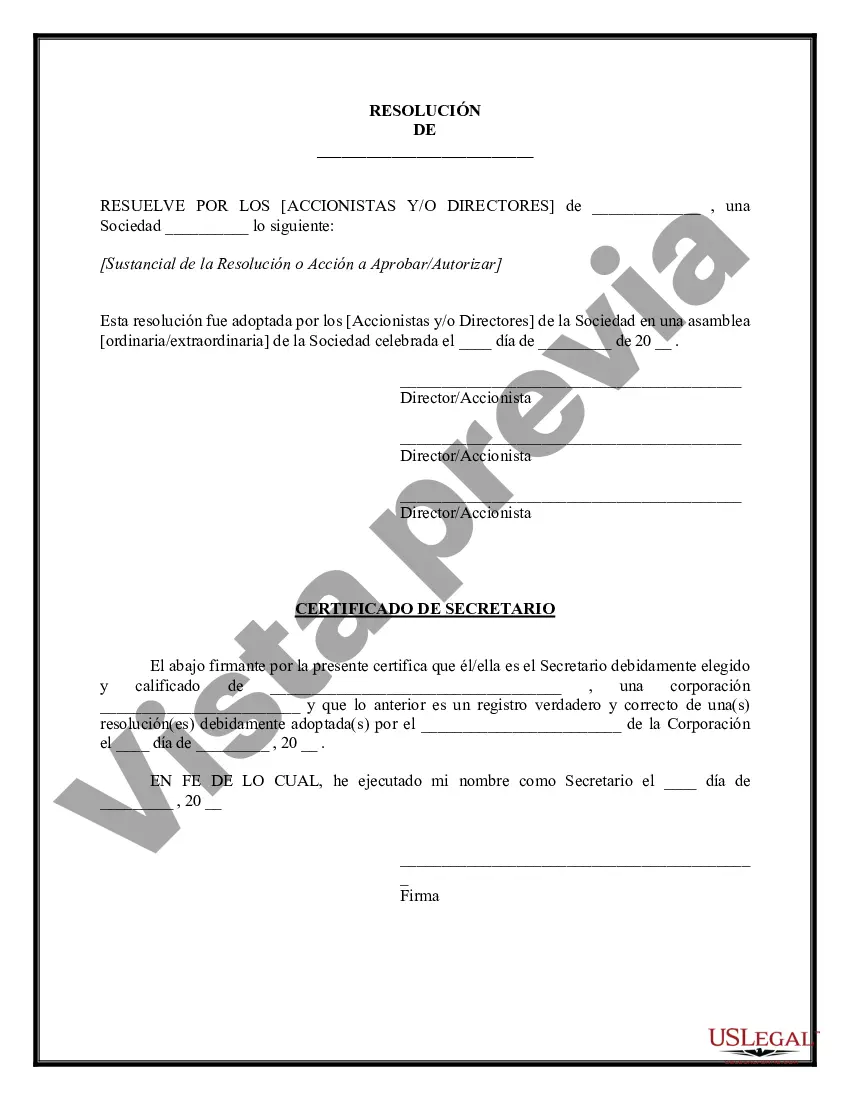

Franklin Ohio Corporate Resolution for Single Member LLC refers to a legal document that outlines the decisions and actions taken by the sole owner or member of a limited liability company (LLC) in Franklin, Ohio. This resolution is typically used to provide written consent and address specific matters relating to the operation and management of the LLC. Keywords: Franklin Ohio, corporate resolution, single member LLC, legal document, decisions, actions, sole owner, member, limited liability company, operation, management. There are several types of Franklin Ohio Corporate Resolution for Single Member LLC that may be encountered, each catering to specific situations and requirements. Some common types include: 1. Appointment of Officers: This resolution oversees the appointment and definition of roles for officers within the single-member LLC. It outlines the individual's responsibilities, authorities, and how they contribute to the company's success. 2. Authorization of Business Transactions: This resolution authorizes the single member to engage in specific business transactions on behalf of the LLC. It provides legal consent and defines the limits and scope of the member's authority. 3. Approval of Contracts: This resolution deals with the approval and execution of contracts entered into by the single-member LLC. It ensures that all contractual agreements are legally binding and protects the interests of the LLC. 4. Opening and Closing Bank Accounts: This resolution addresses the opening and closing of bank accounts in the name of the single-member LLC. It establishes the necessary authorization and provides instructions to financial institutions regarding account management. 5. Tax Elections: This resolution allows the single member to make tax-related decisions, such as electing to be taxed as a corporation or an individual. It ensures compliance with state and federal tax requirements and optimizes the LLC's tax liability. 6. Dissolution of the LLC: This resolution documents the single member's decision to dissolve or terminate the LLC's operations. It outlines the steps to be taken, such as notifying creditors, distributing assets, and filing appropriate paperwork with the state. In conclusion, the Franklin Ohio Corporate Resolution for Single Member LLC is a crucial legal instrument that enables the single member of an LLC to make decisions and take actions concerning the company's functioning. By utilizing various types of corporate resolutions, the single member ensures compliance, protects their interests, and maintains the smooth operation of the single-member LLC.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Resolución corporativa para un solo miembro LLC - Corporate Resolution for Single Member LLC

Description

How to fill out Franklin Ohio Resolución Corporativa Para Un Solo Miembro LLC?

Preparing documents for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Franklin Corporate Resolution for Single Member LLC without expert help.

It's easy to avoid spending money on lawyers drafting your documentation and create a legally valid Franklin Corporate Resolution for Single Member LLC by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, adhere to the step-by-step guide below to obtain the Franklin Corporate Resolution for Single Member LLC:

- Look through the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that meets your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any use case with just a few clicks!