The Federal Fair Credit Reporting Act regulates the use of information on a consumer's personal and financial condition. The most typical transaction which this Act would cover would be where a person applies for a personal loan or other consumer credit. Consumer credit is credit for personal, family, or household use, and not for business or commercial transactions. Also, this Act can apply when a person applies for a job or even a policy of insurance when certain investigations are made of the applicant.

Investigative Consumer Reports are special types of consumer report not commonly used by credit and collection professionals. This report differs from the typical report used for the extension of consumer credit because it is can include information regarding a consumer's character, general reputation, and personal characteristics obtained through interviews with neighbors, friends, business associates, etc.

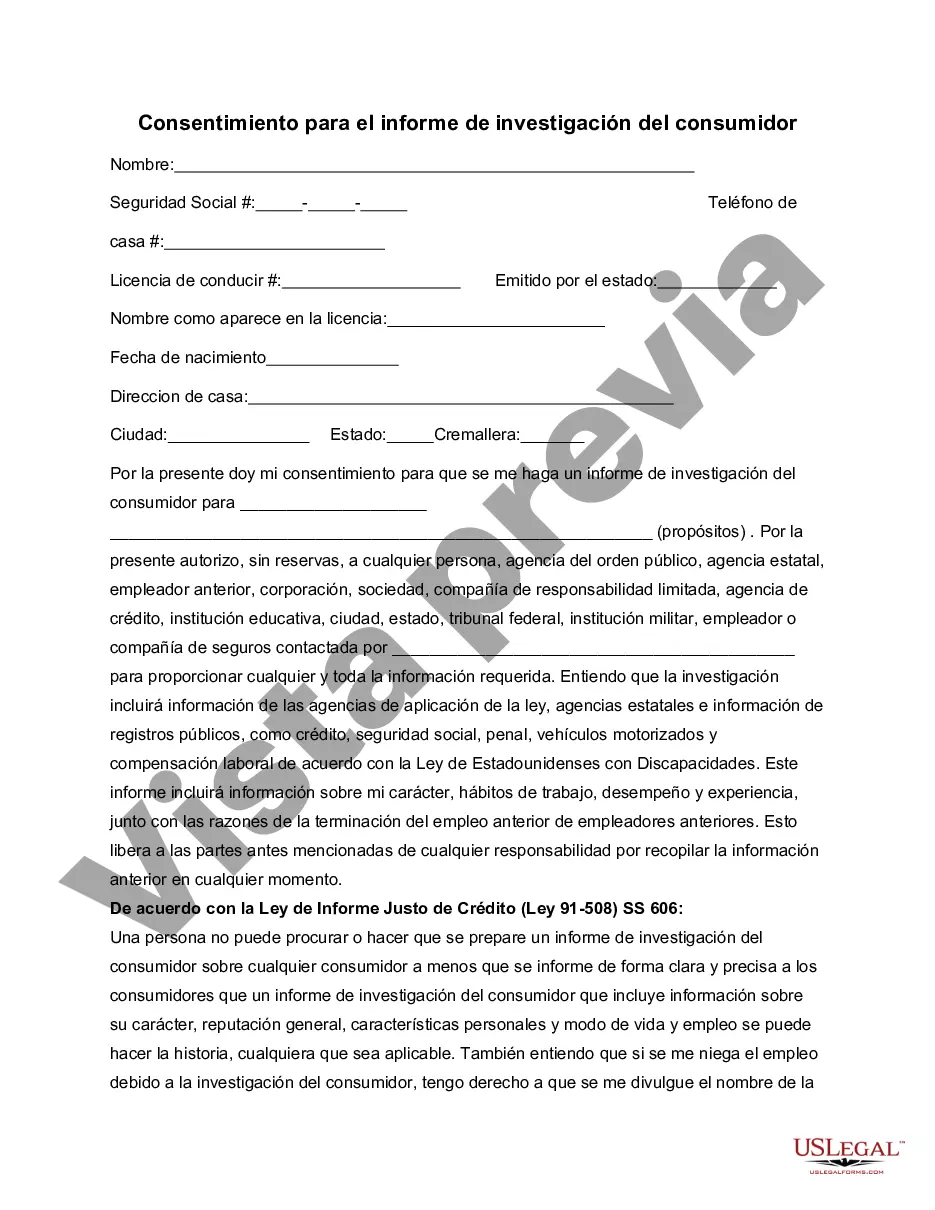

Collin Texas Consent to Investigative Consumer Report is a legal document used in Collin County, Texas, that grants permission to investigate an individual's consumer background for various purposes. This report is commonly required by employers, landlords, and financial institutions to make informed decisions about potential employees, tenants, or borrowers. The Collin Texas Consent to Investigative Consumer Report allows authorized entities to delve into an individual's personal background, including credit history, criminal records, employment records, education, and other relevant information. By signing this consent form, the applicant acknowledges and grants permission to conduct an in-depth investigation into their consumer history. Different types of Collin Texas Consent to Investigative Consumer Reports may include: 1. Employment Background Check: This type of report is typically required by employers during the hiring process. It enables them to evaluate an applicant's qualifications, employment history, criminal records, and creditworthiness. This information helps employers make well-informed decisions regarding potential employees. 2. Tenant Screening Report: Landlords and property management companies often request this type of consent to investigate a potential tenant's background before leasing a property. It delves into the applicant's rental history, creditworthiness, criminal records, and eviction records to assess their reliability as a tenant. 3. Consumer Loan Investigation: Financial institutions, such as banks or credit unions, may require this report when processing loan applications. It provides insights into an individual's credit history, employment stability, and financial responsibilities, helping lenders assess the risk involved in extending credit. 4. Vendor or Contractor Screening: Companies that engage in partnerships or subcontracting agreements may request this consent to investigate the consumer background of potential vendors or contractors. This helps ensure the reliability, reputation, and financial stability of the third party before entering into a business relationship. 5. Professional License Verification: Regulatory bodies or licensing agencies may utilize this consent to investigate an applicant's educational background, professional experience, and ethical conduct for issuing licenses in various fields such as healthcare, law, or finance. Overall, the Collin Texas Consent to Investigative Consumer Report is a vital legal document that authorizes entities to conduct comprehensive background checks for employment, housing, financial, or licensing purposes. It ensures responsible decision-making by verifying an individual's consumer history, thus protecting the interests of employers, landlords, institutions, and the community at large.Collin Texas Consent to Investigative Consumer Report is a legal document used in Collin County, Texas, that grants permission to investigate an individual's consumer background for various purposes. This report is commonly required by employers, landlords, and financial institutions to make informed decisions about potential employees, tenants, or borrowers. The Collin Texas Consent to Investigative Consumer Report allows authorized entities to delve into an individual's personal background, including credit history, criminal records, employment records, education, and other relevant information. By signing this consent form, the applicant acknowledges and grants permission to conduct an in-depth investigation into their consumer history. Different types of Collin Texas Consent to Investigative Consumer Reports may include: 1. Employment Background Check: This type of report is typically required by employers during the hiring process. It enables them to evaluate an applicant's qualifications, employment history, criminal records, and creditworthiness. This information helps employers make well-informed decisions regarding potential employees. 2. Tenant Screening Report: Landlords and property management companies often request this type of consent to investigate a potential tenant's background before leasing a property. It delves into the applicant's rental history, creditworthiness, criminal records, and eviction records to assess their reliability as a tenant. 3. Consumer Loan Investigation: Financial institutions, such as banks or credit unions, may require this report when processing loan applications. It provides insights into an individual's credit history, employment stability, and financial responsibilities, helping lenders assess the risk involved in extending credit. 4. Vendor or Contractor Screening: Companies that engage in partnerships or subcontracting agreements may request this consent to investigate the consumer background of potential vendors or contractors. This helps ensure the reliability, reputation, and financial stability of the third party before entering into a business relationship. 5. Professional License Verification: Regulatory bodies or licensing agencies may utilize this consent to investigate an applicant's educational background, professional experience, and ethical conduct for issuing licenses in various fields such as healthcare, law, or finance. Overall, the Collin Texas Consent to Investigative Consumer Report is a vital legal document that authorizes entities to conduct comprehensive background checks for employment, housing, financial, or licensing purposes. It ensures responsible decision-making by verifying an individual's consumer history, thus protecting the interests of employers, landlords, institutions, and the community at large.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.