Chicago Illinois Escrow Release is a legal process that involves releasing funds or property held in escrow to the appropriate parties involved in a real estate transaction in the city of Chicago, Illinois. Escrow refers to a neutral third-party account or entity that holds funds or assets on behalf of the involved parties until certain conditions are met. The Chicago Illinois Escrow Release process ensures that both the buyer and seller are protected during a real estate transaction and that they fulfill their respective obligations. Typically, the release of escrow funds occurs after all the agreed-upon terms and conditions stated in the purchase contract have been successfully fulfilled and the closing of the transaction has taken place. There are various types of Chicago Illinois Escrow Release depending on the specifics of the real estate transaction: 1. Residential Escrow Release: This type of escrow release is relevant for residential real estate transactions in Chicago, involving single-family homes, condominiums, townhouses, or apartments. It ensures that both the buyer and seller fulfill their obligations as per the purchase agreement before the funds are released. 2. Commercial Escrow Release: This type of escrow release is specific to commercial real estate transactions in Chicago. It typically involves the purchase or sale of commercial properties such as office buildings, retail spaces, industrial properties, or vacant land. The release of funds is contingent upon the completion of the agreed-upon terms and conditions in the commercial purchase contract. 3. New Construction Escrow Release: This type of escrow release is applicable when purchasing a newly constructed property in Chicago. The funds are held in escrow until the construction is completed, and all necessary inspections, permits, and certificates of occupancy are obtained. Once the property is deemed ready for occupancy, the escrow funds are released. 4. Refinance Escrow Release: This escrow release is relevant when refinancing an existing mortgage on a Chicago property. It involves a new lender paying off the existing mortgage with the funds held in escrow, ensuring a smooth transition from one lender to another. In conclusion, Chicago Illinois Escrow Release ensures the secure and orderly transfer of funds or assets in various real estate transactions, including residential, commercial, new construction, and refinancing. It safeguards the interests of both buyers and sellers and guarantees that all contractual obligations are met before the funds are released.

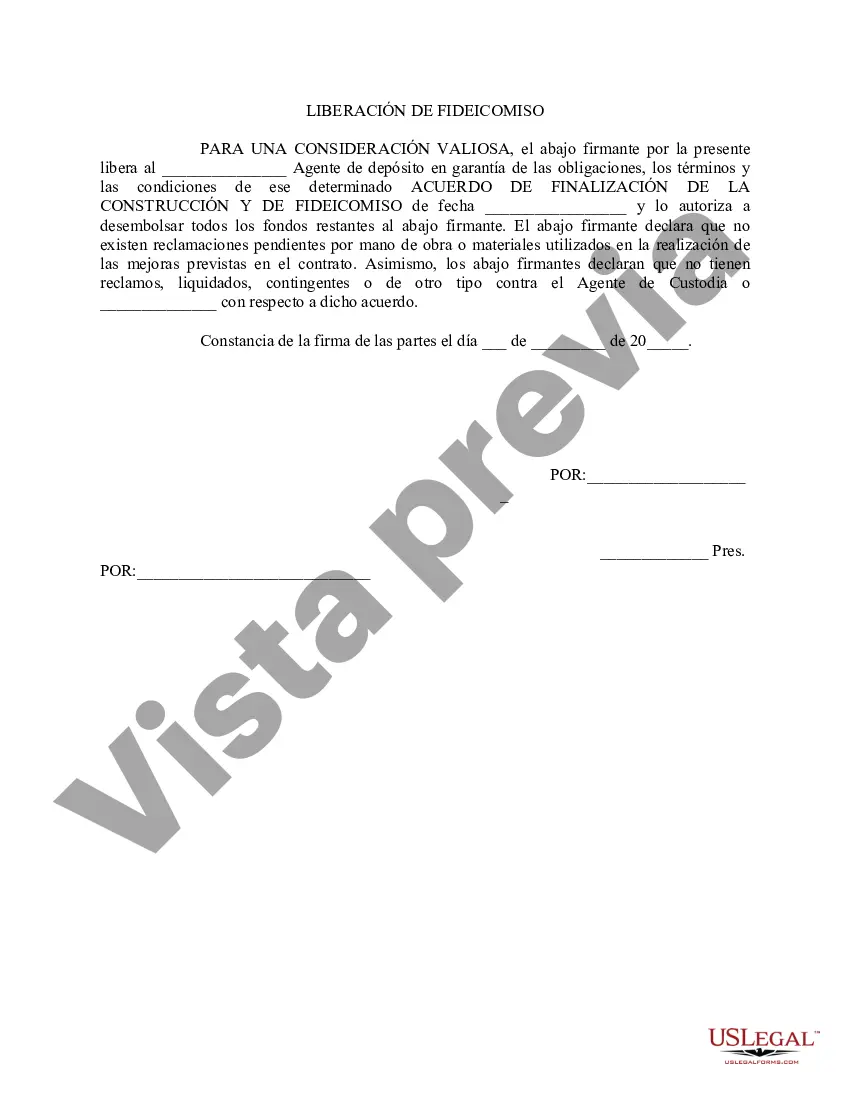

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Liberación de depósito en garantía - Escrow Release

Description

How to fill out Chicago Illinois Liberación De Depósito En Garantía?

Are you looking to quickly create a legally-binding Chicago Escrow Release or maybe any other document to manage your own or business matters? You can select one of the two options: hire a legal advisor to write a valid paper for you or draft it completely on your own. Thankfully, there's a third option - US Legal Forms. It will help you receive professionally written legal papers without paying unreasonable prices for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-compliant document templates, including Chicago Escrow Release and form packages. We provide documents for an array of use cases: from divorce papers to real estate documents. We've been out there for more than 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra hassles.

- First and foremost, carefully verify if the Chicago Escrow Release is adapted to your state's or county's regulations.

- In case the document comes with a desciption, make sure to check what it's suitable for.

- Start the searching process again if the template isn’t what you were looking for by utilizing the search box in the header.

- Select the subscription that is best suited for your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Chicago Escrow Release template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. In addition, the documents we offer are updated by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!