The Federal Fair Credit Reporting Act regulates the use of information on a consumer's personal and financial condition. The most typical transaction which this Act would cover would be where a person applies for a personal loan or other consumer credit. Consumer credit is credit for personal, family, or household use, and not for business or commercial transactions. Also, this Act can apply when a person applies for a job or even a policy of insurance when certain investigations are made of the applicant.

Investigative Consumer Reports are special types of consumer report not commonly used by credit and collection professionals. This report differs from the typical report used for the extension of consumer credit because it is can include information regarding a consumer's character, general reputation, and personal characteristics obtained through interviews with neighbors, friends, business associates, etc.

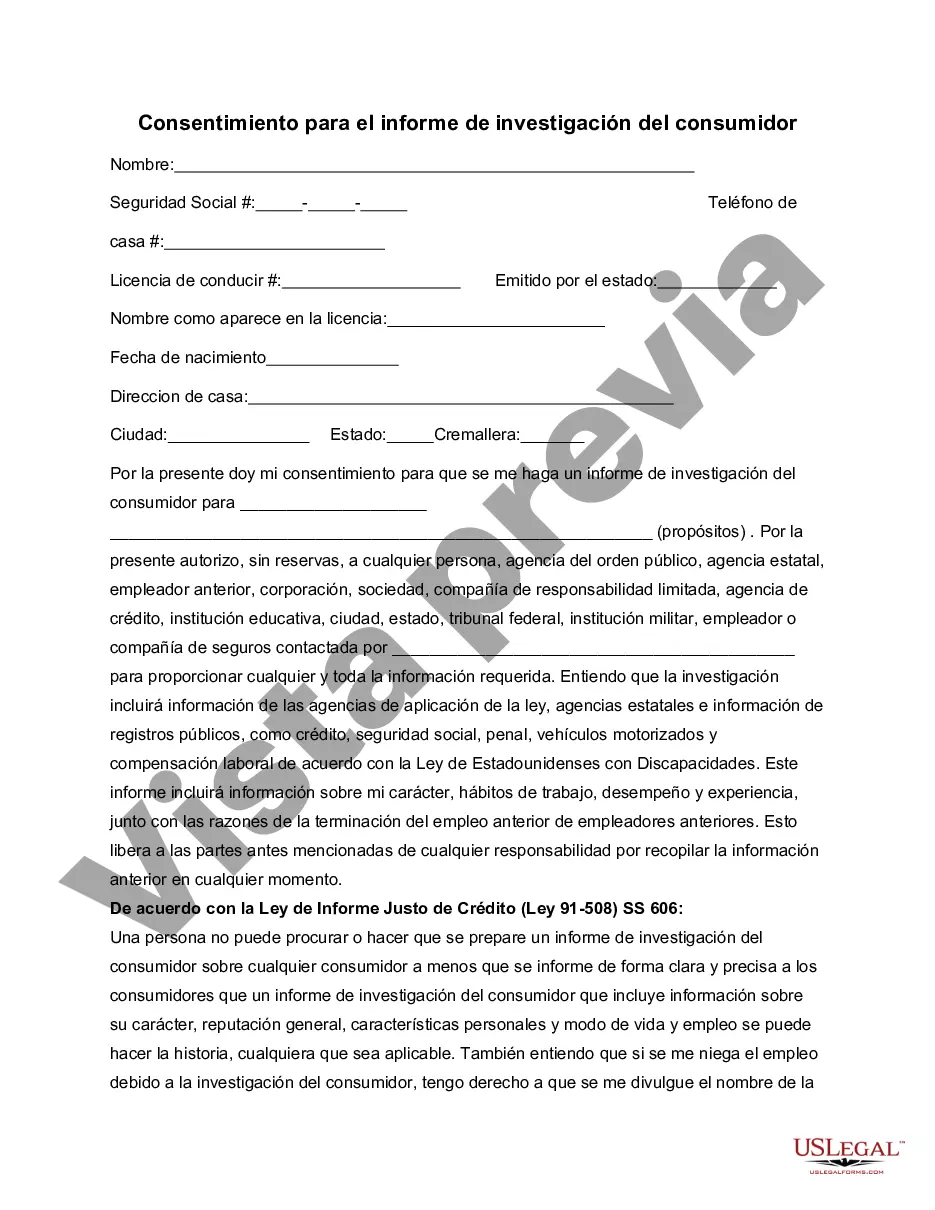

A Miami-Dade Florida Consent to Investigative Consumer Report is a legal document that grants permission to a potential employer or organization to conduct an in-depth investigation into an individual's personal, professional, and financial background. This report can be crucial in the decision-making process when hiring or considering partnerships with individuals or companies. The Miami-Dade Florida Consent to Investigative Consumer Report typically includes a set of specific details necessary for the investigation. This might involve the collection of information such as the individual's full name, address, social security number, date of birth, educational background, employment history, financial records, criminal records, and other relevant personal data. By signing this consent form, applicants allow the potential employer or organization to access this information through third-party agencies specializing in background checks. There could be different types of Miami-Dade Florida Consent to Investigative Consumer Reports, depending on the nature of the investigation required. For instance, some reports might focus solely on employment history, verifying previous job titles, responsibilities, and performance reviews. Others could delve into an individual's credit history, pulling data on loans, mortgages, and payment history. Furthermore, certain positions may require more extensive investigations, including criminal background checks, to ensure the safety and security of the workplace. It is important to note that the Miami-Dade Florida Consent to Investigative Consumer Report adheres to federal and state laws, including the Fair Credit Reporting Act (FCRA). This act establishes guidelines and regulations that protect individuals' rights and govern the proper use of consumer reports during the hiring process. Employers are legally obliged to obtain written consent from an individual before initiating any investigative consumer report. Overall, the Miami-Dade Florida Consent to Investigative Consumer Report is an essential document in today's employment environment. It allows employers to gather relevant information about potential candidates and make informed decisions when selecting individuals for employment or partnerships.A Miami-Dade Florida Consent to Investigative Consumer Report is a legal document that grants permission to a potential employer or organization to conduct an in-depth investigation into an individual's personal, professional, and financial background. This report can be crucial in the decision-making process when hiring or considering partnerships with individuals or companies. The Miami-Dade Florida Consent to Investigative Consumer Report typically includes a set of specific details necessary for the investigation. This might involve the collection of information such as the individual's full name, address, social security number, date of birth, educational background, employment history, financial records, criminal records, and other relevant personal data. By signing this consent form, applicants allow the potential employer or organization to access this information through third-party agencies specializing in background checks. There could be different types of Miami-Dade Florida Consent to Investigative Consumer Reports, depending on the nature of the investigation required. For instance, some reports might focus solely on employment history, verifying previous job titles, responsibilities, and performance reviews. Others could delve into an individual's credit history, pulling data on loans, mortgages, and payment history. Furthermore, certain positions may require more extensive investigations, including criminal background checks, to ensure the safety and security of the workplace. It is important to note that the Miami-Dade Florida Consent to Investigative Consumer Report adheres to federal and state laws, including the Fair Credit Reporting Act (FCRA). This act establishes guidelines and regulations that protect individuals' rights and govern the proper use of consumer reports during the hiring process. Employers are legally obliged to obtain written consent from an individual before initiating any investigative consumer report. Overall, the Miami-Dade Florida Consent to Investigative Consumer Report is an essential document in today's employment environment. It allows employers to gather relevant information about potential candidates and make informed decisions when selecting individuals for employment or partnerships.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.