Lima Arizona Corporate Right of First Refusal — Corporate Resolutions: Understanding and Types In the realm of corporate law and business transactions, the concept of a right of first refusal (ROAR) holds substantial relevance. In Lima, Arizona, corporate right of first refusal provisions in corporate resolutions are utilized to protect the interests and maintain control over company ownership changes. This article aims to provide a detailed description of what a Lima Arizona Corporate Right of First Refusal is, and shed light on different types of resolutions commonly observed in this context. A Corporate Right of First Refusal essentially grants a corporation the exclusive option to purchase a specific asset or interest before it can be sold to a third party. This provision is frequently included in a corporation's bylaws or shareholders' agreement to allow existing shareholders to maintain control and prevent unwelcome or incompatible ownership changes. The resolution governing the Corporate Right of First Refusal outlines the terms, conditions, and procedures by which the existing shareholders can exercise their rights. It aims to strike a balance between protecting the interests of current shareholders while considering the potential benefits of allowing new investors or shareholders to participate. Let's explore some common types of Lima Arizona Corporate Right of First Refusal — Corporate Resolutions: 1. Share Transfer Right of First Refusal Resolution: This resolution applies when a shareholder intends to sell or transfer their shares to a third party. Before proceeding with the sale, the shareholder must first offer the shares to the existing shareholders at the same price and under the same conditions. If the existing shareholders decline, the shares can then be sold to the intended third party. 2. Asset Transfer Right of First Refusal Resolution: In situations where a corporation plans to sell or transfer a particular asset (e.g., real estate, intellectual property, or business divisions), this resolution establishes a process for existing shareholders to be given the first opportunity to purchase the asset. They must match the offered price or negotiate a new one with the corporation before it can be sold elsewhere. 3. Financing Right of First Refusal Resolution: This resolution addresses situations where a corporation seeks external financing, such as through issuing new shares or taking on loans. Existing shareholders are given the right of first refusal to purchase the newly issued shares or provide the required loan before external parties are approached. 4. Merger and Acquisition Right of First Refusal Resolution: To maintain control over potential mergers or acquisition transactions, this resolution allows existing shareholders to exercise their rights by having a first opportunity to purchase the target company or assets involved in the proposed deal. By doing so, they can influence the course of negotiations or prevent unfavorable outcomes. It is crucial to understand that the specific details and variations of these resolutions may differ from case to case or company to company. It is advisable for corporations in Lima, Arizona, seeking to establish a Corporate Right of First Refusal to consult experienced legal professionals to tailor the resolutions to their specific needs and comply with applicable laws and regulations. In summary, a Lima Arizona Corporate Right of First Refusal — Corporate Resolutions provide a mechanism for existing shareholders to maintain control over ownership changes. By incorporating various types of resolutions, corporations can ensure that they have the first opportunity to purchase shares, assets, obtain financing, or influence mergers and acquisitions, securing their interests and continuity in the business landscape.

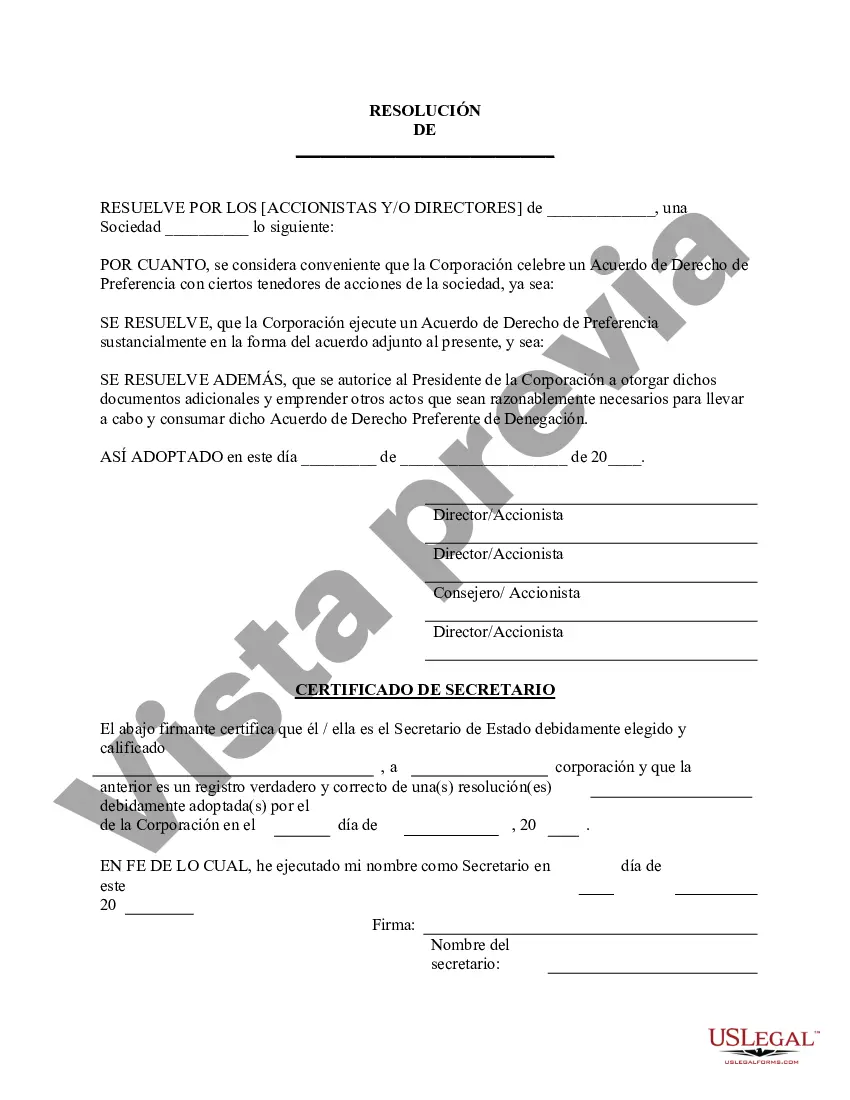

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Derecho Corporativo de Preferencia - Resoluciones Corporativas - Corporate Right of First Refusal - Corporate Resolutions

Description

How to fill out Pima Arizona Derecho Corporativo De Preferencia - Resoluciones Corporativas?

Creating documents, like Pima Corporate Right of First Refusal - Corporate Resolutions, to take care of your legal affairs is a difficult and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task not really affordable. However, you can get your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms created for a variety of cases and life situations. We ensure each document is compliant with the laws of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Pima Corporate Right of First Refusal - Corporate Resolutions form. Simply log in to your account, download the template, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly straightforward! Here’s what you need to do before getting Pima Corporate Right of First Refusal - Corporate Resolutions:

- Ensure that your form is compliant with your state/county since the rules for writing legal papers may differ from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the Pima Corporate Right of First Refusal - Corporate Resolutions isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to start using our website and download the document.

- Everything looks great on your end? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your template is all set. You can try and download it.

It’s an easy task to locate and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!