An angel investor or angel (also known as a business angel or informal investor) is an affluent individual who provides capital for a business start-up, usually in exchange for convertible debt or ownership equity. New start-up companies often turn to the private equity market for seed money because the formal equity market is reluctant to fund risky undertakings. In addition to their willingness to invest in a start-up, angel investors may bring other assets to the partnership. They are often a source of encouragement; they may be mentors in how best to guide a new business through the start-up phase and they are often willing to do this while staying out of the day-to-day management of the business.

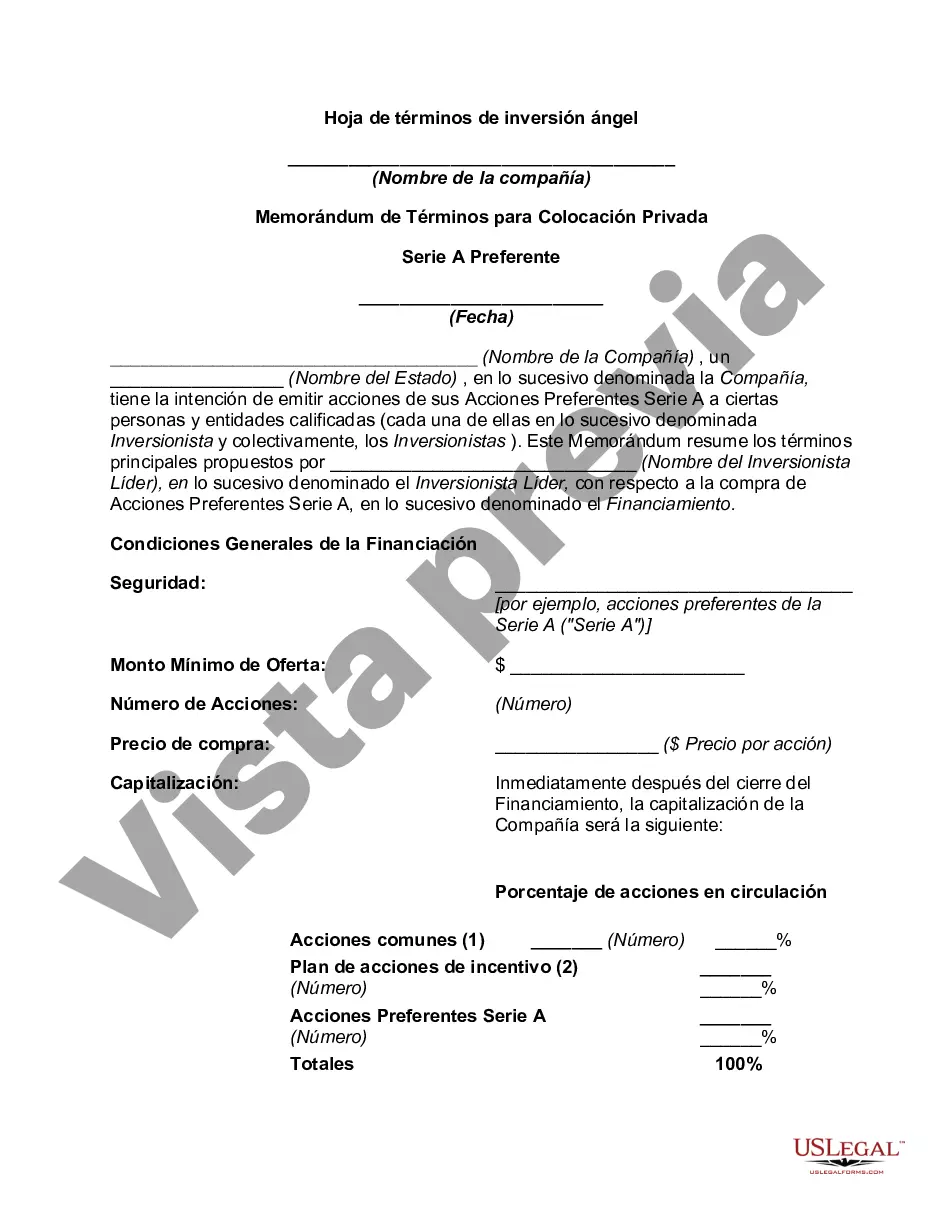

Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made.

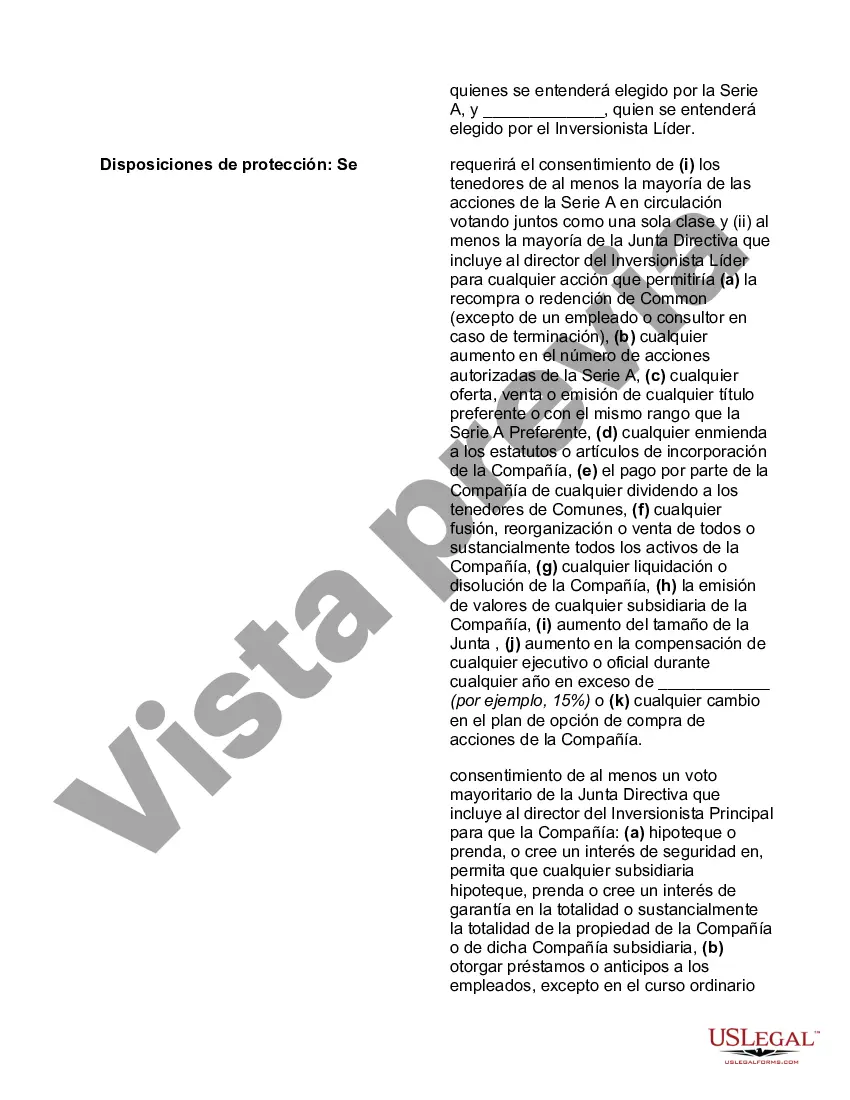

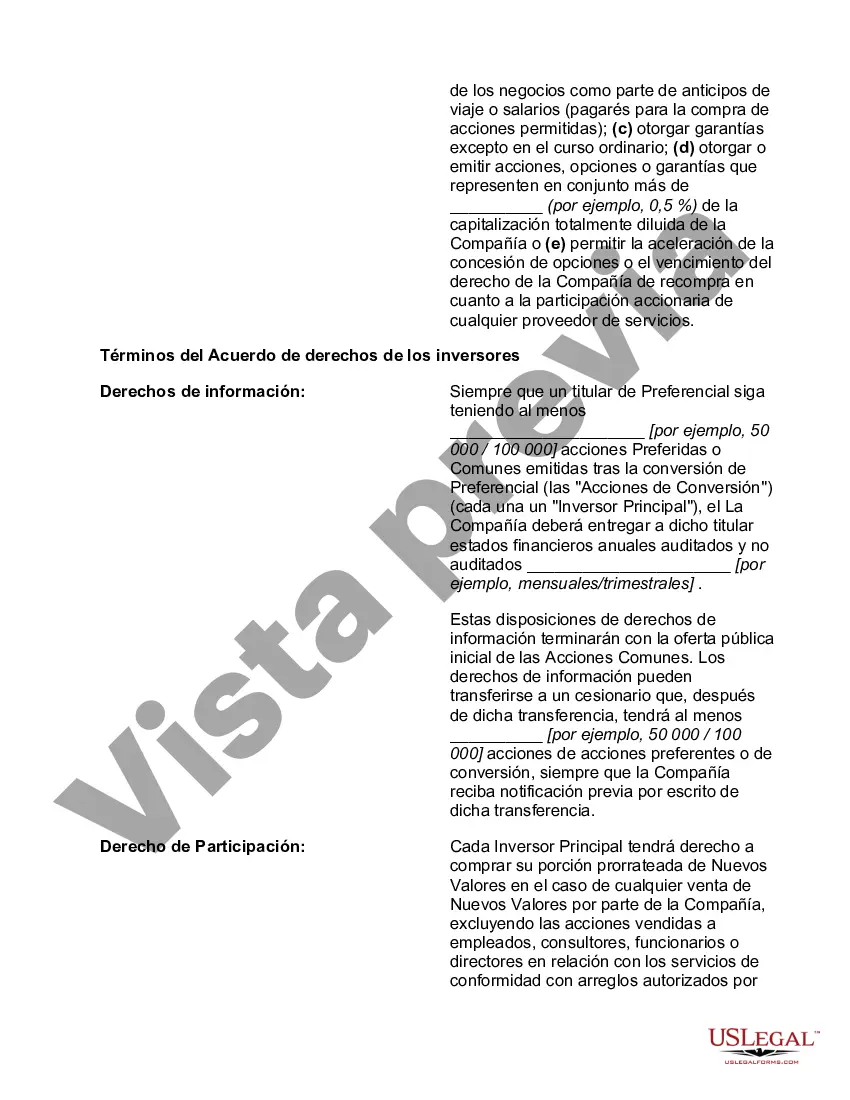

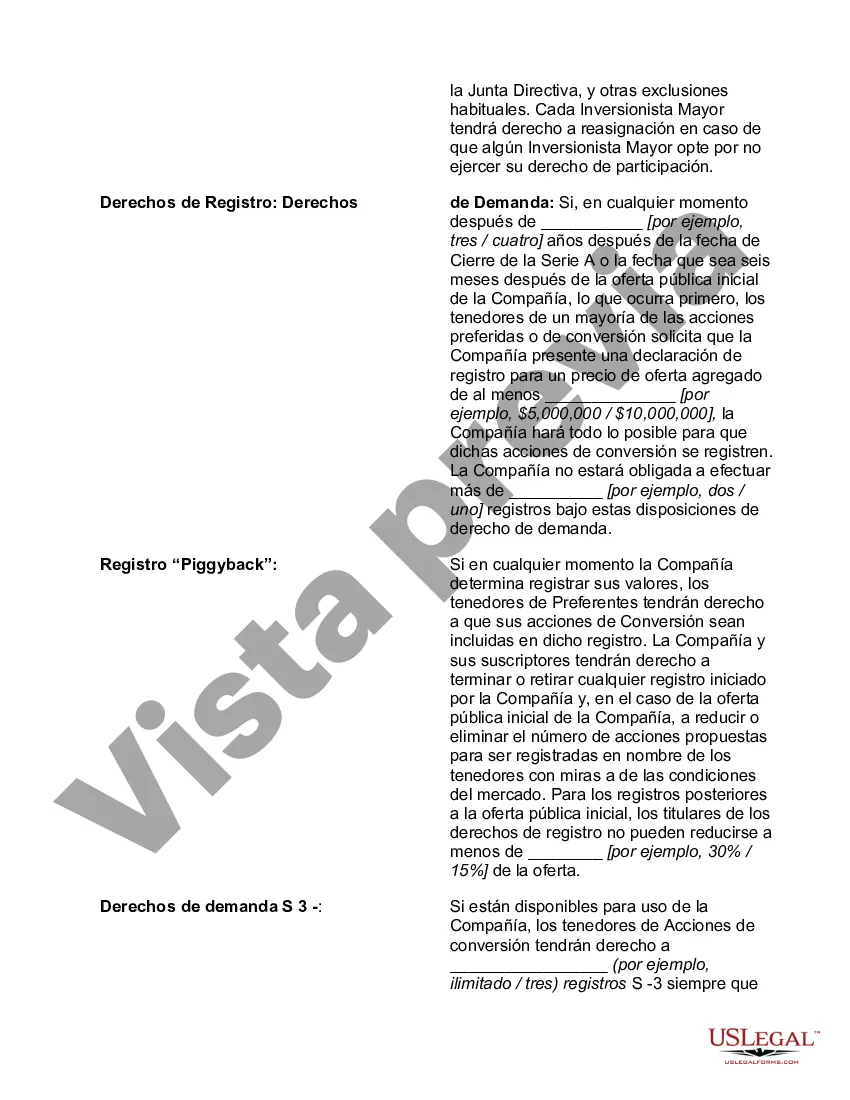

Suffolk New York Angel Investment Term Sheets are legal documents that outline the terms and conditions of investments made by angel investors in businesses located in Suffolk County, New York. These term sheets are crucial for both the investors and the entrepreneurs seeking funding, as they lay out the expectations, rights, and obligations of each party involved in the investment process. Key terms commonly found in Suffolk New York Angel Investment Term Sheets include: 1. Investment Amount: This specifies the amount of capital the angel investor is willing to put into the business. 2. Valuation: The valuation determines the worth of the company and its equity, helping to establish the percentage of ownership the investor will have after the investment. 3. Liquidation Preference: This clause details the order in which investors will receive their investment back in the event of a liquidation or sale of the business. Different types of liquidation preferences can be included, such as participating or non-participating preferences. 4. Conversion Rights: Angel investors often have the option to convert their investment into equity ownership, usually when the company undergoes a subsequent financing round. 5. Anti-Dilution Provisions: These provisions protect the investor from dilution of their ownership stake in case the company issues more equity at a lower valuation in the future. 6. Board Seat: In some cases, the angel investor may require a seat on the company's board of directors or the right to appoint a board observer. 7. Voting Rights: The term sheet may outline the level of influence the investor has on key business decisions and voting matters. 8. Information Rights: These rights ensure that investors receive regular updates about the company's financial, operational, or strategic developments. 9. Vesting Schedules: If the angel investment is made in exchange for equity, a vesting schedule may be established to govern how and when the investor's ownership stake becomes fully theirs. 10. Pro rata Rights: These rights allow the investor the opportunity to maintain their ownership percentage by investing in future financing rounds of the company. It is essential to note that the specific content and terms of Suffolk New York Angel Investment Term Sheets can vary between different investors, businesses, and industries. Therefore, it is crucial for both parties to thoroughly review and negotiate the terms outlined in the term sheet before entering into a formal agreement.Suffolk New York Angel Investment Term Sheets are legal documents that outline the terms and conditions of investments made by angel investors in businesses located in Suffolk County, New York. These term sheets are crucial for both the investors and the entrepreneurs seeking funding, as they lay out the expectations, rights, and obligations of each party involved in the investment process. Key terms commonly found in Suffolk New York Angel Investment Term Sheets include: 1. Investment Amount: This specifies the amount of capital the angel investor is willing to put into the business. 2. Valuation: The valuation determines the worth of the company and its equity, helping to establish the percentage of ownership the investor will have after the investment. 3. Liquidation Preference: This clause details the order in which investors will receive their investment back in the event of a liquidation or sale of the business. Different types of liquidation preferences can be included, such as participating or non-participating preferences. 4. Conversion Rights: Angel investors often have the option to convert their investment into equity ownership, usually when the company undergoes a subsequent financing round. 5. Anti-Dilution Provisions: These provisions protect the investor from dilution of their ownership stake in case the company issues more equity at a lower valuation in the future. 6. Board Seat: In some cases, the angel investor may require a seat on the company's board of directors or the right to appoint a board observer. 7. Voting Rights: The term sheet may outline the level of influence the investor has on key business decisions and voting matters. 8. Information Rights: These rights ensure that investors receive regular updates about the company's financial, operational, or strategic developments. 9. Vesting Schedules: If the angel investment is made in exchange for equity, a vesting schedule may be established to govern how and when the investor's ownership stake becomes fully theirs. 10. Pro rata Rights: These rights allow the investor the opportunity to maintain their ownership percentage by investing in future financing rounds of the company. It is essential to note that the specific content and terms of Suffolk New York Angel Investment Term Sheets can vary between different investors, businesses, and industries. Therefore, it is crucial for both parties to thoroughly review and negotiate the terms outlined in the term sheet before entering into a formal agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.