Phoenix Arizona Resolución corporativa para un solo miembro LLC - Corporate Resolution for Single Member LLC

Description

How to fill out Resolución Corporativa Para Un Solo Miembro LLC?

Navigating legal documents is essential in the modern world. Yet, you don't always have to look for professional help to produce some of them from scratch, such as the Phoenix Corporate Resolution for Single Member LLC, using a service like US Legal Forms.

US Legal Forms offers over 85,000 templates across various categories, from living wills to property agreements to divorce papers. All documents are categorized by their respective state, simplifying the search process.

You can also access comprehensive materials and guides on the site to facilitate any responsibilities related to document processing.

If you are already subscribed to US Legal Forms, you can find the relevant Phoenix Corporate Resolution for Single Member LLC, Log In to your account, and download it. Naturally, our platform cannot fully replace an attorney. If you face a particularly challenging situation, we suggest consulting with a lawyer to review your document before you sign and file it.

With more than 25 years in the industry, US Legal Forms has established itself as a trusted source for various legal documents for countless users. Join them today and effortlessly obtain your state-specific forms!

- Review the document preview and description (if available) to gather basic insight into what you will receive once you acquire the document.

- Confirm that the template you select is suitable for your state/county/region, as state laws can influence the validity of certain documents.

- Investigate related forms or restart the search to find the appropriate document.

- Click Buy now and set up your account. If you already possess an account, choose to Log In.

- Select the option, then choose a suitable payment method, and purchase the Phoenix Corporate Resolution for Single Member LLC.

- Opt to save the form template in the desired format.

- Go to the My documents section to re-download the document.

Form popularity

FAQ

Crear una LLC en 6 Sencillos Pasos Selecciona Tu Estado. Nombra Tu LLC. Elige un Agente Registrado. Presenta Tu LLC con el Estado. Crea un Acuerdo Operativo de LLC. Obten un EIN.

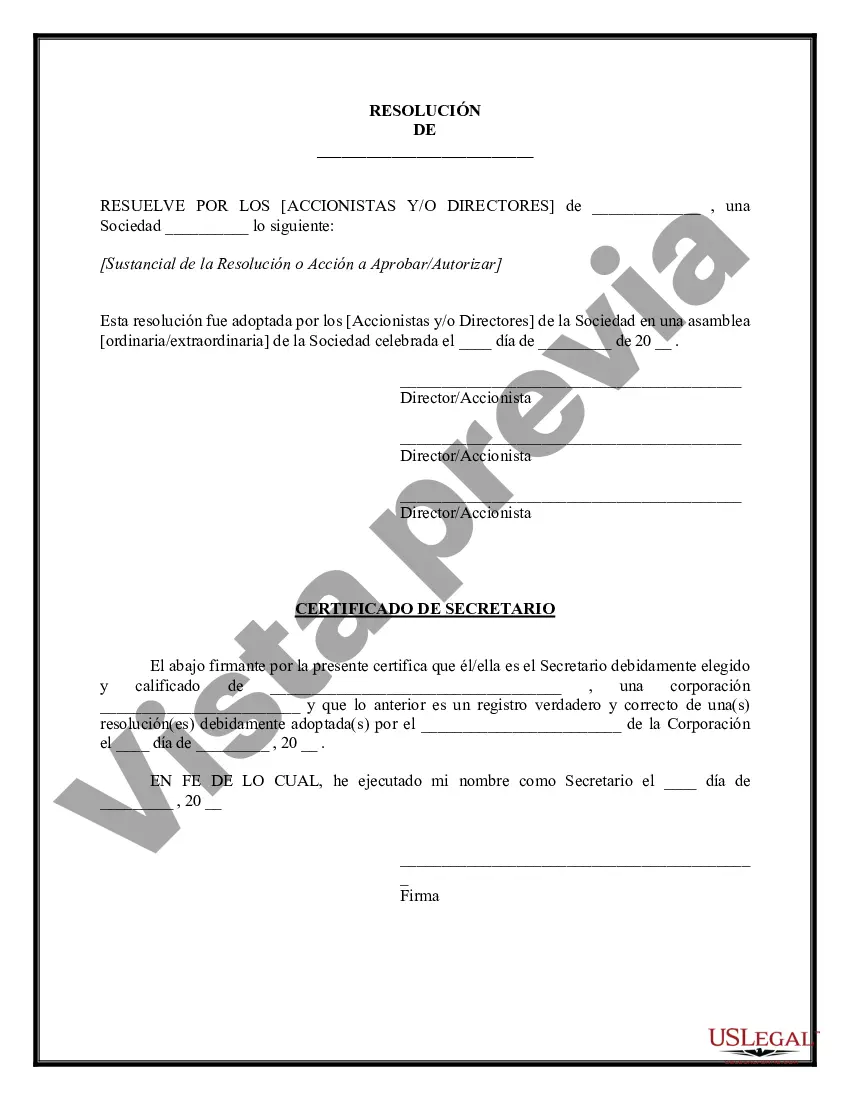

Que incluir en una resolucion corporativa Nombre legal de la empresa. La fecha, hora y lugar donde se crea la resolucion. El organo rector responsable de tomar la resolucion corporativa (generalmente es la junta directiva) Titulo y proposito de la resolucion.

Normalmente, las resoluciones constan de dos partes: Preambulo. Expone los antecedentes o motivos de la resolucion. Comienza con un verbo en cursiva y en gerundio (p. ej.Parte dispositiva. Expone la opinion del organo en cuestion o la medida que debe adoptarse. Consta de parrafos numerados.

Arizona LLC Articles of Organization ($50 or $85) You need to file an Articles of Organization in order to create an LLC in Arizona. The Articles of Organization can be filed by mail or online. The fees for both are the same: $50 for regular filing and $85 for expedited filing. The filing fee is a one-time fee.

Arizona LLC - Como formar una LLC en Arizona (2022) Paso 1: Decida un nombre para su LLC de Arizona. Paso 2: Asignar un agente registrado en Arizona. Paso 3: Presentar articulos de organizacion en Arizona. Paso 4: Cumpla con los requisitos de publicacion de Arizona LLC. Paso 5: Cree su acuerdo operativo de LLC de Arizona.

Proyectos de resolucion: destinados a la adopcion de medidas relativas a la composicion u organizacion interna del cuerpo, las modificaciones del reglamento y, en general, de toda disposicion de caracter imperativo que pueda adoptar la Camara.

Si eres dueno unico o LLC de un solo miembro: anexo C para ganancias o perdidas de negocios. Si tu empresa es una LLC de miembros multiples o una sociedad: formulario 1065 para la LLC o sociedad. Cada socio debe entregar un anexo K-1 junto con su declaracion tributaria personal.

La resolucion es un documento escrito que trata un tema que necesita una solucion o debe ser reconocido. Durante el MOEA, las resoluciones sobre los temas del temario son redactadas en Grupos de Trabajo. Un maximo de seis (6) resoluciones se redactaran y discutiran por comision.

Just follow these seven steps, and you'll be on your way. Name Your Arizona LLC.Choose Your Statutory Agent.Prepare and File Articles of Organization.Receive a Certificate From the State.Create an Operating Agreement.Complete Publication Requirements.Get an Employer Identification Number.

Solucion Haga clic con el boton secundario del mouse en el escritorio y seleccione Panel de control de NVIDIA. Haga clic en Cambiar la resolucion. Ahora haga clic en Personalizar. Haga clic en Crear resolucion personalizada. Escriba los valores que desee.Por ultimo, haga clic en Prueba.