Los Angeles California Corporate Resolution for SBA Loan: A Comprehensive Overview In Los Angeles, California, the Corporate Resolution for SBA Loan refers to a document required by the Small Business Administration (SBA) when a corporation or an eligible entity applies for a loan. This resolution serves as a formal statement or decision by the corporation's board of directors, authorizing certain individuals within the company to borrow funds on behalf of the corporation. It outlines the specific details and terms of the loan agreement, demonstrating the corporation's commitment to comply with SBA loan requirements. Key Elements of a Los Angeles California Corporate Resolution for SBA Loan: 1. Identification of Borrowing Authority: The resolution identifies the designated individuals, usually officers or executives, who are authorized to execute the loan application, negotiate loan terms, and sign relevant loan documents. 2. Loan Purpose and Amount: The resolution specifies the purpose for which the loan is being sought, such as expansion, working capital, equipment purchase, or real estate investment. Additionally, the resolution establishes the maximum loan amount that the corporation is seeking to obtain. 3. Loan Terms and Collateral: The resolution comprehensively outlines the terms and conditions of the proposed loan, including repayment schedule, interest rates, and any collateral pledged to secure the loan, such as corporate assets or personal guarantees. 4. Corporate Representative Authority: This section of the resolution designates the corporate representative(s) who will communicate with the SBA and other entities involved in the loan process, ensuring effective coordination and accurate representation of the corporation's interests. 5. Decision-Making Process: It is vital for the resolution to include details regarding how the board of directors reached the decision to pursue the SBA loan. This typically involves a vote or consent process, ensuring the decision to borrow aligns with corporate bylaws or governing documents. 6. Compliance with SBA Requirements: The resolution addresses the corporation's dedication to fulfilling all relevant SBA regulations and requirements, ensuring that the loan application and subsequent loan activities are conducted in accordance with SBA guidelines. Different Types of Los Angeles California Corporate Resolution for SBA Loan: 1. General Corporate Resolution: This type of resolution covers the overall borrowing authority and loan purposes of the corporation. It authorizes specific individuals to act on behalf of the corporation, overseeing various aspects of the loan process. 2. Amendment Resolution: If a corporation wishes to modify an existing resolution, an amendment resolution is required. It outlines the changes being made and identifies the revised terms and conditions of the SBA loan. 3. Collateral Resolution: In cases where the SBA loan requires collateral, a collateral resolution is necessary. This document formally authorizes the use of specific assets as collateral and designates the individuals responsible for managing the collateral. 4. Subsidiary Resolution: If a subsidiary corporation seeks an SBA loan, it may require a subsidiary resolution. This resolution establishes the authority of the subsidiary to enter into loan agreements and appoints representatives to act on behalf of the subsidiary during the loan process. As always, it is essential to consult a legal professional or a qualified attorney to understand the specific requirements and legal implications associated with Los Angeles California Corporate Resolution for SBA Loan.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Resolución Corporativa para Préstamo SBA - Corporate Resolution for SBA Loan

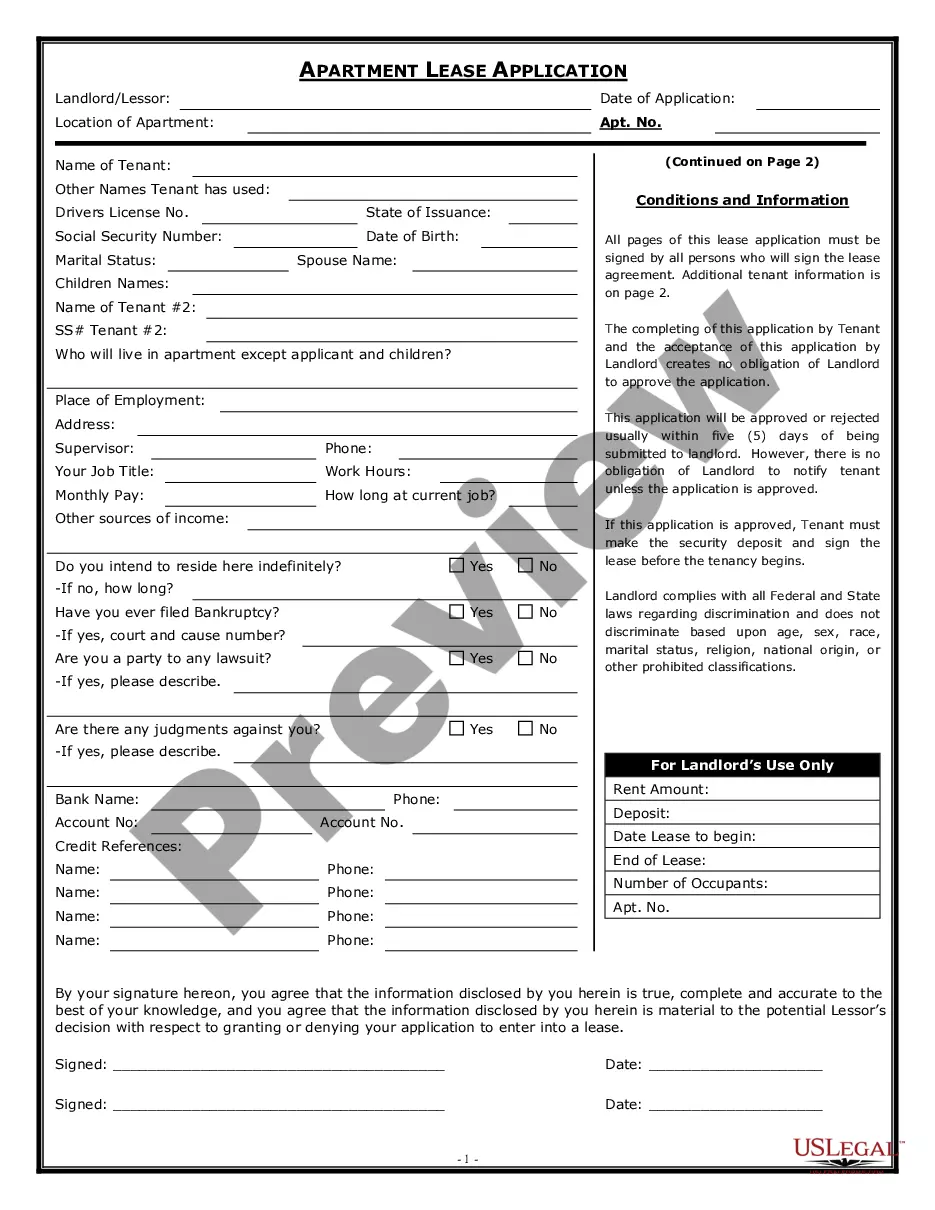

Description

How to fill out Los Angeles California Resolución Corporativa Para Préstamo SBA?

How much time does it normally take you to draw up a legal document? Considering that every state has its laws and regulations for every life sphere, finding a Los Angeles Corporate Resolution for SBA Loan suiting all local requirements can be tiring, and ordering it from a professional lawyer is often expensive. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, collected by states and areas of use. Aside from the Los Angeles Corporate Resolution for SBA Loan, here you can find any specific form to run your business or personal deeds, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can get the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Los Angeles Corporate Resolution for SBA Loan:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Los Angeles Corporate Resolution for SBA Loan.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Actualmente, plataformas como Kueski, Dineria o Creditea ofrecen prestamos sin historial de credito. Estas empresas ofrece prestamos sin historial a jovenes mayores de 18 anos que puedan demostrar ingresos.

La SBA otorga subvenciones a organizaciones comunitarias para ayudar a promover el espiritu empresarial, incluyendo las que apoyan a pequenas empresas propiedad de veteranos y propiedad de veteranos con discapacidad, asi como los Centros de desarrollo de pequenas empresas.

En el caso de los prestamos por desastre de la SBA para viviendas y empresas aprobados en 2020, los prestatarios deberan reanudar los pagos regulares de capital e intereses 12 meses despues de la fecha de vencimiento del siguiente pago, de conformidad con los terminos de la autorizacion del prestamo.

PNC Bank PrestamistaMonto maximoTasa de interes anualRocket Loans$45,0007.161% 29.99%Pendef Credit Union$50,0005.49%Citibank$30,0007.99% a 23.99%PCN Bank$30,0007.161% 29.99%14 more rows

Para obtener un prestamo respaldado por la SBA: Introduzca su codigo postal en Lender Match para encontrar un prestamista en su area. Solicite un prestamo a traves de su prestamista local. Los prestamistas aprobaran y le ayudaran a administrar su prestamo.

Opciones de pago Vaya a Pay.gov. Busque el formulario de la SBA 1201 Borrower Payment. Envie el pago junto con el formulario 1201, por medio de uno de los siguientes metodos de pago en linea aceptados: cuenta bancaria (ACH, por sus siglas en ingles), cuenta de PayPal, tarjeta de debito.

Use el Sistema Financiero de Acceso al Capital de la SBA, o CAFS, por sus siglas en ingles (caweb.sba.gov) para que los prestatarios existentes controlen el estado de los siguientes tipos de prestamos: Programa de proteccion de pago (PPP, por sus siglas en ingles)

Consejos para pedir un prestamo Investiga y compara tus alternativas.Entrega la informacion completa a la primera.Revisa en detalle el contrato.Realiza simulaciones.Verifica los productos que pueden estar vinculados.Elige el plazo correcto de acuerdo a tu capacidad de pago.No solicites mas dinero del que necesitas.

¿Como saber si califico para un prestamo? Solicita el historial crediticio. ¿Como saber si aplicas para un credito?Tener un historial crediticio.No estar en la lista de los centrales de riesgo (la lista negra de Infocorp)Tener ingresos fijos y comprobados.Estar dentro del rango de edad que pide la financiera.

Como acceder a su informe Puede solicitar una copia gratis de su informe de credito de cada una de las tres principales agencias de informes de credito, Equifax®, Experian® y TransUnion®, una vez por ano en AnnualCreditReport.com (en ingles) o llamando al telefono gratuito 1-877-322-8228 (en ingles).