Salt Lake Utah Corporate Right of First Refusal — Corporate Resolutions: Understanding the Basics The Salt Lake Utah Corporate Right of First Refusal is a legal concept pertaining to corporate resolutions that provides a company with the option to purchase a specific asset or investment opportunity before it is offered to external parties. This right is typically granted to a corporation's existing shareholders or partners, allowing them to maintain their ownership stake and protect the company's interests. Key Elements of Salt Lake Utah Corporate Right of First Refusal 1. Definition and Purpose: The Corporate Right of First Refusal is a contractual clause that gives a corporation the first opportunity to purchase a particular asset or investment. By exercising this right, the corporation ensures that it has the chance to acquire assets that align with its strategic goals, maintain control over its operations, or prevent third-party investors from gaining undue control or influence. 2. Application and Scope: The Corporate Right of First Refusal can be applied to various types of transactions, such as the sale or transfer of shares, real estate, intellectual property, business opportunities, or any other valuable asset. Its scope can vary depending on the specific language and terms outlined in the corporate resolutions adopted by a company. 3. Process and Implementation: When a shareholder or partner intends to sell their interest or the corporation wants to sell a valuable asset, the Corporate Right of First Refusal mechanism is invoked. The corporation must notify its existing shareholders or partners about the opportunity, giving them the chance to exercise their right within a specified timeframe. If a shareholder shows interest, they must submit an offer in accordance with the predetermined terms and conditions outlined in the corporate resolutions. Different Types of Salt Lake Utah Corporate Right of First Refusal 1. Simple Right of First Refusal: This type of resolution grants the corporation a basic right to purchase an asset or investment before it is offered to third parties. If the corporation declines to exercise its right, the asset may be sold to an external party under specific conditions. 2. Right of First Negotiation: In this variant, the corporation receives the option to negotiate the terms and price of an asset or investment before the shareholder or partner approaches external parties. It allows the company to secure the best possible deal and establish favorable conditions. 3. Right of First Offer: This type of Corporate Right of First Refusal requires the shareholder or partner to present the corporation with an offer from an external party. If the corporation rejects the offer, the shareholder is then free to proceed with the third-party transaction. This mechanism ensures that the corporation has a chance to match or surpass the external offer. In conclusion, the Salt Lake Utah Corporate Right of First Refusal is a crucial aspect of corporate resolutions, providing corporations with the ability to protect their interests, maintain control, and secure valuable assets or investment opportunities. Different variations of this right, such as the simple right of first refusal, right of first negotiation, and right of first offer, offer companies a range of options tailored to their specific needs.

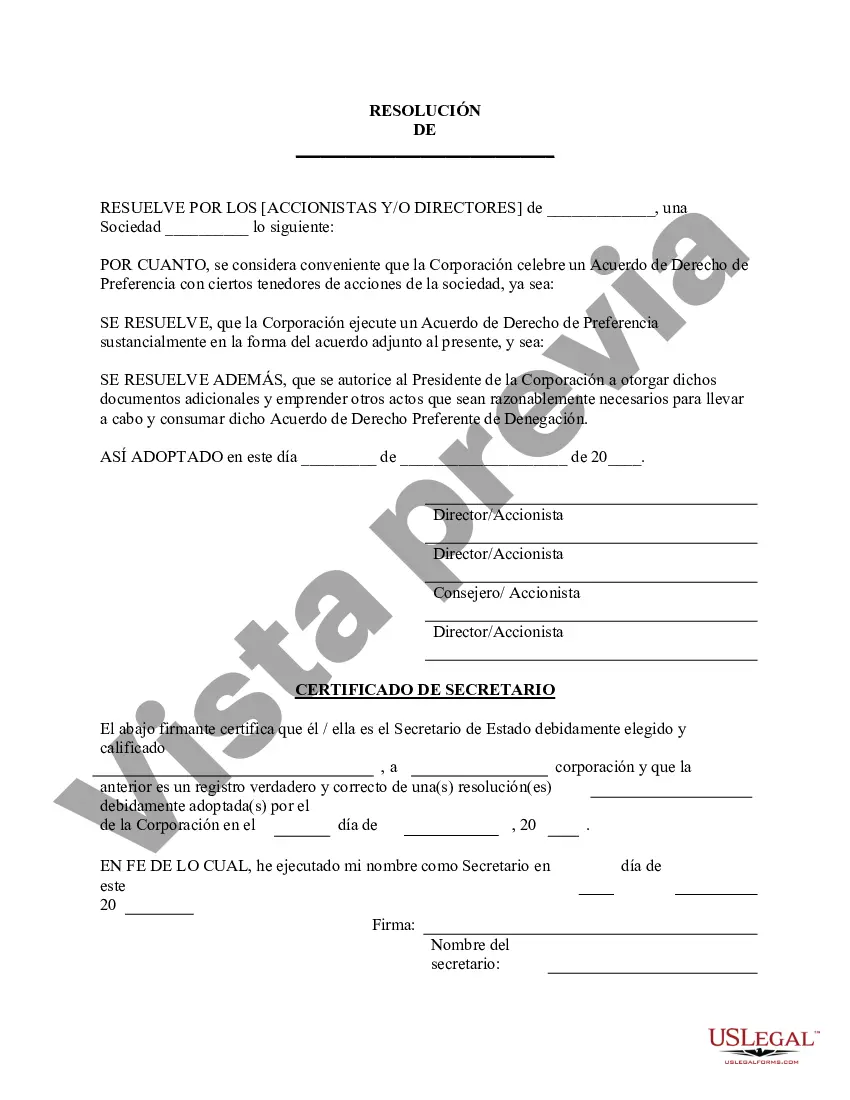

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Derecho Corporativo de Preferencia - Resoluciones Corporativas - Corporate Right of First Refusal - Corporate Resolutions

Description

How to fill out Salt Lake Utah Derecho Corporativo De Preferencia - Resoluciones Corporativas?

Creating legal forms is a necessity in today's world. However, you don't always need to look for professional help to create some of them from the ground up, including Salt Lake Corporate Right of First Refusal - Corporate Resolutions, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in different types varying from living wills to real estate papers to divorce documents. All forms are organized according to their valid state, making the searching experience less challenging. You can also find detailed materials and guides on the website to make any activities related to paperwork execution straightforward.

Here's how to find and download Salt Lake Corporate Right of First Refusal - Corporate Resolutions.

- Take a look at the document's preview and description (if available) to get a general information on what you’ll get after downloading the document.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can impact the validity of some documents.

- Examine the related forms or start the search over to find the right file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment gateway, and buy Salt Lake Corporate Right of First Refusal - Corporate Resolutions.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Salt Lake Corporate Right of First Refusal - Corporate Resolutions, log in to your account, and download it. Of course, our platform can’t replace a lawyer entirely. If you have to deal with an exceptionally difficult case, we advise getting a lawyer to check your form before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and purchase your state-specific paperwork with ease!