An angel investor or angel (also known as a business angel or informal investor) is an affluent individual who provides capital for a business start-up, usually in exchange for convertible debt or ownership equity. New start-up companies often turn to the private equity market for seed money because the formal equity market is reluctant to fund risky undertakings. In addition to their willingness to invest in a start-up, angel investors may bring other assets to the partnership. They are often a source of encouragement; they may be mentors in how best to guide a new business through the start-up phase and they are often willing to do this while staying out of the day-to-day management of the business.

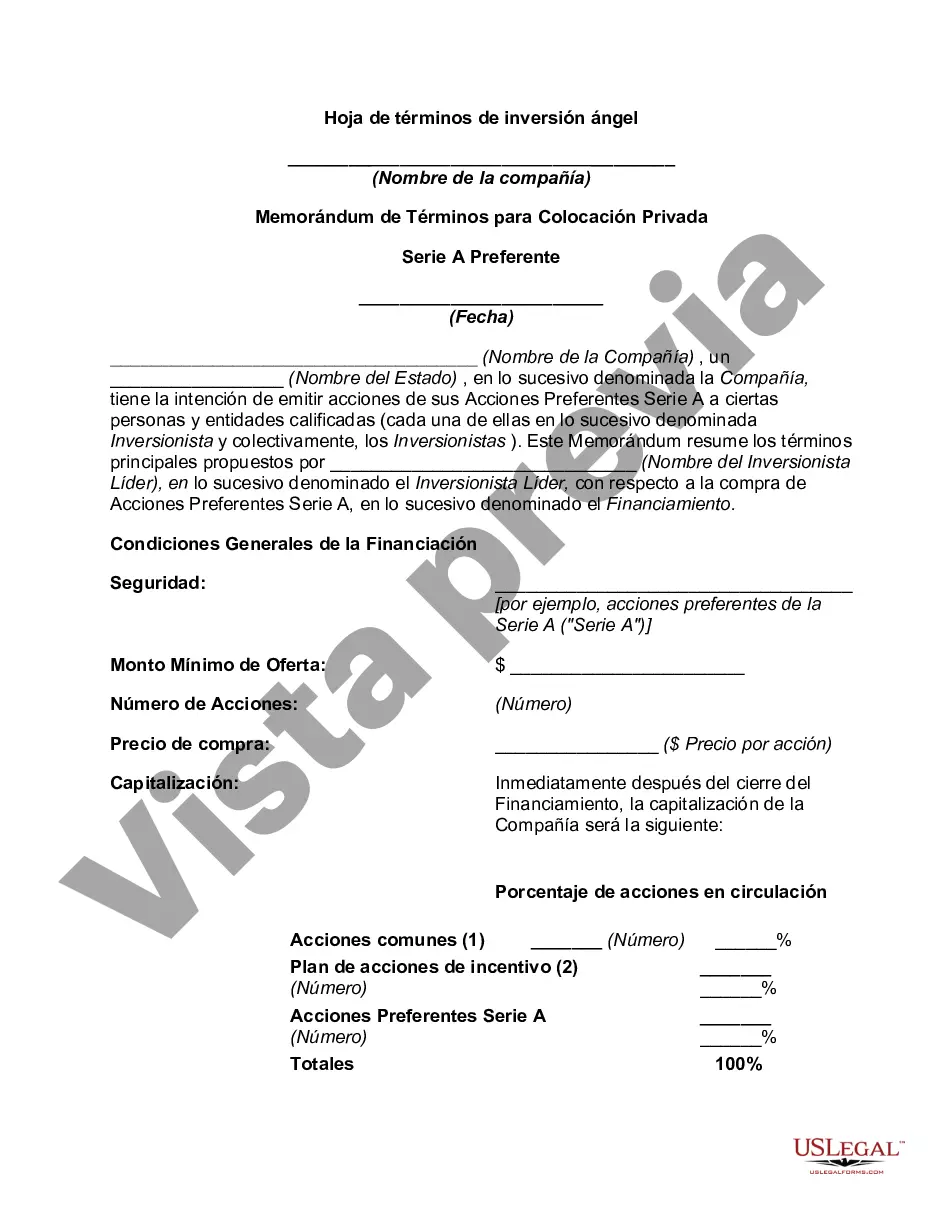

Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made.

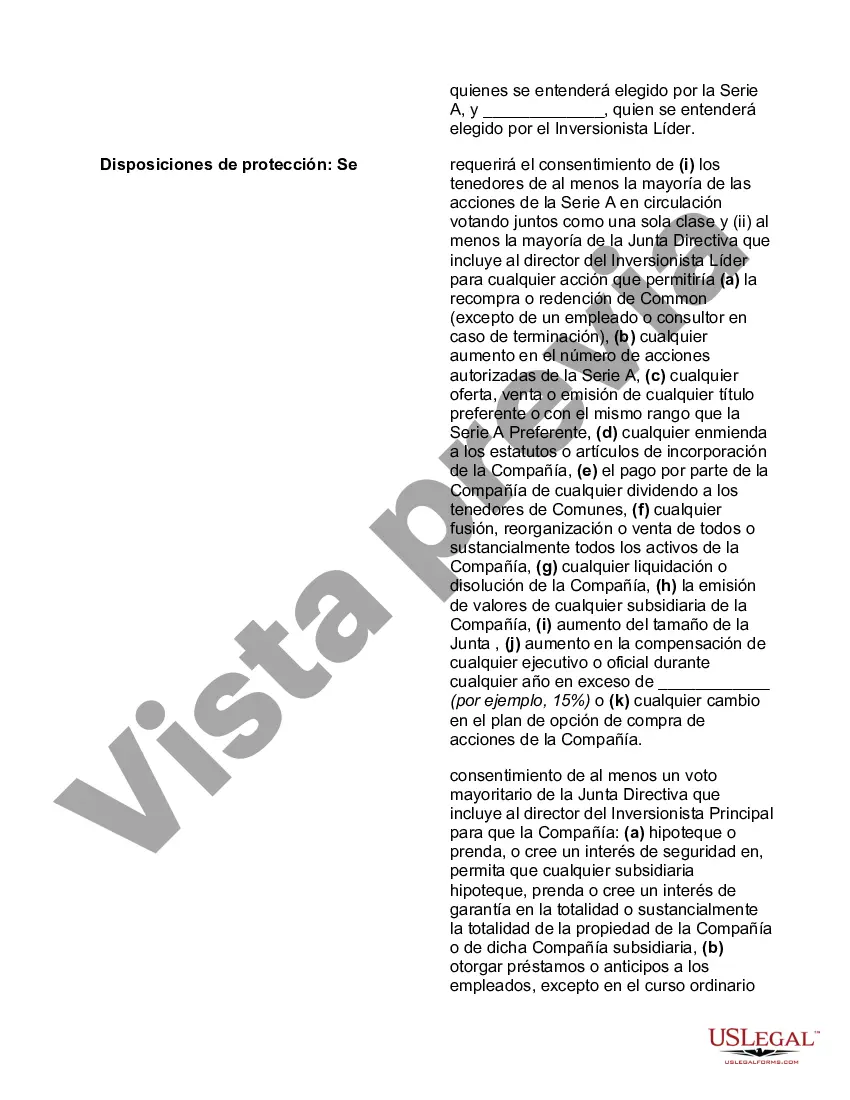

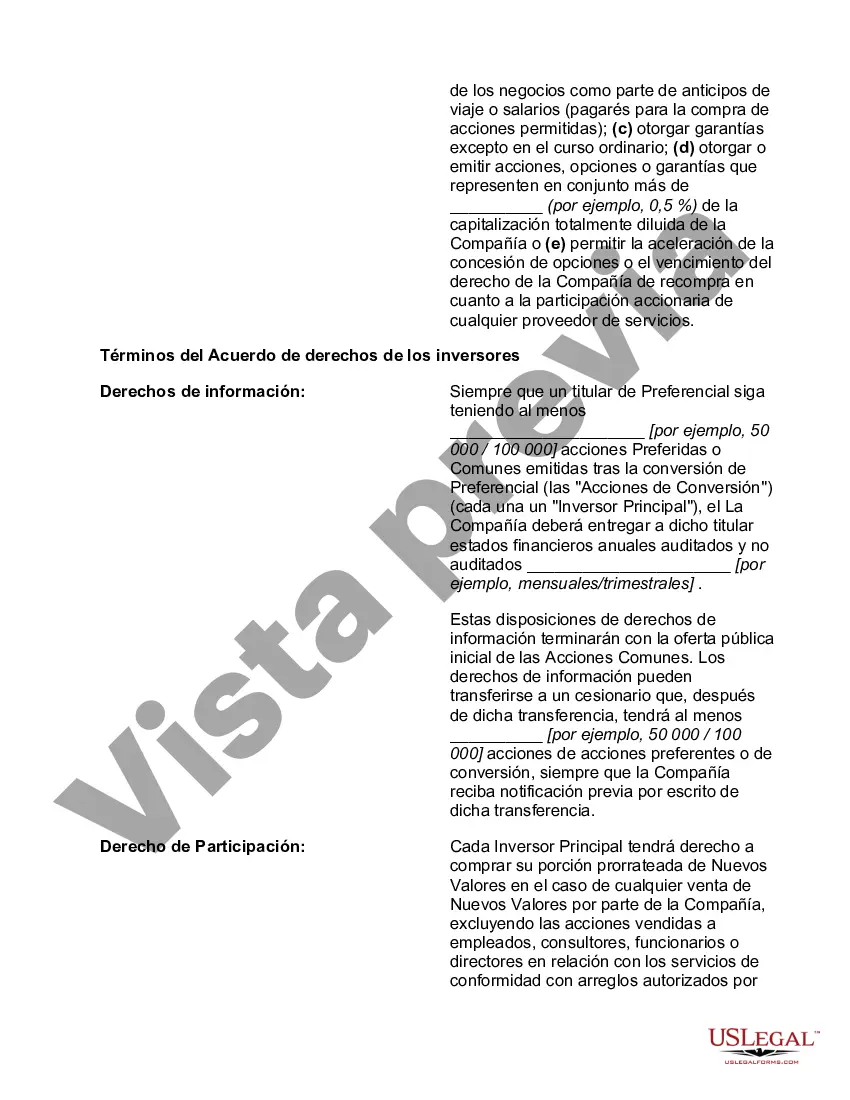

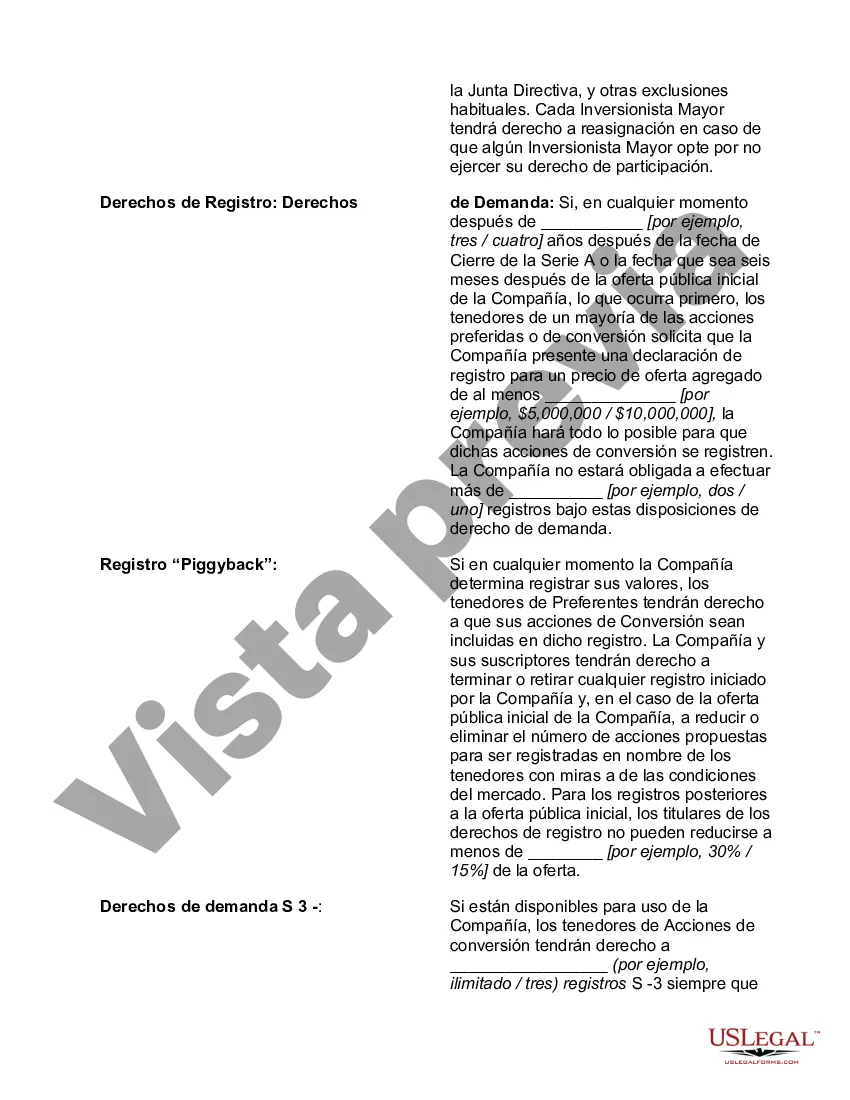

Dallas Texas Angel Investment Term Sheet is a legally binding document that outlines the terms and conditions under which angel investors provide funding to startups or early-stage companies based in Dallas, Texas. This term sheet serves as the basis for negotiations between the investors and the founders, laying out crucial details that drive the investment process and protect the interests of both parties. The main purpose of a Dallas Texas Angel Investment Term Sheet is to establish the framework for the investment agreement, defining the essential elements that dictate the relationship between the investors and the company seeking capital. This includes provisions on investment amount, equity ownership, valuation, rights and privileges, and other critical terms. There are several types of Dallas Texas Angel Investment Term Sheets, including: 1. Convertible Note Term Sheets: This type of term sheet outlines the terms of a convertible note, a debt instrument that converts into equity at a later stage, usually during a future financing round. It covers aspects such as interest rate, maturity date, conversion discount, and valuation cap. 2. Preferred Equity Term Sheets: Preferred equity term sheets define the terms for preferred shares, which hold rights and privileges that differ from common equity. These sheets outline details such as liquidation preferences, dividend rights, anti-dilution provisions, and board seat allocations. 3. SAFE (Simple Agreement for Future Equity) Term Sheets: SAFE term sheets are becoming increasingly popular for early-stage startup investments. They represent an agreement to provide funding at a future equity round but do not involve issuing immediate equity. The term sheet outlines conditions like valuation cap, discount rate, and key points determining the conversion terms when the equity round occurs. 4. Participating Preferred Term Sheets: This type of term sheet covers an equity structure where preferred shareholders have the right to receive their initial investment back first (liquidation preference) and then participate pro rata with common shareholders in any remaining distributions during an exit event. 5. Non-Disclosure Agreement (NDA) or Confidentiality Term Sheets: While not a specific type of investment term sheet, NDAs can be included in the investment process. These sheets ensure that sensitive business information shared during negotiations remains confidential and protected. Overall, Dallas Texas Angel Investment Term Sheets are tailor-made agreements that establish the foundation for investments, protecting the interests of both angel investors and startups seeking funding. Entrepreneurs must carefully review these term sheets before entering into any agreements and seek legal counsel to ensure clarity and protection of their rights as well as compliance with applicable regulations.Dallas Texas Angel Investment Term Sheet is a legally binding document that outlines the terms and conditions under which angel investors provide funding to startups or early-stage companies based in Dallas, Texas. This term sheet serves as the basis for negotiations between the investors and the founders, laying out crucial details that drive the investment process and protect the interests of both parties. The main purpose of a Dallas Texas Angel Investment Term Sheet is to establish the framework for the investment agreement, defining the essential elements that dictate the relationship between the investors and the company seeking capital. This includes provisions on investment amount, equity ownership, valuation, rights and privileges, and other critical terms. There are several types of Dallas Texas Angel Investment Term Sheets, including: 1. Convertible Note Term Sheets: This type of term sheet outlines the terms of a convertible note, a debt instrument that converts into equity at a later stage, usually during a future financing round. It covers aspects such as interest rate, maturity date, conversion discount, and valuation cap. 2. Preferred Equity Term Sheets: Preferred equity term sheets define the terms for preferred shares, which hold rights and privileges that differ from common equity. These sheets outline details such as liquidation preferences, dividend rights, anti-dilution provisions, and board seat allocations. 3. SAFE (Simple Agreement for Future Equity) Term Sheets: SAFE term sheets are becoming increasingly popular for early-stage startup investments. They represent an agreement to provide funding at a future equity round but do not involve issuing immediate equity. The term sheet outlines conditions like valuation cap, discount rate, and key points determining the conversion terms when the equity round occurs. 4. Participating Preferred Term Sheets: This type of term sheet covers an equity structure where preferred shareholders have the right to receive their initial investment back first (liquidation preference) and then participate pro rata with common shareholders in any remaining distributions during an exit event. 5. Non-Disclosure Agreement (NDA) or Confidentiality Term Sheets: While not a specific type of investment term sheet, NDAs can be included in the investment process. These sheets ensure that sensitive business information shared during negotiations remains confidential and protected. Overall, Dallas Texas Angel Investment Term Sheets are tailor-made agreements that establish the foundation for investments, protecting the interests of both angel investors and startups seeking funding. Entrepreneurs must carefully review these term sheets before entering into any agreements and seek legal counsel to ensure clarity and protection of their rights as well as compliance with applicable regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.