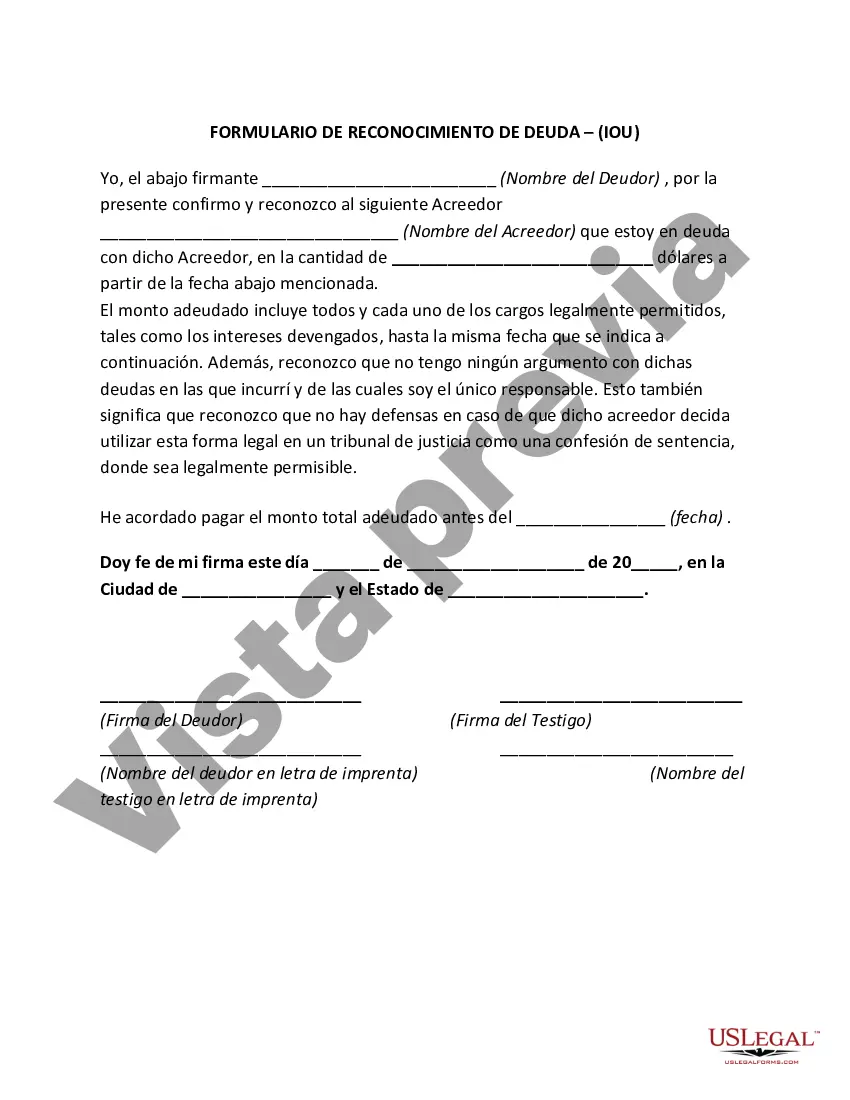

Whether you're borrowing money or providing a loan to someone else, a Promissory Note is usually the best way to establish a record of the transaction and make sure that repayment terms, for example, are clear and fair.

However, an “IOU†is generally regarded as only an acknowledgment of a debt, not a promise to pay the debt. However, this form is a written promise to pay a debt.

San Jose California Debt Acknowledgment — IO— - I Owe You: A debt acknowledgment, also known as an IOU (I Owe You), is a legal document used in San Jose, California, to acknowledge a debt owed by one individual to another. It serves as evidence of a debt and outlines the terms and conditions under which repayment will be made. This document is commonly used in various situations, such as personal loans, business transactions, or any other scenario where money is borrowed or owed. The San Jose California Debt Acknowledgment — IO— - I Owe You typically includes relevant information such as the amount borrowed, the date of borrowing, the name and contact information of the borrower and lender, the repayment terms, interest (if applicable), and any other specific details regarding the loan. Different types of Debt Acknowledgment — IO— - I Owe You in San Jose, California, may vary based on specific circumstances and loan agreements. Some common types include: 1. Personal Loan IOU: This type of debt acknowledgment is typically used when individuals borrow money from family or friends for personal reasons, such as medical expenses, educational purposes, or unexpected emergencies. Both parties involved sign the agreement, ensuring that proper documentation is maintained for future reference. 2. Business Loan IOU: In San Jose, California, businesses often utilize this type of IOU to document loans taken from individuals or financial institutions. Whether it is to fund startup costs or manage cash flow, a business loan IOU outlines the amount borrowed, repayment terms, and interest rates, if applicable, to ensure transparency and legal compliance. 3. Promissory Note: Although not explicitly referred to as an IOU, a promissory note can also serve as a form of debt acknowledgment in San Jose, California. A promissory note typically includes more detailed terms and conditions of the loan, such as repayment schedule, interest rates, consequences of default, and collateral if relevant. 4. Partial Payment Agreement: In certain circumstances, debtors may struggle to repay the full amount owed. Instead of defaulting on the loan, a partial payment agreement can be established. This type of IOU would outline the agreed-upon partial payments, repayment schedule, and any modifications to the original terms. It is important to note that an IOU, or debt acknowledgment, serves as a legally binding agreement between the borrower and lender in San Jose, California. It is recommended to consult legal professionals or utilize online templates to ensure the document adheres to the local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.