Travis Texas Corporate Resolution for LLC: A Comprehensive Guide A Travis Texas Corporate Resolution for LLC refers to a legal document created by a limited liability company (LLC) in Travis County, Texas. This resolution serves as an official record of decisions made by the company's members or managers. Keywords: Travis Texas, LLC, Corporate Resolution, Limited Liability Company, Travis County, legal document, decisions, members, managers. Types of Travis Texas Corporate Resolution for LLC: 1. Organizational Resolutions: These resolutions are adopted when forming an LLC or making significant changes to its structure. They generally cover decisions such as appointing managers or members, creating an operating agreement, determining capital contributions, and defining the roles and responsibilities of the company's members. 2. Authorization Resolutions: Authorization resolutions are employed when the LLC needs to grant specific powers to its managers or members. These resolutions enable the designated individuals to act on behalf of the LLC in various matters like signing contracts, making financial decisions, entering into partnerships, approving loans, or acquiring assets. 3. Financial Resolutions: Financial resolutions deal with matters related to the company's financial operations. They might include approving annual budgets, authorizing payroll disbursements, signing off on tax filings, opening and closing bank accounts, securing loans or lines of credit, and overseeing the distribution of profits or losses among members. 4. Amendment or Modification Resolutions: When an LLC intends to alter its articles of organization or operating agreement, amendment resolutions are required. These resolutions typically outline the proposed changes, such as adjusting the LLC's purpose, adding or removing members or managers, modifying capital contribution requirements, or revising voting rights. 5. Dissolution Resolutions: Dissolution resolutions come into play when an LLC decides to cease its business operations. They record the agreement among members to dissolve the LLC, specify the liquidation process, and establish how remaining assets will be distributed among members or creditors. It is essential to note that each LLC's specific needs may vary, and not every resolution mentioned above will be applicable to all companies. Moreover, it is highly recommended consulting a legal professional to ensure compliance with the specific regulations in Travis County, Texas, when drafting and executing these resolutions.

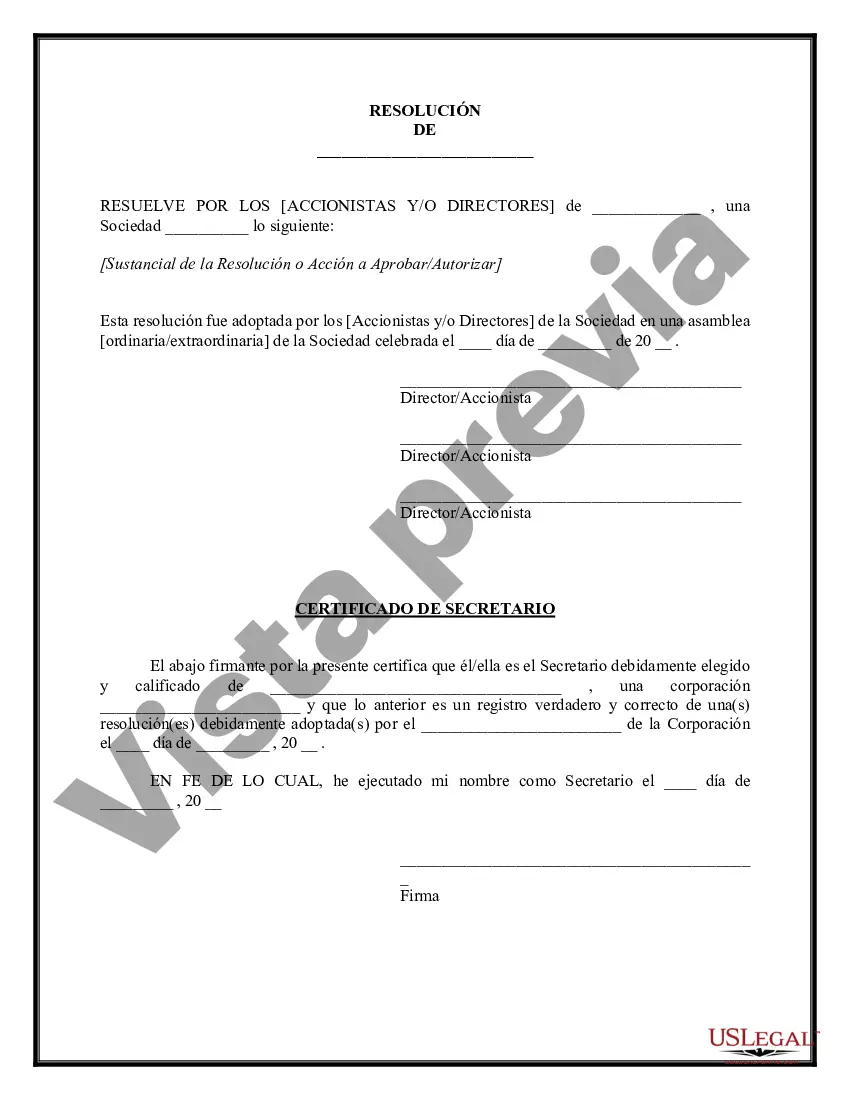

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Resolución Corporativa para LLC - Corporate Resolution for LLC

Description

How to fill out Travis Texas Resolución Corporativa Para LLC?

Drafting papers for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft Travis Corporate Resolution for LLC without professional help.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Travis Corporate Resolution for LLC on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Travis Corporate Resolution for LLC:

- Look through the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that fits your needs, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any scenario with just a few clicks!