The Federal Fair Credit Reporting Act regulates the use of information on a consumer's personal and financial condition. The most typical transaction which this Act would cover would be where a person applies for a personal loan or other consumer credit. Consumer credit is credit for personal, family, or household use, and not for business or commercial transactions. Also, this Act can apply when a person applies for a job or even a policy of insurance when certain investigations are made of the applicant.

Investigative Consumer Reports are special types of consumer report not commonly used by credit and collection professionals. This report differs from the typical report used for the extension of consumer credit because it is can include information regarding a consumer's character, general reputation, and personal characteristics obtained through interviews with neighbors, friends, business associates, etc.

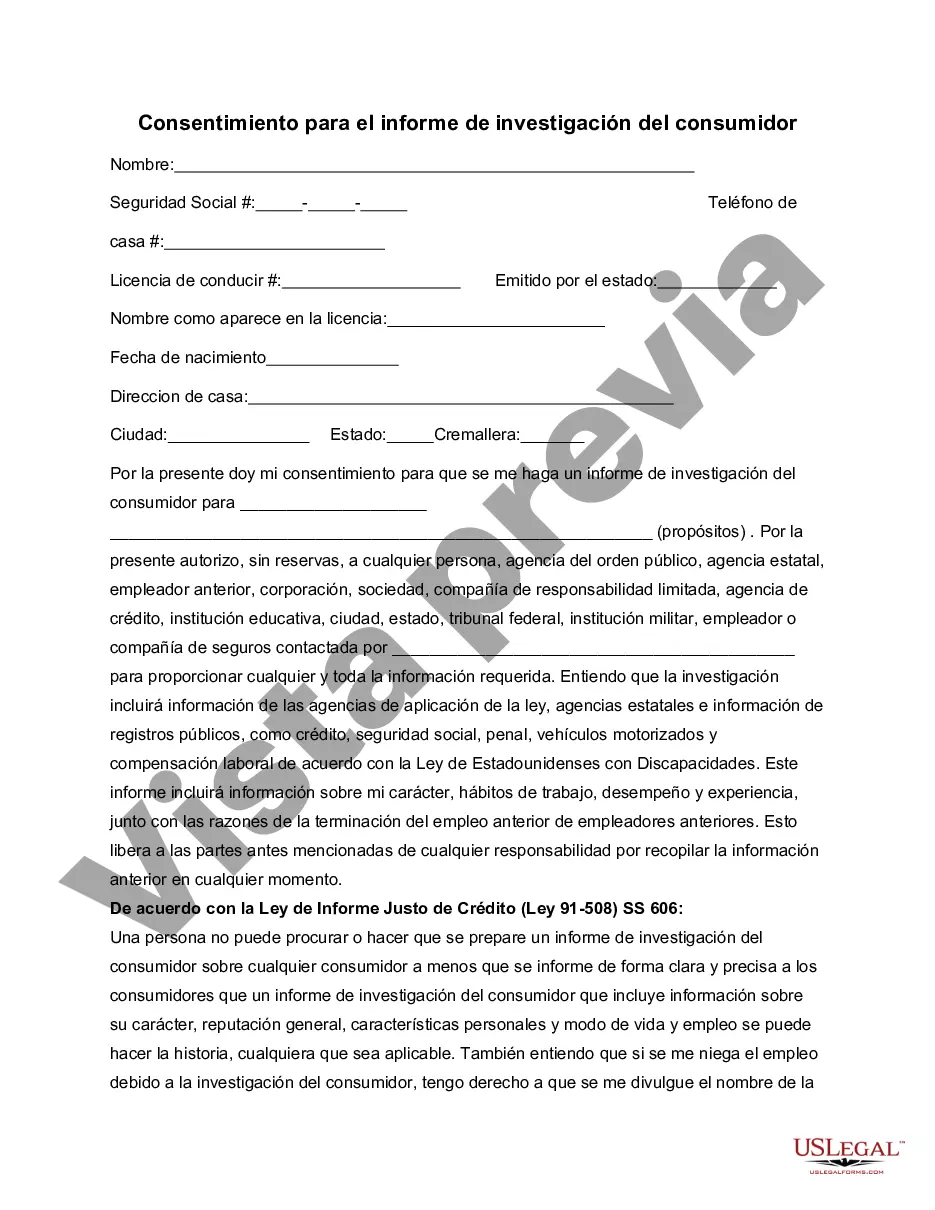

Harris Texas Consent to Investigative Consumer Report is a document required by employers or businesses in Harris County, Texas, that gives them permission to conduct an investigative consumer report on an individual. This report is needed when an employer wants to delve into the applicant's background, including their education, employment history, references, and personal character. The purpose of a Harris Texas Consent to Investigative Consumer Report is to ensure that employers have accurate and up-to-date information about potential employees before making important hiring decisions. It allows businesses to obtain a comprehensive picture of an individual's qualifications and character, thus reducing the risk of hiring someone with a questionable background or potential risks to the company. The Harris Texas Consent to Investigative Consumer Report typically includes several key elements. These may include the applicant's full name, address, social security number, date of birth, and other identifying information. It may also include a statement indicating that the applicant understands and authorizes the employer to conduct the investigation, as well as a release of liability for the employer. Different types of Harris Texas Consent to Investigative Consumer Report may exist to cater to specific industry requirements or background checks. For instance, some industries like banking or finance may have stricter regulations and require additional types of checks, such as credit history or criminal record checks. In these cases, the consent form may vary slightly to cover the additional checks requested. The importance of a Harris Texas Consent to Investigative Consumer Report cannot be overstated. It allows employers to make informed decisions based on accurate and pertinent information. It safeguards businesses from potential liabilities and ensures the protection of their employees, customers, and overall brand reputation. In conclusion, the Harris Texas Consent to Investigative Consumer Report is a crucial document that authorizes employers to conduct thorough background checks on potential employees. It ensures employers make informed hiring decisions and mitigates any potential risks. With different types of consent forms catering to different industry needs, businesses can maintain high standards of recruitment and safeguard themselves from potential liabilities.Harris Texas Consent to Investigative Consumer Report is a document required by employers or businesses in Harris County, Texas, that gives them permission to conduct an investigative consumer report on an individual. This report is needed when an employer wants to delve into the applicant's background, including their education, employment history, references, and personal character. The purpose of a Harris Texas Consent to Investigative Consumer Report is to ensure that employers have accurate and up-to-date information about potential employees before making important hiring decisions. It allows businesses to obtain a comprehensive picture of an individual's qualifications and character, thus reducing the risk of hiring someone with a questionable background or potential risks to the company. The Harris Texas Consent to Investigative Consumer Report typically includes several key elements. These may include the applicant's full name, address, social security number, date of birth, and other identifying information. It may also include a statement indicating that the applicant understands and authorizes the employer to conduct the investigation, as well as a release of liability for the employer. Different types of Harris Texas Consent to Investigative Consumer Report may exist to cater to specific industry requirements or background checks. For instance, some industries like banking or finance may have stricter regulations and require additional types of checks, such as credit history or criminal record checks. In these cases, the consent form may vary slightly to cover the additional checks requested. The importance of a Harris Texas Consent to Investigative Consumer Report cannot be overstated. It allows employers to make informed decisions based on accurate and pertinent information. It safeguards businesses from potential liabilities and ensures the protection of their employees, customers, and overall brand reputation. In conclusion, the Harris Texas Consent to Investigative Consumer Report is a crucial document that authorizes employers to conduct thorough background checks on potential employees. It ensures employers make informed hiring decisions and mitigates any potential risks. With different types of consent forms catering to different industry needs, businesses can maintain high standards of recruitment and safeguard themselves from potential liabilities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.