A corporate resolution for a bank account in Montgomery, Maryland is a legal document that outlines specific actions and decisions made by a corporation's board of directors or shareholders regarding the opening, closing, or management of a bank account in the jurisdiction of Montgomery, Maryland. It serves as formal authorization and sets forth the requirements and limitations in regard to the account's operations. Key elements discussed in a Montgomery Maryland Corporate Resolution for Bank Account include identifying the corporation's name, its registration/address in Montgomery, Maryland, and the purpose for which the account is being opened. The resolution also provides details on who within the corporation is authorized to transact on behalf of the account, such as signatories, authorized officers, or designated individuals. There might be variations of Montgomery Maryland Corporate Resolution for Bank Account based on different circumstances or specific requirements. Some types include: 1. Opening Resolution: This type of resolution is used when the corporation decides to open a new bank account. It specifies the necessary information such as the bank's name, branch address, account type, and initial deposit amount required. Additionally, it designates the authorized individuals who can oversee the account and make transactions on behalf of the corporation. 2. Closing Resolution: When a corporation decides to close a bank account in Montgomery, Maryland, a closing resolution is necessary. It authorizes the individuals nominated by the corporation to complete all steps required for the account closure, such as withdrawing remaining funds, canceling automatic payments or transfers, and notifying the bank officially. 3. Change of Signatories Resolution: In situations where the existing authorized signatories need to be modified, a change of signatories resolution is drafted. This resolution identifies the individuals being added or removed as signatories and outlines the specific processes and steps required to effectuate the change. 4. Amendment Resolution: An amendment resolution is employed when certain provisions of an existing corporate resolution need alteration. Such changes may include modifying the authorized individuals, bank account details, or any other relevant information. The amendment resolution sets forth the approved modifications and ensures that the updated resolution effectively supersedes the previous version. In conclusion, a Montgomery Maryland Corporate Resolution for Bank Account is a vital legal document that enables a corporation to establish, manage, or close a bank account in Montgomery, Maryland. The different types of resolutions outlined above cater to various scenarios that may arise during the course of a corporation's banking activities in the jurisdiction. It is crucial for corporations to consult legal advisors or professionals well-versed in business and banking laws to ensure the accuracy and compliance of these resolutions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Resolución Corporativa para Cuenta Bancaria - Corporate Resolution for Bank Account

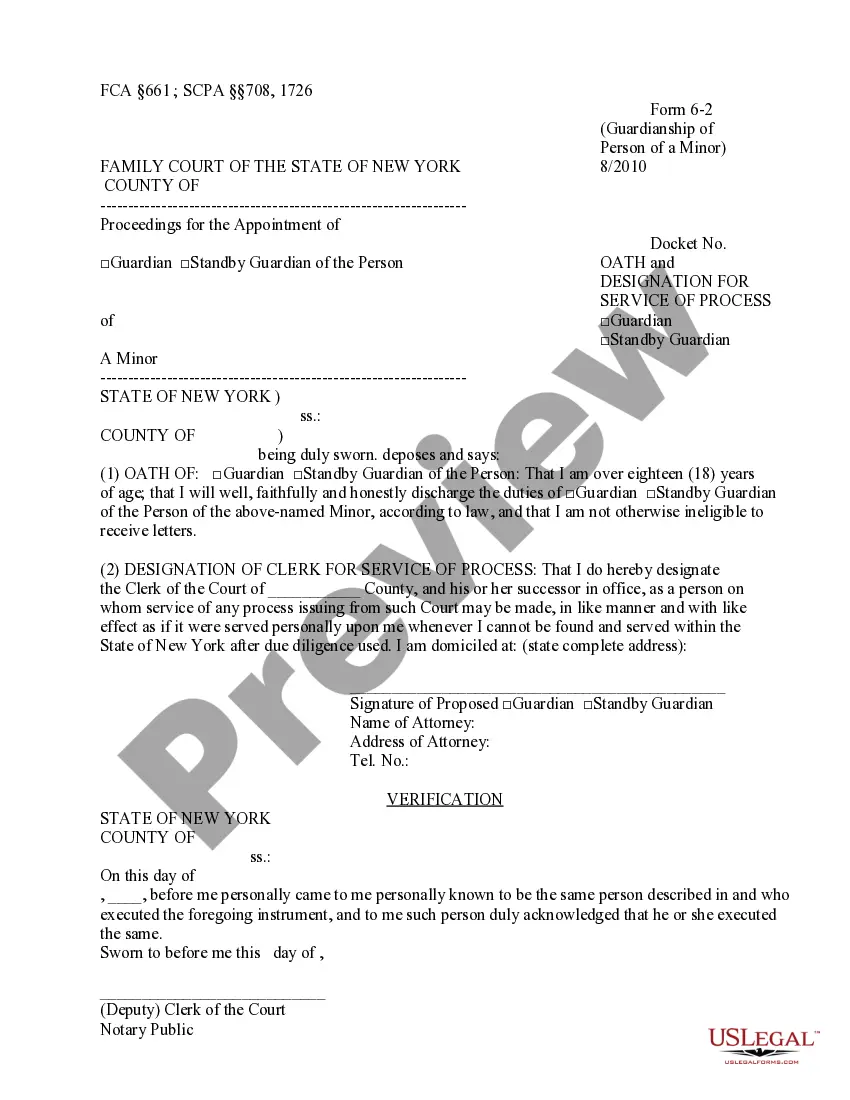

Description

How to fill out Montgomery Maryland Resolución Corporativa Para Cuenta Bancaria?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal documentation that differs from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and download a document for any individual or business purpose utilized in your region, including the Montgomery Corporate Resolution for Bank Account.

Locating templates on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Montgomery Corporate Resolution for Bank Account will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the Montgomery Corporate Resolution for Bank Account:

- Ensure you have opened the proper page with your regional form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your needs.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Montgomery Corporate Resolution for Bank Account on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!