An angel investor or angel (also known as a business angel or informal investor) is an affluent individual who provides capital for a business start-up, usually in exchange for convertible debt or ownership equity. New start-up companies often turn to the private equity market for seed money because the formal equity market is reluctant to fund risky undertakings. In addition to their willingness to invest in a start-up, angel investors may bring other assets to the partnership. They are often a source of encouragement; they may be mentors in how best to guide a new business through the start-up phase and they are often willing to do this while staying out of the day-to-day management of the business.

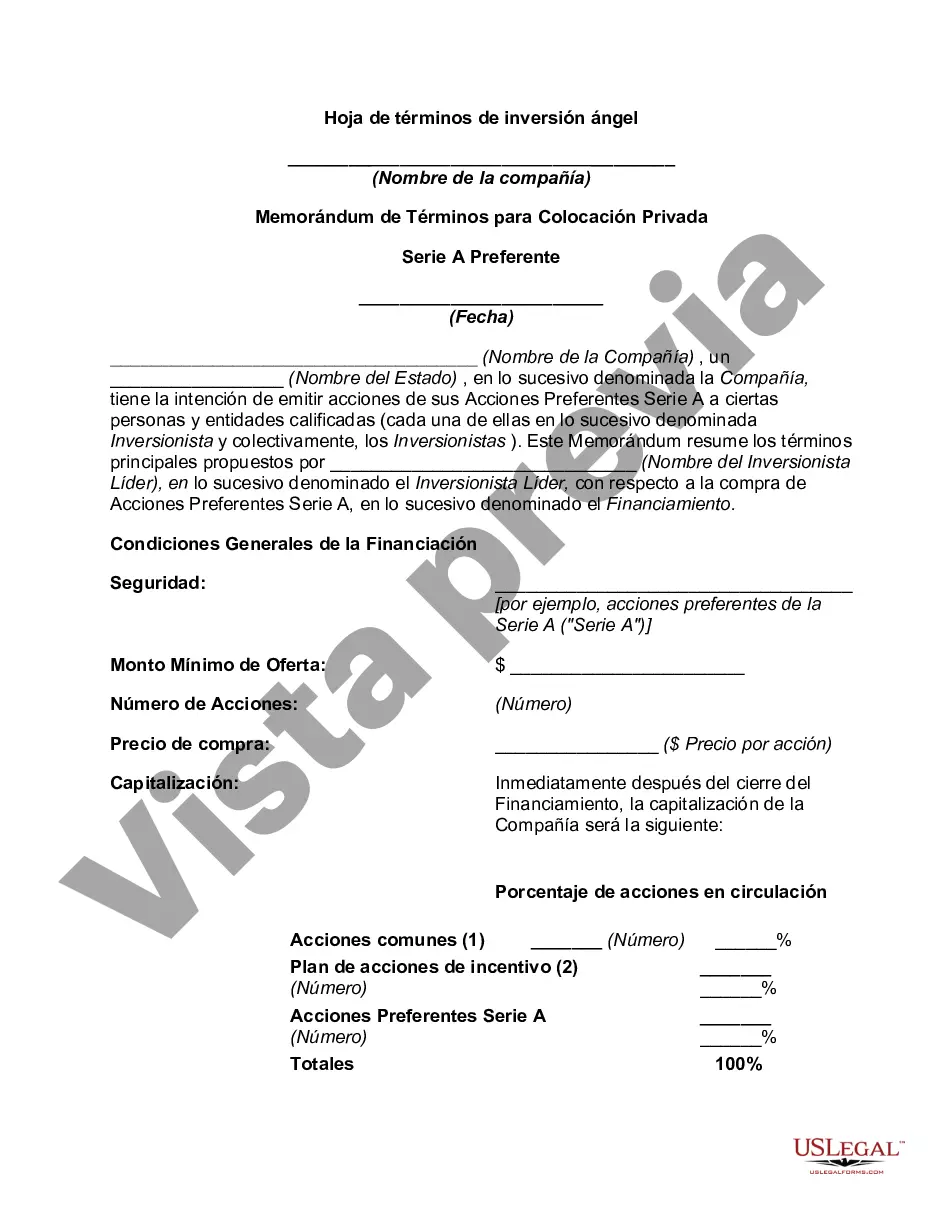

Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made.

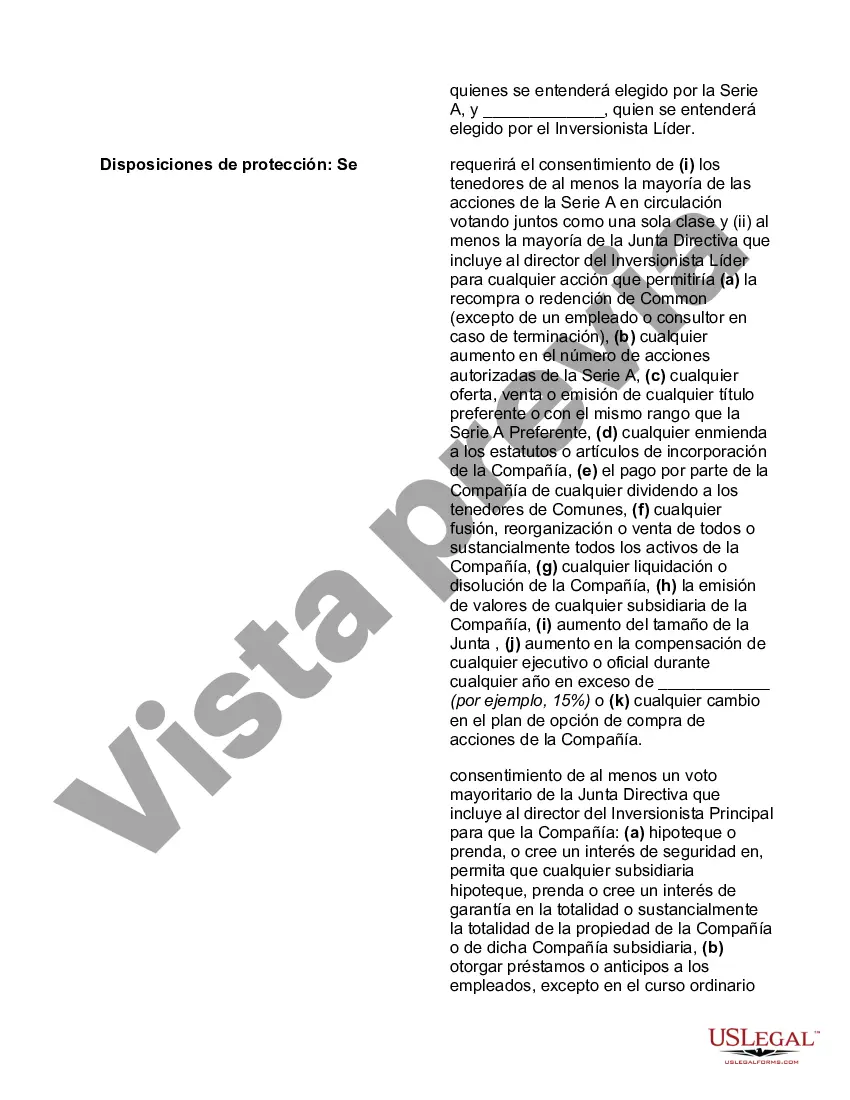

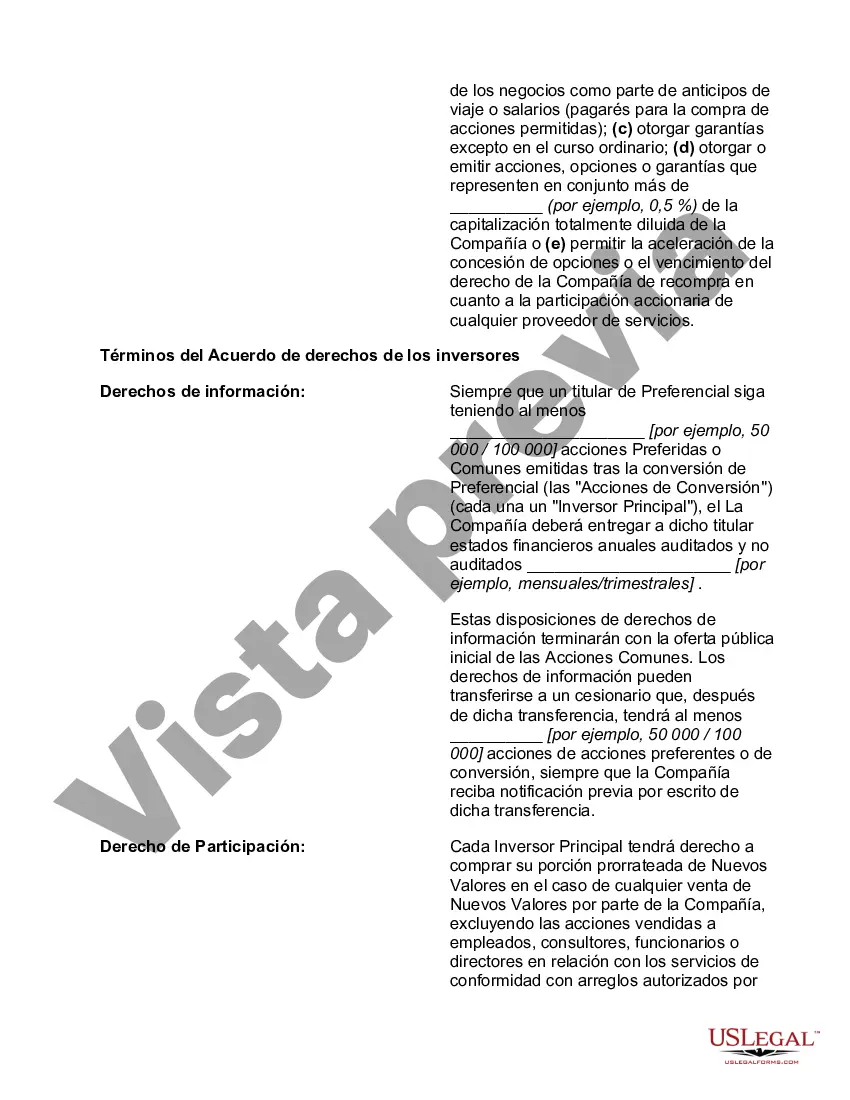

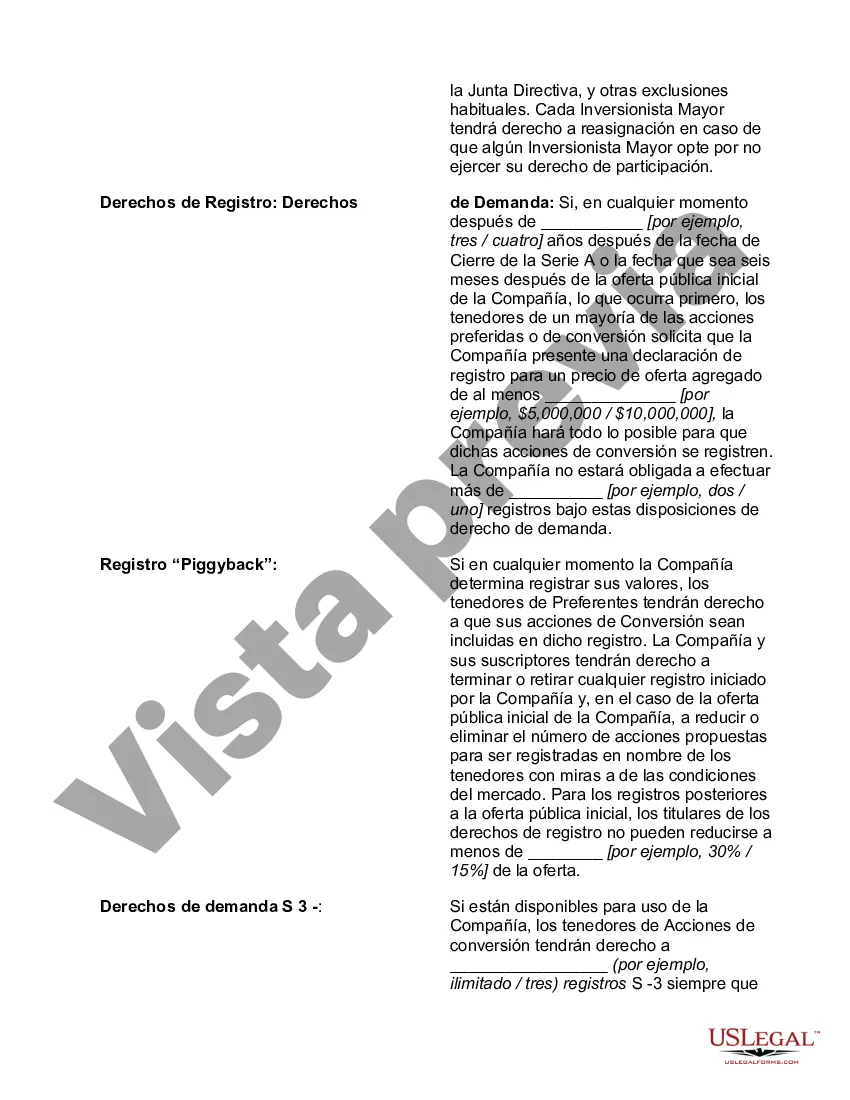

San Diego California Angel Investment Term Sheet is a legal document that outlines the key terms and conditions of an angel investor's investment in a startup or early-stage company located in San Diego, California. It serves as a framework to define the rights and obligations of both the investor and the company seeking funding. The term sheet is typically negotiated between the angel investor and the entrepreneur or company founders and acts as a precursor to creating a formal investment agreement. It outlines various essential aspects that both parties need to agree upon before finalizing the investment deal. The key components of a San Diego California Angel Investment Term Sheet may include: 1. Investment Amount: The term sheet specifies the amount of capital the angel investor is willing to invest in the startup or early-stage company. The investment could be in the form of equity, convertible note, or any other agreed-upon financial structure. 2. Valuation: The valuation of the company is a crucial aspect discussed in the term sheet. It determines the ownership percentage the investor will receive in exchange for the investment amount. Valuation helps both parties assess the company's worth and agree on an equitable investment ratio. 3. Investor Rights: The term sheet outlines the specific rights granted to the angel investor, such as board representation, protective provisions, veto rights, preferred stock rights, anti-dilution protection, and information rights. These rights protect the investor's interest and influence in the company's decision-making process. 4. Liquidation Preference: The term sheet may define the liquidation preference, which determines the order of priority in distributing funds during a liquidity event, such as a sale or acquisition. Common types of liquidation preferences include participating preference and non-participating preference. 5. Conversion Rights: If the investor chooses to invest through a convertible note, the term sheet will detail the conversion terms, including the conversion price and conditions triggering conversion of the note into equity shares. 6. Anti-Dilution Protection: This provision protects the investor from future equity issuance sat a lower valuation, ensuring they maintain their ownership percentage. There are different types of anti-dilution protection, such as full-ratchet and weighted-average, which may be specified in the term sheet. 7. Vesting Schedule: The term sheet may include a vesting schedule for the company's founders or key employees. Vesting ensures that shares are earned over time, typically over a four-year period, subject to continued service or achieving specific performance milestones. San Diego California Angel Investment Term Sheets may vary based on the specific preferences and requirements of individual investors and companies. Some term sheets may also include additional clauses or provisions unique to the San Diego startup ecosystem or the angel investor's preferences.San Diego California Angel Investment Term Sheet is a legal document that outlines the key terms and conditions of an angel investor's investment in a startup or early-stage company located in San Diego, California. It serves as a framework to define the rights and obligations of both the investor and the company seeking funding. The term sheet is typically negotiated between the angel investor and the entrepreneur or company founders and acts as a precursor to creating a formal investment agreement. It outlines various essential aspects that both parties need to agree upon before finalizing the investment deal. The key components of a San Diego California Angel Investment Term Sheet may include: 1. Investment Amount: The term sheet specifies the amount of capital the angel investor is willing to invest in the startup or early-stage company. The investment could be in the form of equity, convertible note, or any other agreed-upon financial structure. 2. Valuation: The valuation of the company is a crucial aspect discussed in the term sheet. It determines the ownership percentage the investor will receive in exchange for the investment amount. Valuation helps both parties assess the company's worth and agree on an equitable investment ratio. 3. Investor Rights: The term sheet outlines the specific rights granted to the angel investor, such as board representation, protective provisions, veto rights, preferred stock rights, anti-dilution protection, and information rights. These rights protect the investor's interest and influence in the company's decision-making process. 4. Liquidation Preference: The term sheet may define the liquidation preference, which determines the order of priority in distributing funds during a liquidity event, such as a sale or acquisition. Common types of liquidation preferences include participating preference and non-participating preference. 5. Conversion Rights: If the investor chooses to invest through a convertible note, the term sheet will detail the conversion terms, including the conversion price and conditions triggering conversion of the note into equity shares. 6. Anti-Dilution Protection: This provision protects the investor from future equity issuance sat a lower valuation, ensuring they maintain their ownership percentage. There are different types of anti-dilution protection, such as full-ratchet and weighted-average, which may be specified in the term sheet. 7. Vesting Schedule: The term sheet may include a vesting schedule for the company's founders or key employees. Vesting ensures that shares are earned over time, typically over a four-year period, subject to continued service or achieving specific performance milestones. San Diego California Angel Investment Term Sheets may vary based on the specific preferences and requirements of individual investors and companies. Some term sheets may also include additional clauses or provisions unique to the San Diego startup ecosystem or the angel investor's preferences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.