Cook Illinois Corporate Resolution for LLC is a legal document that outlines the decisions made by members and managers of an LLC based in Cook County, Illinois. This resolution serves as an official record of the actions taken during a meeting or by written consent of the LLC members or managers. A Cook Illinois Corporate Resolution for LLC typically includes important details such as the date, time, and location of the meeting, as well as the names of the attendees. It also outlines the specific matters being discussed and the resolutions reached in regard to those matters. There are different types of Cook Illinois Corporate Resolutions for LLC that may be relevant to various aspects of the business. Some common types include: 1. Operating Agreement Resolution: This type of resolution addresses decisions related to the LLC's operating agreement, such as amending or updating the provisions, adding or removing members, or changing ownership percentages. 2. Financial Resolution: This resolution focuses on financial matters, such as approving the LLC's annual budget, authorizing borrowing or lending money, entering into contracts, or making investments on behalf of the LLC. 3. Employment Resolution: This type of resolution pertains to matters related to employment, such as hiring or terminating employees, determining employee compensation and benefits, or establishing workplace policies. 4. Tax Resolution: LCS often need to make decisions regarding tax matters. These resolutions might address issues like electing a certain tax classification, authorizing tax planning strategies, or filing tax forms and returns. 5. Real Estate Resolution: When an LLC is involved in real estate transactions, resolutions may be necessary to authorize property purchases or sales, lease agreements, zoning matters, or property development plans. It's important to note that the specific contents and types of Cook Illinois Corporate Resolution for LLC may vary depending on the needs, goals, and operations of the specific LLC. Consulting with a qualified attorney or legal professional is highly recommended ensuring compliance with relevant state laws and to address the LLC's specific requirements effectively.

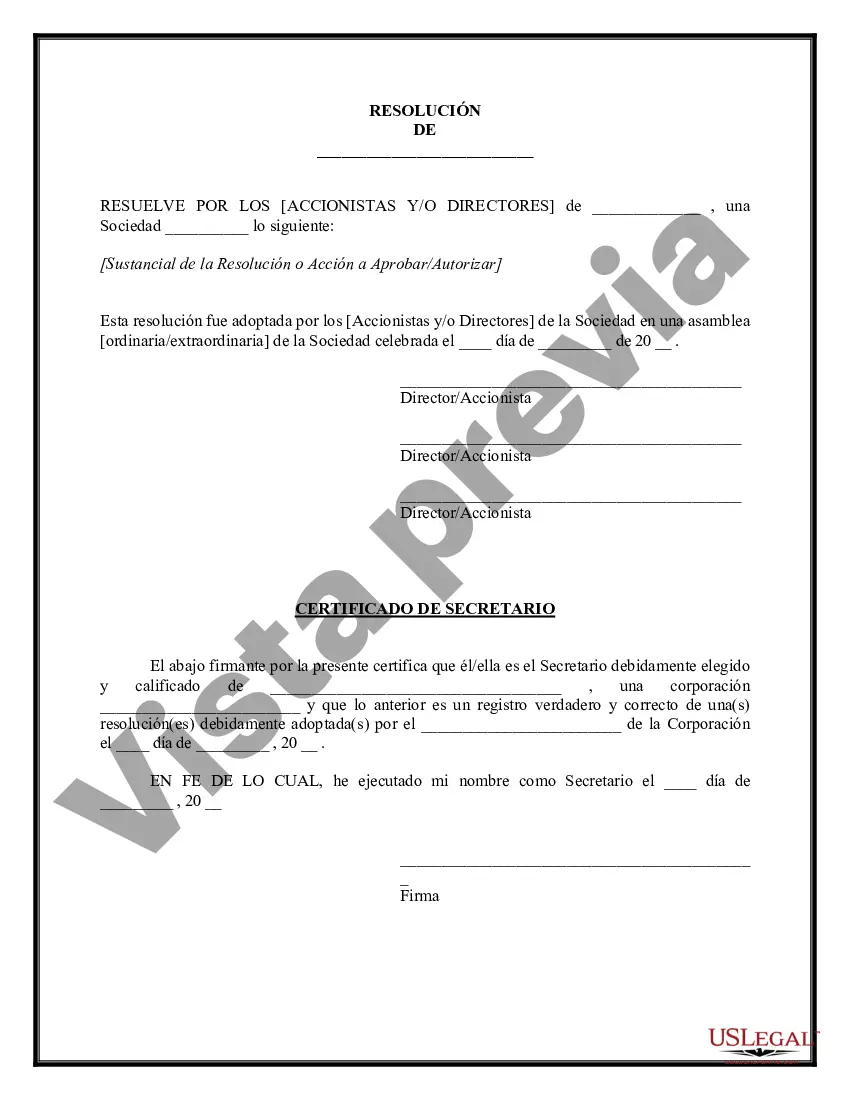

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Resolución Corporativa para LLC - Corporate Resolution for LLC

Description

How to fill out Cook Illinois Resolución Corporativa Para LLC?

Whether you intend to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Cook Corporate Resolution for LLC is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to obtain the Cook Corporate Resolution for LLC. Follow the guidelines below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Cook Corporate Resolution for LLC in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!