A corporate resolution is an official document issued by a corporation's board of directors or its members to authorize specific actions or decisions. In the context of SBA loans in Phoenix, Arizona, a Phoenix Arizona Corporate Resolution for SBA Loan refers to a resolution specific to companies located in Phoenix, Arizona, seeking to obtain a Small Business Administration (SBA) loan. This resolution is essential when a company intends to apply for an SBA loan, as it authorizes the necessary actions and confirms the company's commitment to fulfilling the loan requirements. The Phoenix Arizona Corporate Resolution for SBA Loan outlines the details of the loan application process, the intended purpose of the loan, and the responsibilities of the company's officers. The content of a Phoenix Arizona Corporate Resolution for SBA Loan may vary depending on the specific requirements of the SBA and the circumstances of the company. However, some common elements typically included in such resolutions are: 1. Introduction: The resolution begins with an introduction, clearly stating the name of the company, its registered address, and its intention to apply for an SBA loan. 2. Loan Purpose and Amount: The resolution details the purpose for which the loan is intended, such as financing equipment purchases, working capital, or expansion. It also specifies the loan amount required. 3. Board Authorization: The resolution confirms that the board of directors has reviewed the loan application and authorizes specific officers or members to act on behalf of the company during the loan process. This includes appointing an authorized signatory responsible for executing loan documents. 4. Financial Information: The resolution may require the company to provide certain financial information necessary for the loan application, such as tax returns, financial statements, or projections. 5. Collateral and Guarantees: If the SBA loan requires collateral or personal guarantees, the resolution may address the company's willingness to pledge assets or seek personal guarantees from its officers or members. 6. SBA Loan Program: If the resolution pertains to a specific SBA loan program, such as the 7(a) or the 504 loan program, it may specify the relevant program and outline any program-specific requirements or conditions. 7. Officer Responsibilities: The resolution outlines the responsibilities of the company's officers or members in ensuring compliance with the SBA loan terms, including the submission of periodic financial statements or reporting requirements. Different types of Phoenix Arizona Corporate Resolutions for SBA Loans can exist based on the distinct loan programs or specific needs of a company. Some potential variations may include: 1. Phoenix Arizona Corporate Resolution for SBA 7(a) Loan: This resolution specifically pertains to companies seeking a 7(a) loan through the SBA program. 2. Phoenix Arizona Corporate Resolution for SBA 504 Loan: This resolution is tailored for companies applying for an SBA 504 loan, which provides funding for fixed assets, such as real estate or major equipment. 3. Phoenix Arizona Corporate Resolution for SBA Disaster Loan: In the event of a declared disaster in Phoenix, Arizona, companies may require a resolution specific to SBA disaster loans, which are aimed at assisting businesses affected by natural disasters. 4. Phoenix Arizona Corporate Resolution for SBA Microloan: For smaller loan amounts, a company may utilize a resolution specific to SBA microloans, designed to support startups and small businesses with limited access to traditional financing. In conclusion, a Phoenix Arizona Corporate Resolution for SBA Loan is a crucial document that authorizes a company's actions and responsibilities when applying for an SBA loan in Phoenix, Arizona. Its content varies based on the loan program, loan amount, and specific requirements of the SBA.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Resolución Corporativa para Préstamo SBA - Corporate Resolution for SBA Loan

Description

How to fill out Phoenix Arizona Resolución Corporativa Para Préstamo SBA?

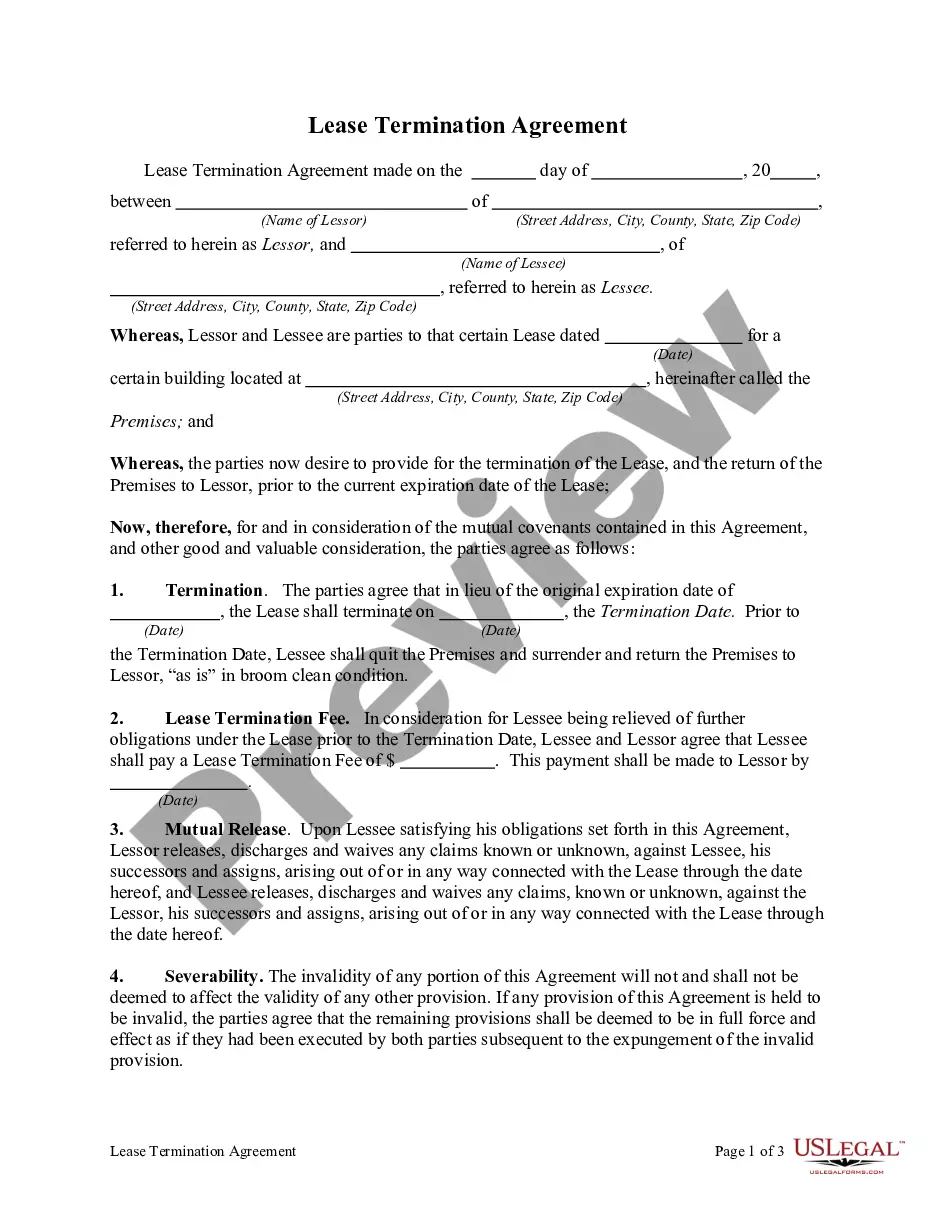

Are you looking to quickly draft a legally-binding Phoenix Corporate Resolution for SBA Loan or probably any other form to handle your personal or corporate matters? You can select one of the two options: contact a professional to draft a legal document for you or draft it completely on your own. Thankfully, there's a third solution - US Legal Forms. It will help you receive neatly written legal documents without paying sky-high prices for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-specific form templates, including Phoenix Corporate Resolution for SBA Loan and form packages. We offer documents for an array of life circumstances: from divorce paperwork to real estate document templates. We've been out there for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the needed document without extra hassles.

- First and foremost, double-check if the Phoenix Corporate Resolution for SBA Loan is adapted to your state's or county's laws.

- In case the form includes a desciption, make sure to check what it's intended for.

- Start the searching process again if the document isn’t what you were seeking by using the search box in the header.

- Choose the subscription that best suits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Phoenix Corporate Resolution for SBA Loan template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. In addition, the paperwork we provide are reviewed by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!