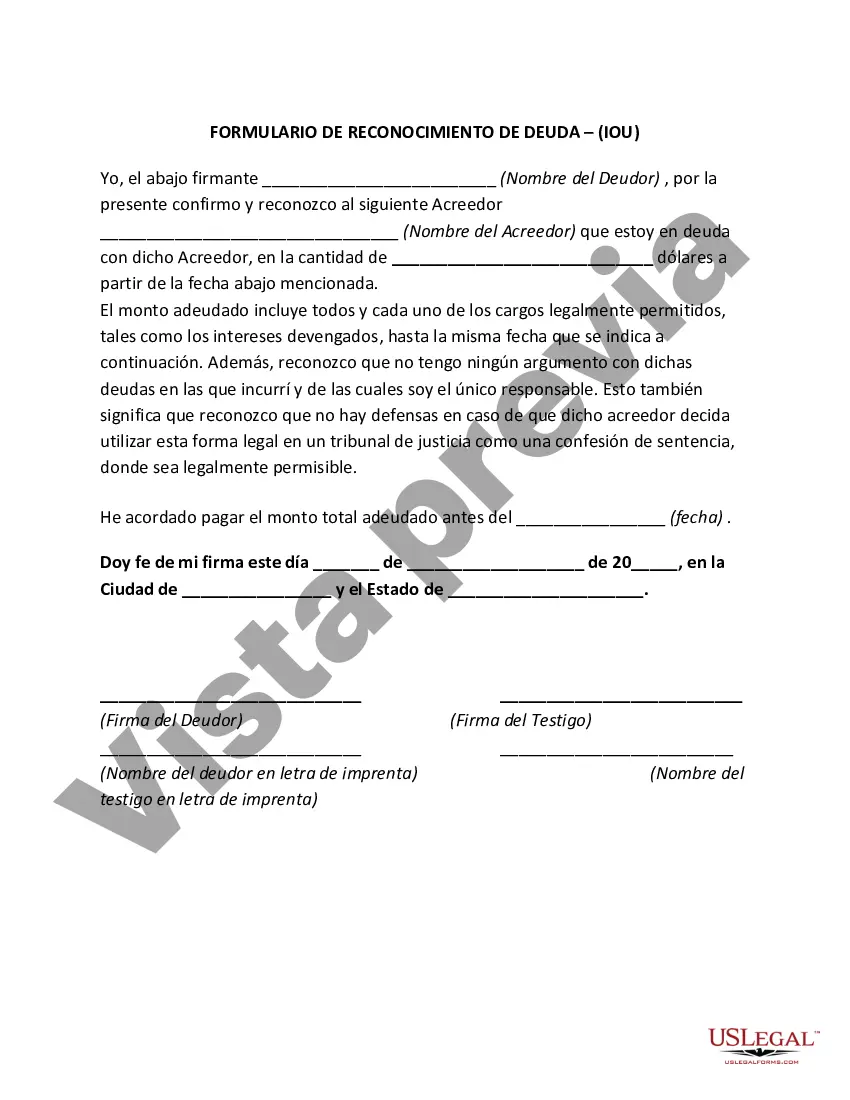

Harris Texas Debt Acknowledgment — IO— - I Owe You: Detailed Description and Types In Harris County, Texas, the Debt Acknowledgment — IO— - I Owe You is a legal document commonly used to acknowledge the existence of a debt owed by one party to another. This document represents a mutual understanding between the debtor and the creditor regarding the amount borrowed and the terms of repayment. It is crucial for both parties to have a clear and comprehensive debt acknowledgment in order to prevent any misunderstandings or disputes in the future. The Harris Texas Debt Acknowledgment — IO— - I Owe You typically includes important components such as: 1. Names and Contact Information: The debtor's and creditor's full names, addresses, and contact details need to be mentioned accurately. 2. Debt Description: The document must specify the nature of the debt, including the purpose or reason behind borrowing the money. It can be a loan, credit transaction, or any other form of financial obligation. 3. Principal Amount: The exact amount of money owed, including any interest, penalties, or additional charges, should be clearly stated in both numerical and written forms. 4. Payment Terms: The agreed-upon method and schedule of repayment must be specified. This may include the repayment amount, due dates, frequency (monthly, quarterly, etc.), and any other relevant details such as grace periods or late payment penalties. 5. Signatures and Witness: Both the debtor and creditor should sign the debt acknowledgment as a sign of acceptance and agreement. Additionally, it is advisable to have at least one witness sign the document to validate its authenticity. Types of Harris Texas Debt Acknowledgment — IO— - I Owe You: 1. Personal Loan Debt Acknowledgment: This type of debt acknowledgment is commonly used between friends, family members, or individuals who have a personal relationship. It helps establish a formal agreement to protect both parties' interests. 2. Small Business Debt Acknowledgment: Entrepreneurs and business owners often use this type of document when borrowing money for their business operations. It outlines the terms and conditions agreed upon between the business and the lender. 3. Legal and Commercial Debt Acknowledgment: Law firms, corporations, or any other entities engaging in financial transactions can utilize this type of debt acknowledgment to establish a legally binding agreement. 4. Mortgage Debt Acknowledgment: This specific type of debt acknowledgment is used in real estate transactions, acknowledging the debt incurred by a borrower for purchasing a property. It outlines the terms of the mortgage, as well as the property details and collateral involved. 5. Debt Acknowledgment with Collateral: In certain cases, when the borrower pledges collateral (such as a vehicle, property, or valuable assets) as security for the debt, a specific debt acknowledgment is used to reflect this agreement. By utilizing a Harris Texas Debt Acknowledgment — IO— - I Owe You, individuals and organizations can establish a clear understanding of their financial obligations, mitigate risks, and protect themselves legally. It is advisable to consult a legal professional familiar with the applicable laws to ensure the accuracy and enforceability of such documents.Harris Texas Debt Acknowledgment — IO— - I Owe You: Detailed Description and Types In Harris County, Texas, the Debt Acknowledgment — IO— - I Owe You is a legal document commonly used to acknowledge the existence of a debt owed by one party to another. This document represents a mutual understanding between the debtor and the creditor regarding the amount borrowed and the terms of repayment. It is crucial for both parties to have a clear and comprehensive debt acknowledgment in order to prevent any misunderstandings or disputes in the future. The Harris Texas Debt Acknowledgment — IO— - I Owe You typically includes important components such as: 1. Names and Contact Information: The debtor's and creditor's full names, addresses, and contact details need to be mentioned accurately. 2. Debt Description: The document must specify the nature of the debt, including the purpose or reason behind borrowing the money. It can be a loan, credit transaction, or any other form of financial obligation. 3. Principal Amount: The exact amount of money owed, including any interest, penalties, or additional charges, should be clearly stated in both numerical and written forms. 4. Payment Terms: The agreed-upon method and schedule of repayment must be specified. This may include the repayment amount, due dates, frequency (monthly, quarterly, etc.), and any other relevant details such as grace periods or late payment penalties. 5. Signatures and Witness: Both the debtor and creditor should sign the debt acknowledgment as a sign of acceptance and agreement. Additionally, it is advisable to have at least one witness sign the document to validate its authenticity. Types of Harris Texas Debt Acknowledgment — IO— - I Owe You: 1. Personal Loan Debt Acknowledgment: This type of debt acknowledgment is commonly used between friends, family members, or individuals who have a personal relationship. It helps establish a formal agreement to protect both parties' interests. 2. Small Business Debt Acknowledgment: Entrepreneurs and business owners often use this type of document when borrowing money for their business operations. It outlines the terms and conditions agreed upon between the business and the lender. 3. Legal and Commercial Debt Acknowledgment: Law firms, corporations, or any other entities engaging in financial transactions can utilize this type of debt acknowledgment to establish a legally binding agreement. 4. Mortgage Debt Acknowledgment: This specific type of debt acknowledgment is used in real estate transactions, acknowledging the debt incurred by a borrower for purchasing a property. It outlines the terms of the mortgage, as well as the property details and collateral involved. 5. Debt Acknowledgment with Collateral: In certain cases, when the borrower pledges collateral (such as a vehicle, property, or valuable assets) as security for the debt, a specific debt acknowledgment is used to reflect this agreement. By utilizing a Harris Texas Debt Acknowledgment — IO— - I Owe You, individuals and organizations can establish a clear understanding of their financial obligations, mitigate risks, and protect themselves legally. It is advisable to consult a legal professional familiar with the applicable laws to ensure the accuracy and enforceability of such documents.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.