Los Angeles California Corporate Right of First Refusal — Corporate Resolutions: Explained In Los Angeles, California, the corporate right of first refusal is a legal concept utilized through corporate resolutions. It grants certain privileges and constraints concerning the purchase or sale of shares by the shareholders of a corporation. This process ensures that existing shareholders have priority over outside investors or third parties when new shares are issued or transferred. What is Corporate Right of First Refusal? Corporate right of first refusal is a provision embedded in corporate resolutions that can be found in the company's bylaws or shareholders' agreement. This right empowers current shareholders to acquire any newly issued or transferred shares before they are offered to outsiders. Essentially, it grants shareholders the first opportunity to maintain or increase their ownership stake in the company. Key Elements of Corporate Right of First Refusal: 1. Shareholder Priority: The right of first refusal ensures that existing shareholders are given priority over external parties in purchasing or selling shares of the company. 2. Trigger Events: This provision is typically initiated when specific events occur, such as the sale of shares by an existing shareholder, an issuance of new shares by the company, or a transfer of shares to a third party. 3. Offer Price: When a shareholder decides to sell their shares or new shares are issued, the existing shareholders must be presented with an offer price. This price must be fair and reasonably marketable, ensuring the existing shareholders are given a fair opportunity to exercise their right of first refusal. 4. Time Constraints: Corporate resolutions usually include a timeframe within which the existing shareholders must exercise their right of first refusal. This ensures that the process moves forward efficiently and discourages unnecessary delays. 5. Interaction with Anti-Dilution Provisions: In some cases, the right of first refusal may interact with anti-dilution provisions. These provisions aim to protect shareholders from losing value or control due to the issuance of new shares at a discounted rate. Types of Corporate Right of First Refusal in Los Angeles, California: 1. Perpetual Right of First Refusal: This type of right of first refusal can be exercised by shareholders indefinitely or until certain conditions are met. 2. Limited Right of First Refusal: With this type of right of first refusal, shareholders have a limited time frame or number of occurrences to exercise their right. Once the specified limit is reached, the right may no longer be available. 3. Hybrid Right of First Refusal: A hybrid right of first refusal grants shareholders different priorities depending on the situation. For example, existing preferred shareholders may have a higher priority in purchasing newly issued preferred shares, while common shareholders may have priority over outside investors in purchasing newly issued common shares. In conclusion, the Los Angeles California corporate right of first refusal — corporate resolutions is a legal mechanism that safeguards the interests of existing shareholders in acquiring or selling shares of a corporation. It prioritizes shareholders over third parties and ensures a fair and transparent process. Different types of this provision include perpetual, limited, and hybrid rights of first refusal.

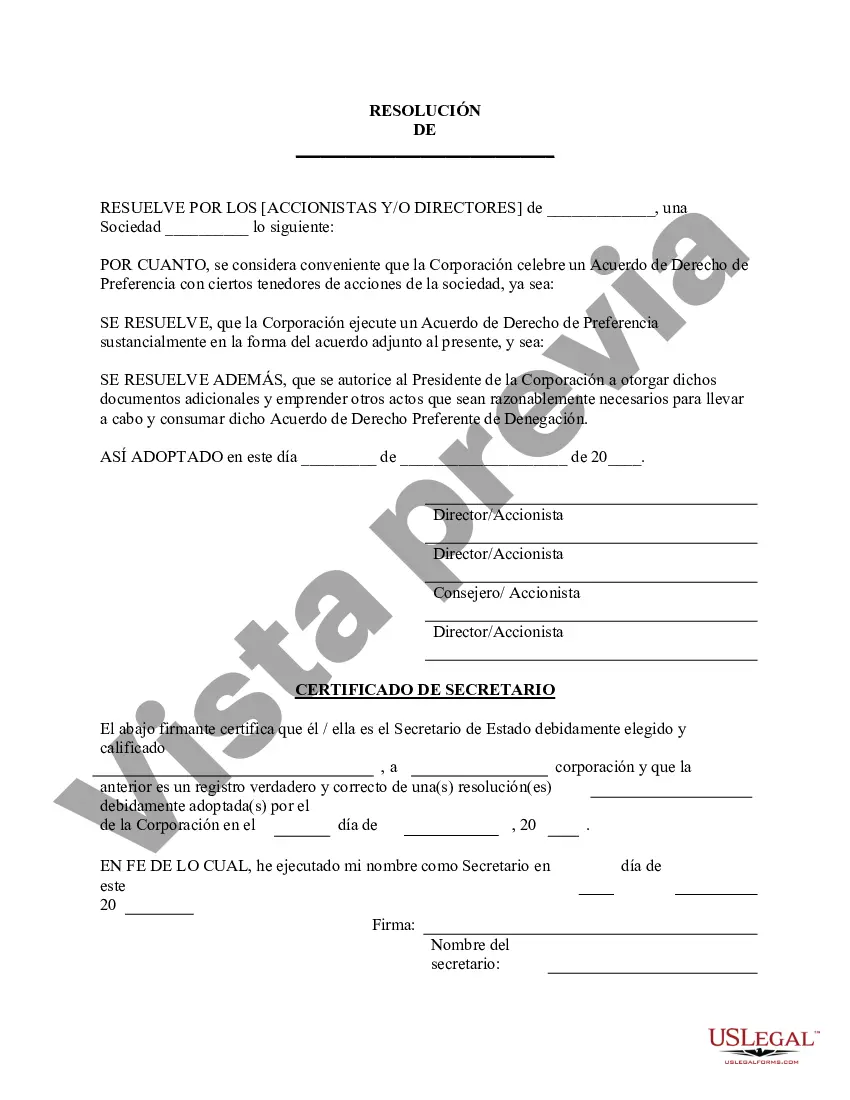

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Derecho Corporativo de Preferencia - Resoluciones Corporativas - Corporate Right of First Refusal - Corporate Resolutions

Description

How to fill out Los Angeles California Derecho Corporativo De Preferencia - Resoluciones Corporativas?

Are you looking to quickly draft a legally-binding Los Angeles Corporate Right of First Refusal - Corporate Resolutions or maybe any other form to handle your own or corporate matters? You can go with two options: hire a legal advisor to draft a valid document for you or create it entirely on your own. Thankfully, there's another solution - US Legal Forms. It will help you receive neatly written legal documents without paying unreasonable prices for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-compliant form templates, including Los Angeles Corporate Right of First Refusal - Corporate Resolutions and form packages. We provide documents for a myriad of use cases: from divorce papers to real estate documents. We've been out there for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra troubles.

- To start with, double-check if the Los Angeles Corporate Right of First Refusal - Corporate Resolutions is adapted to your state's or county's laws.

- If the form has a desciption, make sure to verify what it's suitable for.

- Start the search again if the form isn’t what you were looking for by using the search bar in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Los Angeles Corporate Right of First Refusal - Corporate Resolutions template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. In addition, the templates we offer are updated by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!