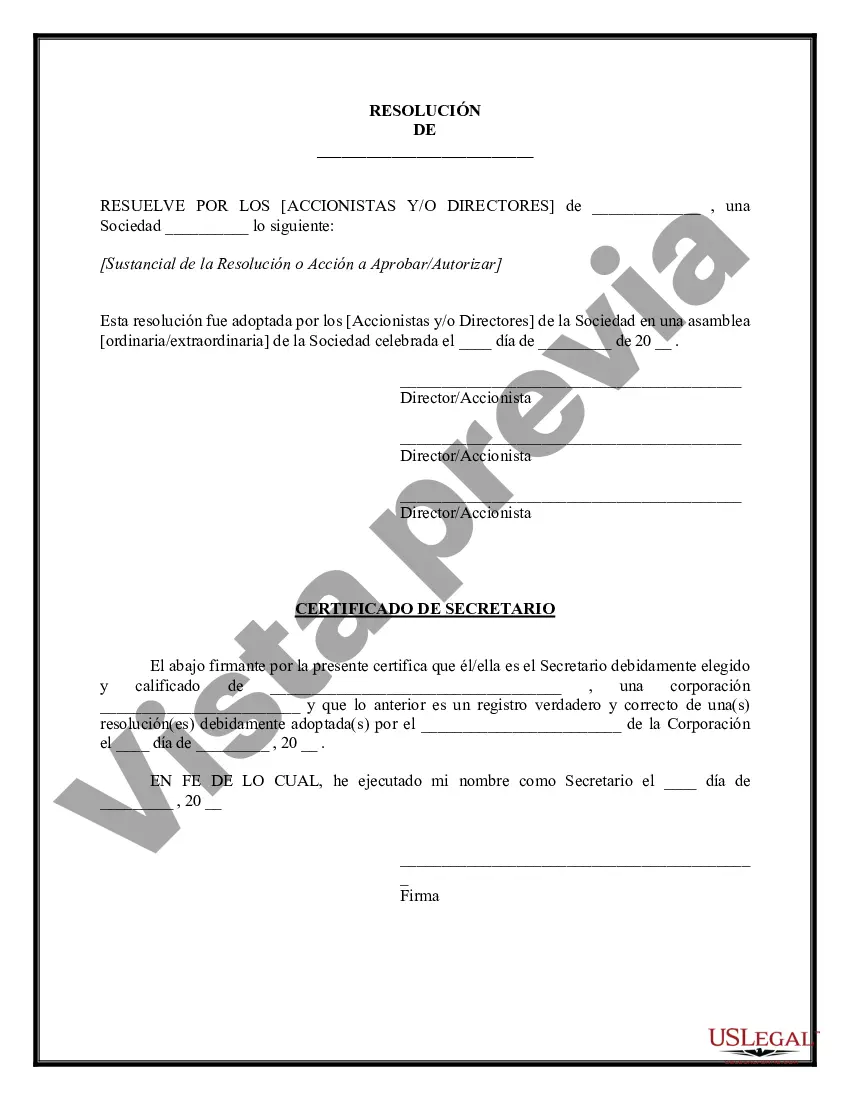

A Chicago Illinois Corporate Resolution for Single Member LLC is an important legal document that outlines decisions made by a single member or owner of a Limited Liability Company (LLC) registered in Chicago, Illinois. This resolution serves as an official record of actions taken by the sole member to guide the LLC's operations, management, and decision-making processes. By drafting and adopting a corporate resolution, the single member ensures clarity, accountability, and compliance with legal requirements. In Chicago, there may be different types of Corporate Resolutions for Single Member LCS based on the specific activities the member wishes to address. Some common types can include: 1. Management and Operations Resolution: This resolution outlines the powers and responsibilities of the single member regarding day-to-day operations, managerial decisions, and the authority to enter into contracts or agreements on behalf of the LLC. 2. Financial Resolution: This type of resolution focuses on the LLC's financial matters, including authorizing bank accounts, approving financial transactions, investments, and accounting practices. 3. Tax Resolution: A tax resolution addresses tax-related matters of the LLC, such as filing taxes, designating a tax representative, adopting specific tax strategies, or authorizing tax-related decisions. 4. Amendment Resolution: This resolution is used when the single member wants to modify or update the LLC's operating agreement, articles of organization, or other important legal documents. 5. Dissolution Resolution: In the event that the single member decides to dissolve the LLC, this resolution outlines the procedures and steps to formally terminate the entity, including the distribution of assets, tax obligations, and notifying relevant parties. While these five types of resolutions are commonly encountered amongst single member LCS in Chicago, others may be necessary depending on the specific needs and circumstances of the business. It is crucial for a single member of a Chicago Illinois Single Member LLC to consult with an attorney or legal professional well-versed in corporate resolutions to ensure compliance with state and local laws. Additionally, maintaining a comprehensive record of corporate resolutions is highly recommended providing a clear and transparent record of decisions made on behalf of the LLC.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Resolución corporativa para un solo miembro LLC - Corporate Resolution for Single Member LLC

Description

How to fill out Chicago Illinois Resolución Corporativa Para Un Solo Miembro LLC?

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life situation, finding a Chicago Corporate Resolution for Single Member LLC suiting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, grouped by states and areas of use. In addition to the Chicago Corporate Resolution for Single Member LLC, here you can find any specific document to run your business or personal deeds, complying with your regional requirements. Professionals check all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Chicago Corporate Resolution for Single Member LLC:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Chicago Corporate Resolution for Single Member LLC.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!