Bronx New York Corporate Resolution for IDL Loan is a legal document that outlines the decisions and actions taken by a corporation located in the Bronx, New York, to apply for and utilize an Economic Injury Disaster Loan (IDL) offered by the Small Business Administration (SBA). This resolution plays a crucial role in facilitating the loan application process and demonstrating the corporation's intent and commitment to obtaining and using the approved loan funds responsibly. The Bronx New York Corporate Resolution for IDL Loan typically includes several important components: 1. Identification of the Corporation: This section states the legal name of the corporation, its principal office address in the Bronx, and any other pertinent identifying information. 2. Authorization of Loan Application: The resolution authorizes a designated individual, usually a corporate officer or manager, to file and sign all necessary loan application documents on behalf of the corporation. This individual should possess the appropriate authority as designated by the corporation's bylaws or operating agreement. 3. Loan Amount and Purpose: The resolution specifies the estimated loan amount the corporation intends to request from the SBA, as well as the intended purpose of the loan funds. It may include details about how the funds will be used to cover eligible operating expenses, such as payroll, rent, utilities, and other necessary expenditures. 4. Additional Borrowing Details: If applicable, the resolution may also address any additional borrowing requirements or restrictions imposed by the SBA or other lending institutions. 5. Loan Agreement and Collateral: This section confirms the corporation's agreement to abide by the terms and conditions outlined in the loan agreement provided by the SBA. It may also address the issue of collateral, if required. 6. Execution and Notarization: The resolution must be signed by the authorized corporate officer(s) and notarized to ensure its legality and authenticity. Different types of Bronx New York Corporate Resolutions for IDL Loans may exist based on the specific circumstances of the corporation. For example, if the corporation consists of multiple shareholders or partners, a resolution may be required to reflect their collective decision and agreement to proceed with the loan application. It is important to consult with an attorney or legal advisor familiar with corporate law to ensure that all relevant legal requirements are met and that the resolution accurately represents the corporation's intentions regarding the IDL loan application.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Resolución Corporativa de Préstamo EIDL - Corporate Resolution for EIDL Loan

Description

How to fill out Bronx New York Resolución Corporativa De Préstamo EIDL?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask an attorney to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Bronx Corporate Resolution for EIDL Loan, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Therefore, if you need the current version of the Bronx Corporate Resolution for EIDL Loan, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Bronx Corporate Resolution for EIDL Loan:

- Look through the page and verify there is a sample for your area.

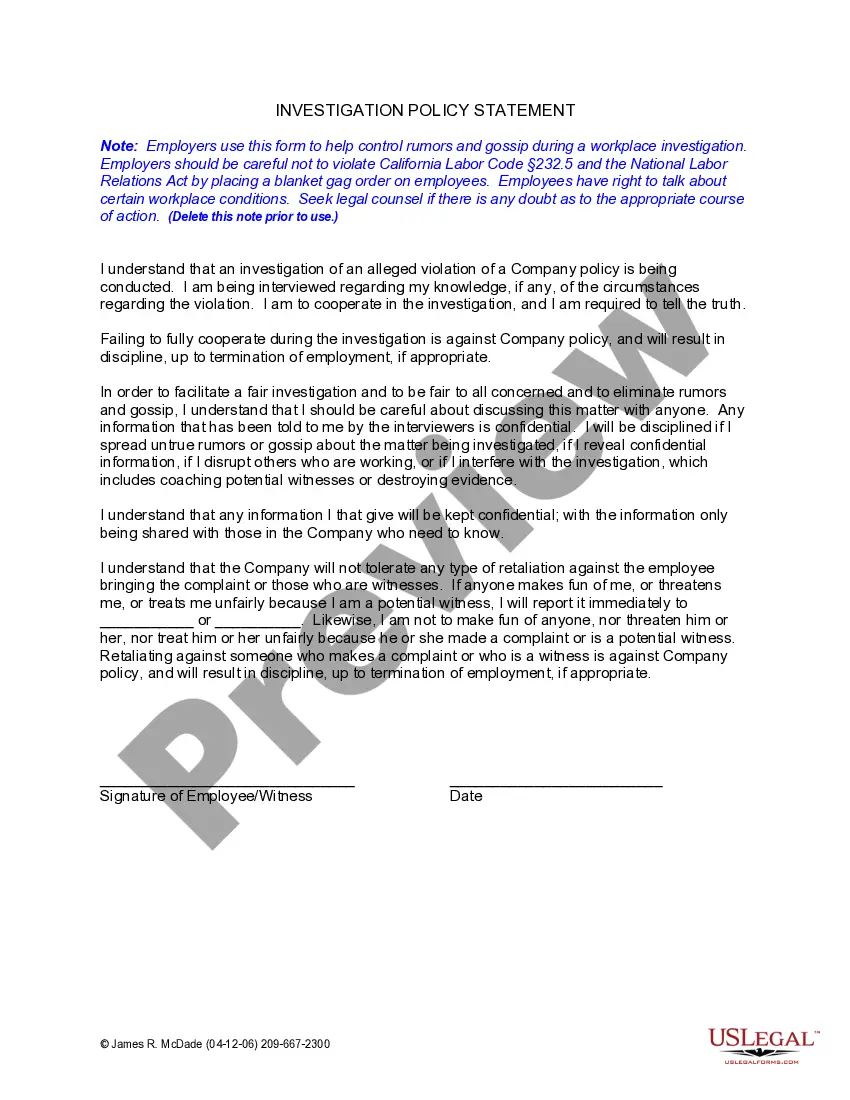

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Bronx Corporate Resolution for EIDL Loan and save it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!