Whether you're borrowing money or providing a loan to someone else, a Promissory Note is usually the best way to establish a record of the transaction and make sure that repayment terms, for example, are clear and fair.

However, an “IOU†is generally regarded as only an acknowledgment of a debt, not a promise to pay the debt. However, this form is a written promise to pay a debt.

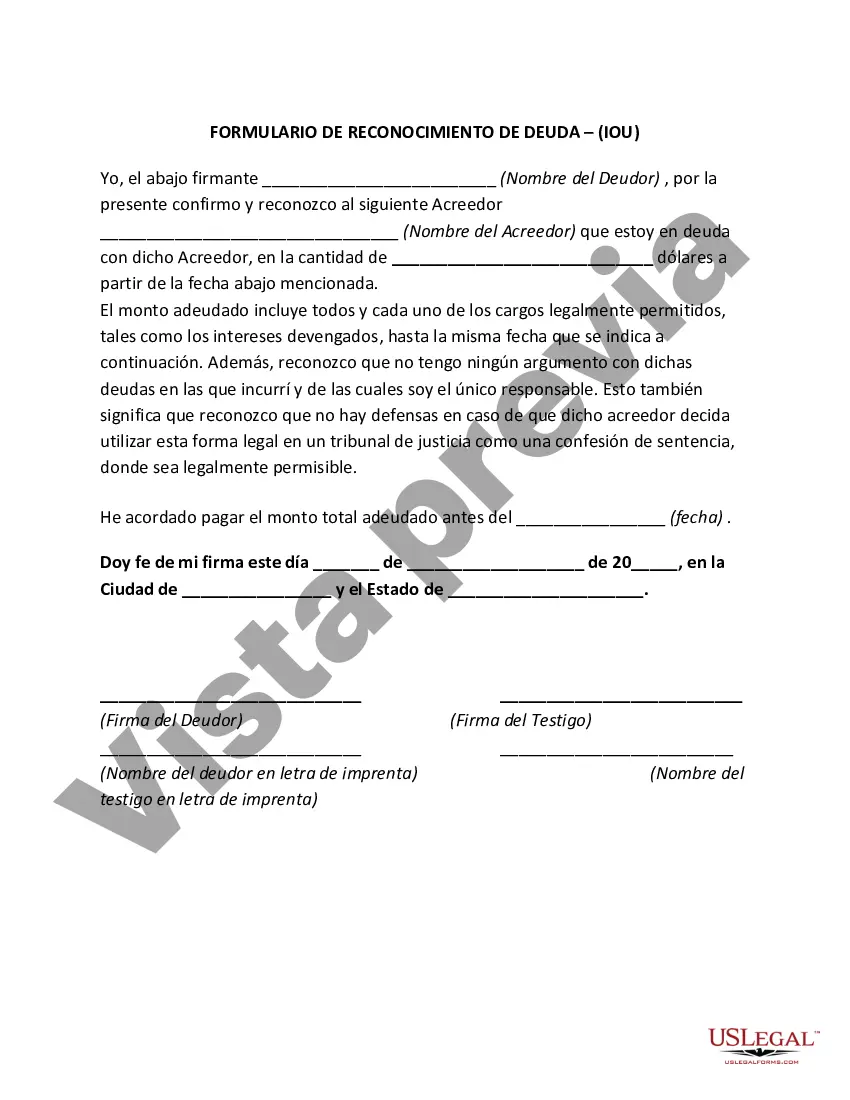

Wake North Carolina Debt Acknowledgment — IO— - I Owe You is a legal document that serves as evidence of a debt owed by one party to another. This document is commonly used in Wake County, North Carolina, to formalize financial transactions and ensure both parties are aware of the debt and its terms. The Wake North Carolina Debt Acknowledgment — IO— - I Owe You typically includes crucial information such as the names and contact details of the debtor and creditor, the date the debt was incurred, the amount owed, and the agreed-upon repayment terms. It serves as a binding agreement, offering protection to both parties involved. There are different types of Wake North Carolina Debt Acknowledgment — IO— - I Owe You, each designed to cater to specific circumstances: 1. Personal Debt Acknowledgment: This type of IOU is commonly used between individuals, friends, or family members who lend or borrow money from each other. It ensures transparency and defines the repayment terms without the need for complicated legal contracts. 2. Business Debt Acknowledgment: This IOU is prevalent in Wake County, North Carolina, within business contexts. It establishes a formal record of debts owed between companies or individuals and commercial entities. It helps protect business transactions and can be used as evidence in case of legal disputes. 3. Legal Debt Acknowledgment: This type of IOU is often used when debts are owed for legal services, such as attorney fees or court-ordered payments. It outlines the obligations and terms established within the legal system, ensuring compliance and accountability. 4. Loan Debt Acknowledgment: This IOU is commonly used when borrowing money from a financial institution, such as a bank or credit union. It outlines the terms and conditions of the loan, including interest rates, repayment schedules, and consequences for non-payment. 5. Mortgage Debt Acknowledgment: This IOU specifically applies to real estate transactions, where a borrower acknowledges the debt owed to a lender for a mortgage loan. It highlights the terms of the loan, property details, and the consequences of defaulting on payments. In all cases, Wake North Carolina Debt Acknowledgment — IO— - I Owe You serves as a vital legal document to ensure clarity and protection in debt-related matters. It is essential to consult a legal professional or use a template provided by relevant authorities to ensure its correctness and enforceability.Wake North Carolina Debt Acknowledgment — IO— - I Owe You is a legal document that serves as evidence of a debt owed by one party to another. This document is commonly used in Wake County, North Carolina, to formalize financial transactions and ensure both parties are aware of the debt and its terms. The Wake North Carolina Debt Acknowledgment — IO— - I Owe You typically includes crucial information such as the names and contact details of the debtor and creditor, the date the debt was incurred, the amount owed, and the agreed-upon repayment terms. It serves as a binding agreement, offering protection to both parties involved. There are different types of Wake North Carolina Debt Acknowledgment — IO— - I Owe You, each designed to cater to specific circumstances: 1. Personal Debt Acknowledgment: This type of IOU is commonly used between individuals, friends, or family members who lend or borrow money from each other. It ensures transparency and defines the repayment terms without the need for complicated legal contracts. 2. Business Debt Acknowledgment: This IOU is prevalent in Wake County, North Carolina, within business contexts. It establishes a formal record of debts owed between companies or individuals and commercial entities. It helps protect business transactions and can be used as evidence in case of legal disputes. 3. Legal Debt Acknowledgment: This type of IOU is often used when debts are owed for legal services, such as attorney fees or court-ordered payments. It outlines the obligations and terms established within the legal system, ensuring compliance and accountability. 4. Loan Debt Acknowledgment: This IOU is commonly used when borrowing money from a financial institution, such as a bank or credit union. It outlines the terms and conditions of the loan, including interest rates, repayment schedules, and consequences for non-payment. 5. Mortgage Debt Acknowledgment: This IOU specifically applies to real estate transactions, where a borrower acknowledges the debt owed to a lender for a mortgage loan. It highlights the terms of the loan, property details, and the consequences of defaulting on payments. In all cases, Wake North Carolina Debt Acknowledgment — IO— - I Owe You serves as a vital legal document to ensure clarity and protection in debt-related matters. It is essential to consult a legal professional or use a template provided by relevant authorities to ensure its correctness and enforceability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.