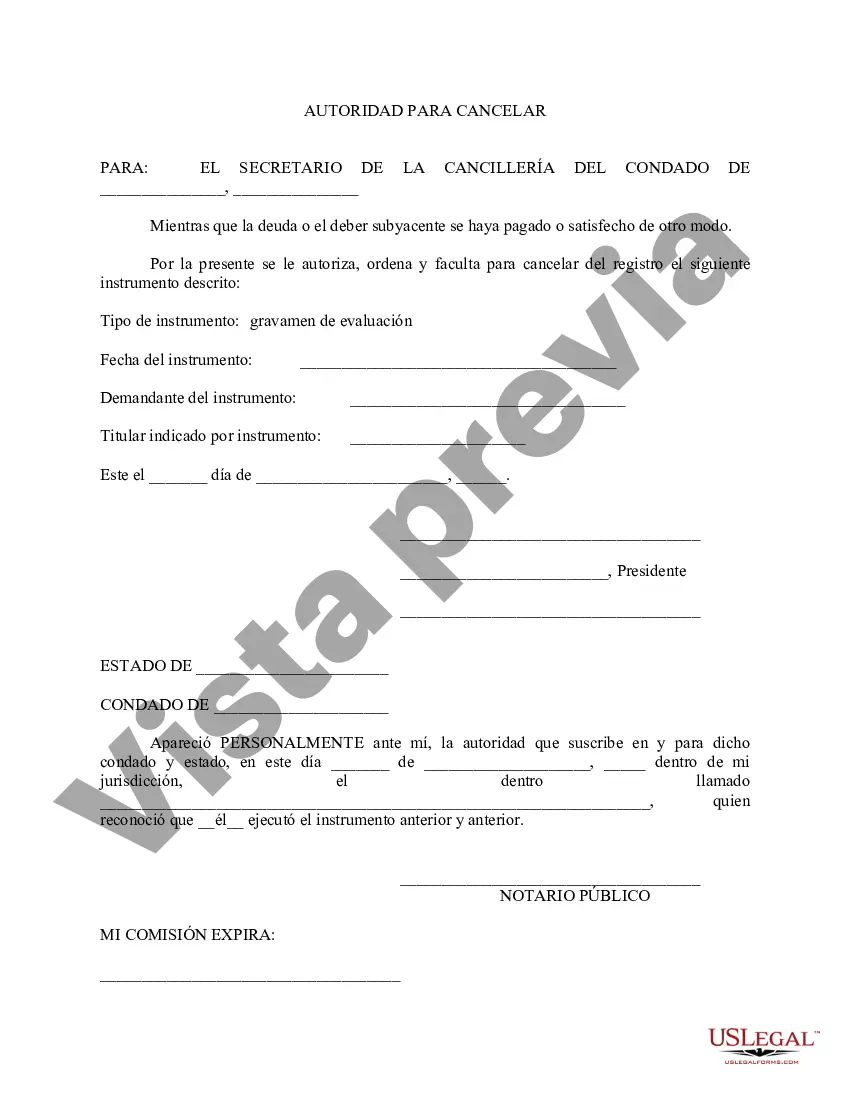

This form is a model Authority to Cancell Lien. Lienholder files with court certifying that indebtedness has been satisfied and lien should be cancelled. Adapt to fit your specific facts and circumstances.

Travis Texas Authority to Cancel, or more officially known as the Travis County Central Appraisal District (TICAD) Authority to Cancel, is a legal process that allows property owners to appeal or challenge the assessed value of their property for taxation purposes in Travis County, Texas. This system grants property owners the opportunity to seek a reduction in property taxes by presenting evidence that their property has been inaccurately valued. The Travis Texas Authority to Cancel is applicable to various types of properties within Travis County, including residential homes, commercial buildings, vacant land, and industrial properties. Different types of Travis Texas Authority to Cancel include the following: 1. Residential Property Authority to Cancel: This type of cancellation is particularly relevant for homeowners who believe that the appraised value of their residential property is excessively high. With this authority, homeowners can file a formal protest and present evidence supporting their claim for a lower property value. 2. Commercial Property Authority to Cancel: Property owners with commercial properties, such as retail stores, office buildings, or hotels, can utilize this authority. They can challenge the appraisal value based on factors like market conditions, rental income, or property condition. 3. Land Authority to Cancel: This type of authority applies to property owners who own vacant land or undeveloped lots. It allows them to argue that the appraisal of their land is unreasonably high due to factors like zoning restrictions, location, or limited usability. 4. Industrial Property Authority to Cancel: This authority is designed for owners of industrial buildings, manufacturing facilities, or warehouses. Property owners can question the appraisal value by presenting evidence of economic factors affecting the industry, such as a decline in demand or outdated machinery. To initiate the Travis Texas Authority to Cancel process, property owners must file a formal protest with the Travis County Central Appraisal District within a specific timeframe after receiving their appraisal notice. This involves completing a protest form, gathering supporting evidence, and attending a hearing to present their case. In conclusion, Travis Texas Authority to Cancel is an essential tool for property owners in Travis County to challenge their property tax assessments. With different types applicable to residential, commercial, land, and industrial properties, property owners can pursue a fair and accurate appraisal value for their properties.Travis Texas Authority to Cancel, or more officially known as the Travis County Central Appraisal District (TICAD) Authority to Cancel, is a legal process that allows property owners to appeal or challenge the assessed value of their property for taxation purposes in Travis County, Texas. This system grants property owners the opportunity to seek a reduction in property taxes by presenting evidence that their property has been inaccurately valued. The Travis Texas Authority to Cancel is applicable to various types of properties within Travis County, including residential homes, commercial buildings, vacant land, and industrial properties. Different types of Travis Texas Authority to Cancel include the following: 1. Residential Property Authority to Cancel: This type of cancellation is particularly relevant for homeowners who believe that the appraised value of their residential property is excessively high. With this authority, homeowners can file a formal protest and present evidence supporting their claim for a lower property value. 2. Commercial Property Authority to Cancel: Property owners with commercial properties, such as retail stores, office buildings, or hotels, can utilize this authority. They can challenge the appraisal value based on factors like market conditions, rental income, or property condition. 3. Land Authority to Cancel: This type of authority applies to property owners who own vacant land or undeveloped lots. It allows them to argue that the appraisal of their land is unreasonably high due to factors like zoning restrictions, location, or limited usability. 4. Industrial Property Authority to Cancel: This authority is designed for owners of industrial buildings, manufacturing facilities, or warehouses. Property owners can question the appraisal value by presenting evidence of economic factors affecting the industry, such as a decline in demand or outdated machinery. To initiate the Travis Texas Authority to Cancel process, property owners must file a formal protest with the Travis County Central Appraisal District within a specific timeframe after receiving their appraisal notice. This involves completing a protest form, gathering supporting evidence, and attending a hearing to present their case. In conclusion, Travis Texas Authority to Cancel is an essential tool for property owners in Travis County to challenge their property tax assessments. With different types applicable to residential, commercial, land, and industrial properties, property owners can pursue a fair and accurate appraisal value for their properties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.