An angel investor or angel (also known as a business angel or informal investor) is an affluent individual who provides capital for a business start-up, usually in exchange for convertible debt or ownership equity. New start-up companies often turn to the private equity market for seed money because the formal equity market is reluctant to fund risky undertakings. In addition to their willingness to invest in a start-up, angel investors may bring other assets to the partnership. They are often a source of encouragement; they may be mentors in how best to guide a new business through the start-up phase and they are often willing to do this while staying out of the day-to-day management of the business.

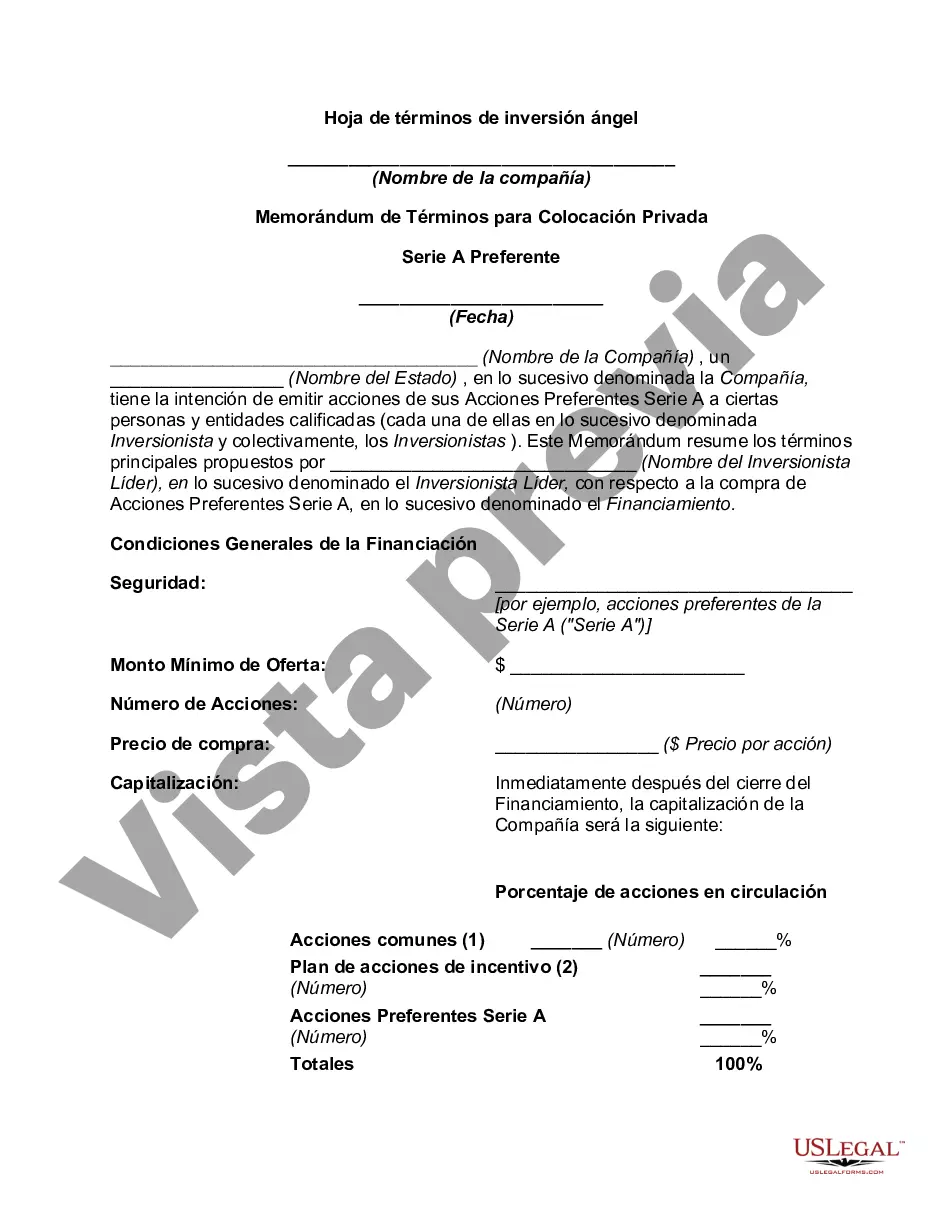

Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made.

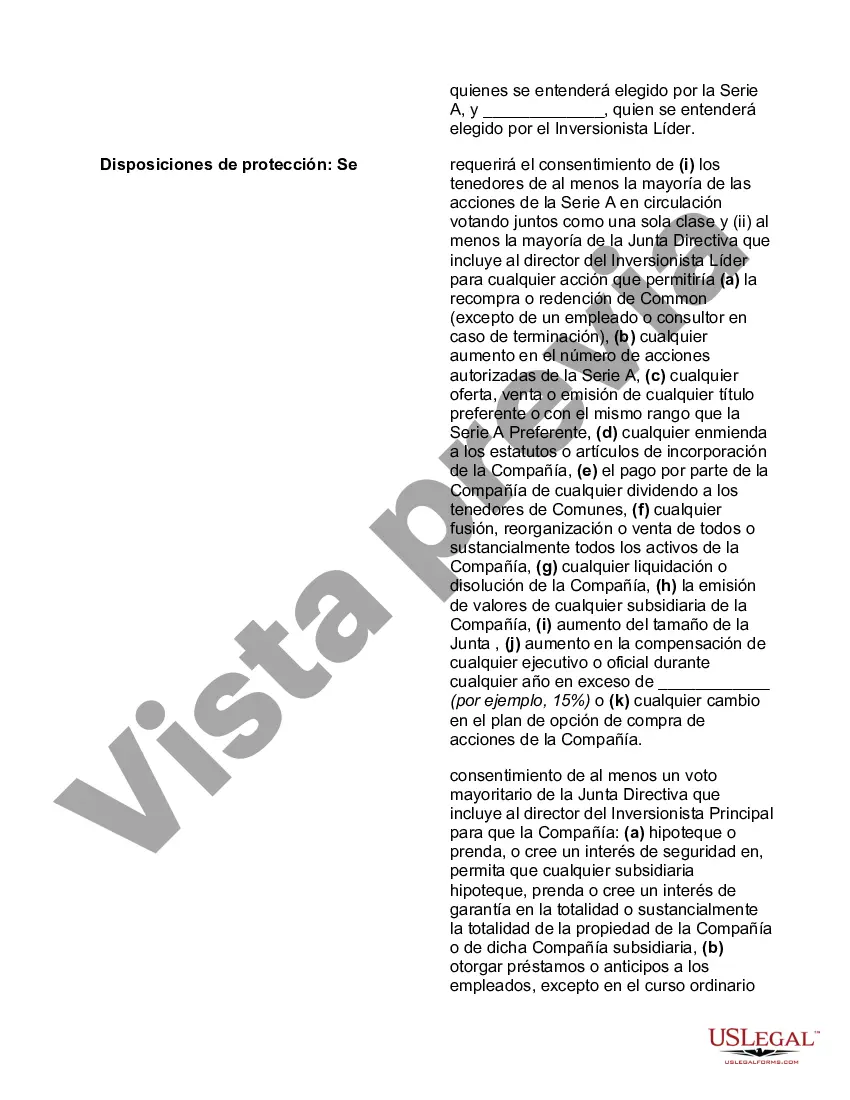

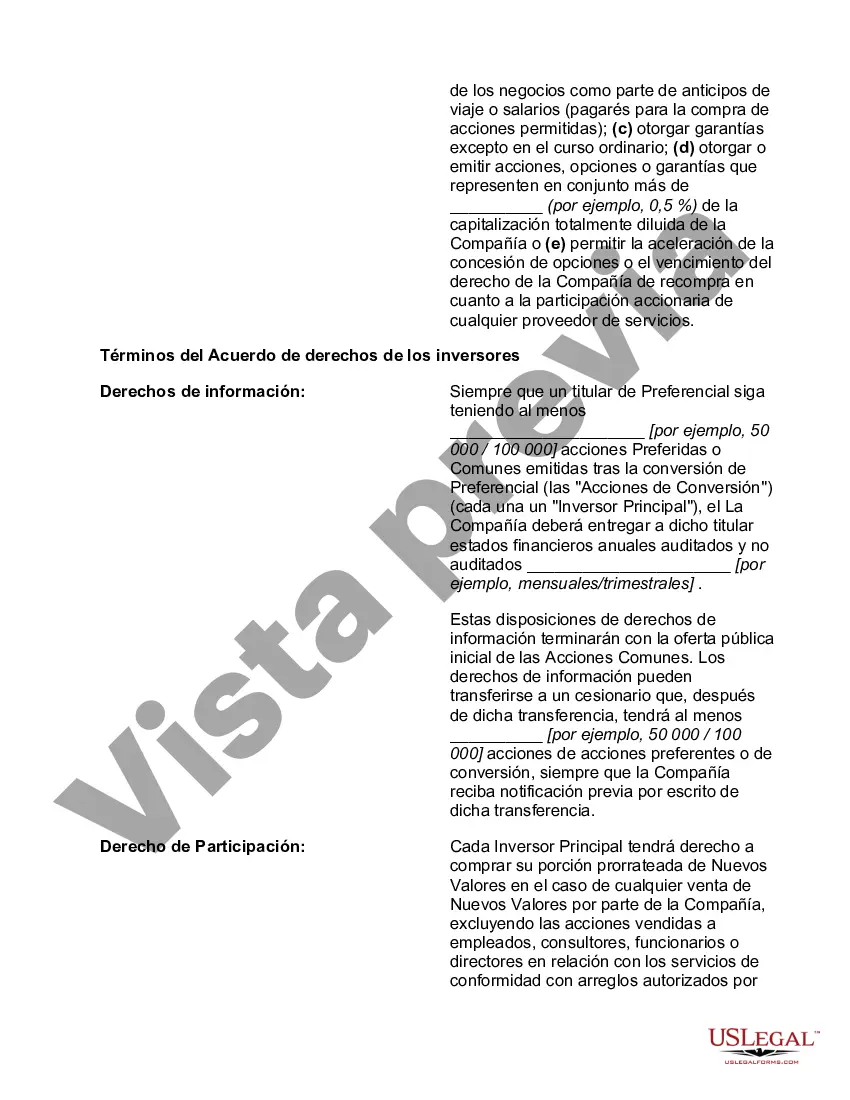

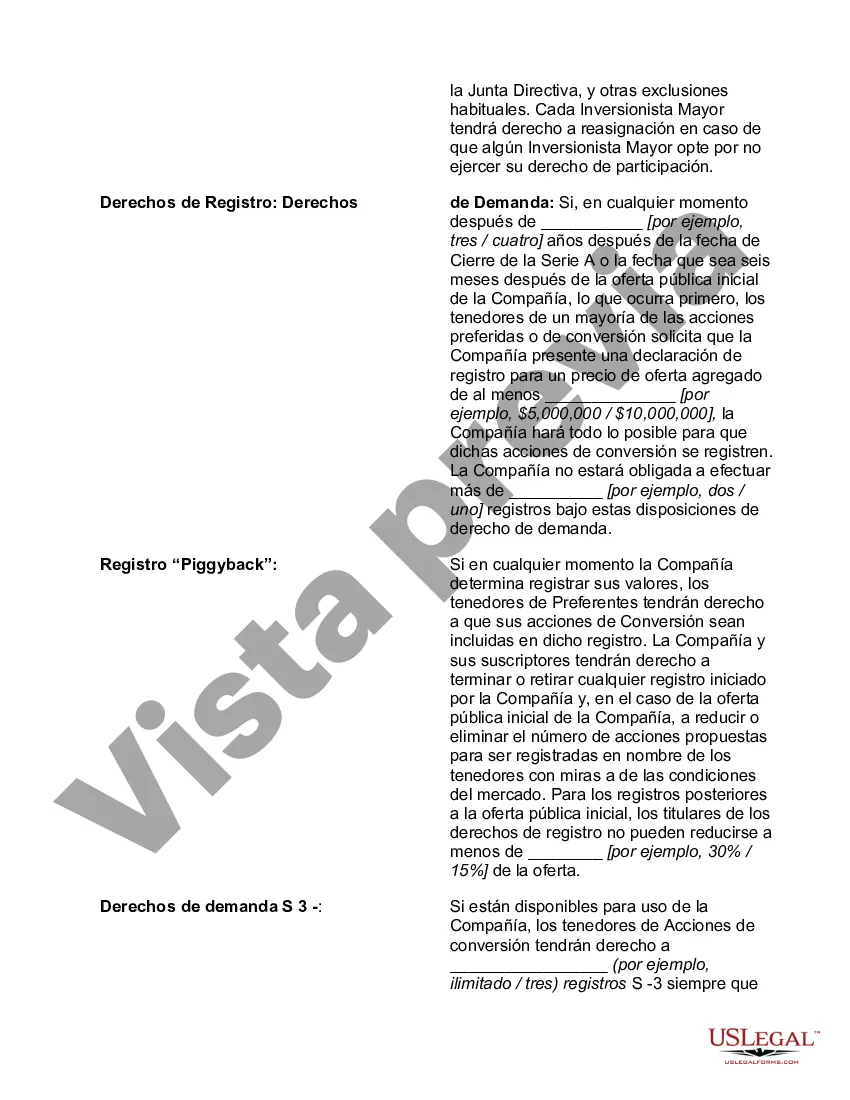

Mecklenburg County, located in the state of North Carolina, offers various options for angel investors through its Angel Investment Term Sheet. This document serves as a legally binding agreement between the investor and the entrepreneur or startup seeking funding. The term sheet outlines the terms and conditions of the investment, such as the amount of funding, ownership stake, and other key provisions. Angel investors play a crucial role in fueling innovation and economic growth by providing capital and expertise to promising early-stage companies. In Mecklenburg County, several types of Angel Investment Term Sheets are available to cater to the diverse needs of investors and entrepreneurs. 1. Mecklenburg County Equity Angel Investment Term Sheet: This type of term sheet is designed for equity-based investments, where the angel investor obtains ownership shares in the company in exchange for the funding provided. It defines the percentage of ownership, voting rights, and potential exit strategies like sale or acquisition. 2. Convertible Note Angel Investment Term Sheet: A convertible note term sheet is suitable for investors who prefer convertible debt instruments. With this option, the investor provides a loan to the startup initially, which can later convert into equity if certain predefined conditions are met. This sheet outlines the terms for the loan, conversion terms, and interest rates. 3. Preferred Stock Angel Investment Term Sheet: Preferred stock term sheets are utilized when angel investors want to receive preferential treatment in the event of liquidation or distribution of assets. This sheet specifies the rights and privileges associated with preferred stock, such as dividends, liquidation preferences, and anti-dilution provisions. 4. Mezzanine Financing Angel Investment Term Sheet: Mezzanine financing is a hybrid of debt and equity financing, appealing to investors seeking a higher return on investment. This type of term sheet outlines the terms for providing debt instruments, such as subordinated debt or preferred equity, which typically includes interest payments and warrants. 5. SAFE (Simple Agreement for Future Equity) Angel Investment Term Sheet: SAFE term sheets are gaining popularity among investors and startups due to their simplicity and flexibility. Instead of providing an immediate equity stake or loan, the investor contributes funds in exchange for the right to obtain equity in the future when a specific triggering event occurs, such as a future financing round or acquisition. 6. Revenue Share Angel Investment Term Sheet: For entrepreneurs who prefer to avoid equity dilution, revenue share term sheets are ideal. These agreements establish a fixed percentage of revenue that the company agrees to pay the investor periodically until a certain predetermined multiple of the investment amount is reached. These varied types of Angel Investment Term Sheets in Mecklenburg County offer investors and entrepreneurs the opportunity to structure their funding arrangements based on their unique preferences and business needs. It is crucial for both parties to thoroughly analyze and negotiate the terms outlined in these term sheets to ensure a mutually beneficial partnership.Mecklenburg County, located in the state of North Carolina, offers various options for angel investors through its Angel Investment Term Sheet. This document serves as a legally binding agreement between the investor and the entrepreneur or startup seeking funding. The term sheet outlines the terms and conditions of the investment, such as the amount of funding, ownership stake, and other key provisions. Angel investors play a crucial role in fueling innovation and economic growth by providing capital and expertise to promising early-stage companies. In Mecklenburg County, several types of Angel Investment Term Sheets are available to cater to the diverse needs of investors and entrepreneurs. 1. Mecklenburg County Equity Angel Investment Term Sheet: This type of term sheet is designed for equity-based investments, where the angel investor obtains ownership shares in the company in exchange for the funding provided. It defines the percentage of ownership, voting rights, and potential exit strategies like sale or acquisition. 2. Convertible Note Angel Investment Term Sheet: A convertible note term sheet is suitable for investors who prefer convertible debt instruments. With this option, the investor provides a loan to the startup initially, which can later convert into equity if certain predefined conditions are met. This sheet outlines the terms for the loan, conversion terms, and interest rates. 3. Preferred Stock Angel Investment Term Sheet: Preferred stock term sheets are utilized when angel investors want to receive preferential treatment in the event of liquidation or distribution of assets. This sheet specifies the rights and privileges associated with preferred stock, such as dividends, liquidation preferences, and anti-dilution provisions. 4. Mezzanine Financing Angel Investment Term Sheet: Mezzanine financing is a hybrid of debt and equity financing, appealing to investors seeking a higher return on investment. This type of term sheet outlines the terms for providing debt instruments, such as subordinated debt or preferred equity, which typically includes interest payments and warrants. 5. SAFE (Simple Agreement for Future Equity) Angel Investment Term Sheet: SAFE term sheets are gaining popularity among investors and startups due to their simplicity and flexibility. Instead of providing an immediate equity stake or loan, the investor contributes funds in exchange for the right to obtain equity in the future when a specific triggering event occurs, such as a future financing round or acquisition. 6. Revenue Share Angel Investment Term Sheet: For entrepreneurs who prefer to avoid equity dilution, revenue share term sheets are ideal. These agreements establish a fixed percentage of revenue that the company agrees to pay the investor periodically until a certain predetermined multiple of the investment amount is reached. These varied types of Angel Investment Term Sheets in Mecklenburg County offer investors and entrepreneurs the opportunity to structure their funding arrangements based on their unique preferences and business needs. It is crucial for both parties to thoroughly analyze and negotiate the terms outlined in these term sheets to ensure a mutually beneficial partnership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.