Hennepin County, located in the state of Minnesota, is one of the most populous counties in the state. Known for its vibrant city of Minneapolis, beautiful lakes, and diverse communities, Hennepin County offers a range of attractions and opportunities. One important legal document that involves debtors and their accounts is the Hennepin Minnesota Acknowledgment by Debtor of Correctness of Account Stated. This acknowledgment is a crucial step in the debt collection process, ensuring that both parties are in agreement regarding the accuracy of the account statement. In Hennepin County, this acknowledgment serves as a legally binding document that verifies the debtor's recognition and acceptance of the account's correctness. By signing this document, the debtor acknowledges that they have reviewed the account statement and confirm its accuracy, preventing any potential disputes or misunderstandings down the line. Different types of Hennepin Minnesota Acknowledgment by Debtor of Correctness of Account Stated may include: 1. Individual Debtor Acknowledgment: This type of acknowledgment is used when an individual debtor, such as a person or a sole proprietor, confirms the correctness of their account stated. 2. Business Debtor Acknowledgment: This acknowledgment is specifically designed for businesses, including partnerships, corporations, or limited liability companies. It ensures that the business debtor acknowledges the accuracy of their stated account. 3. Joint Debtor Acknowledgment: In situations where multiple debtors are involved, such as joint borrowers on a loan, a joint debtor acknowledgment is utilized. This document ensures that all debtors collectively acknowledge the correctness of the account stated. 4. Debtor's Authorized Representative Acknowledgment: When a debtor designates someone to act as their representative in the acknowledgment process, this type of acknowledgment is used. It verifies that the authorized representative acknowledges the correctness of the stated account on behalf of the debtor. Ensure to consult legal professionals or seek advice from an attorney when using or drafting a Hennepin Minnesota Acknowledgment by Debtor of Correctness of Account Stated to ensure compliance with local laws and to handle any specific circumstances that may arise.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Reconocimiento por parte del deudor de la corrección de la cuenta declarada - Acknowledgment by Debtor of Correctness of Account Stated

Description

How to fill out Hennepin Minnesota Reconocimiento Por Parte Del Deudor De La Corrección De La Cuenta Declarada?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Hennepin Acknowledgment by Debtor of Correctness of Account Stated, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you obtain a sample, it remains available in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Hennepin Acknowledgment by Debtor of Correctness of Account Stated from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Hennepin Acknowledgment by Debtor of Correctness of Account Stated:

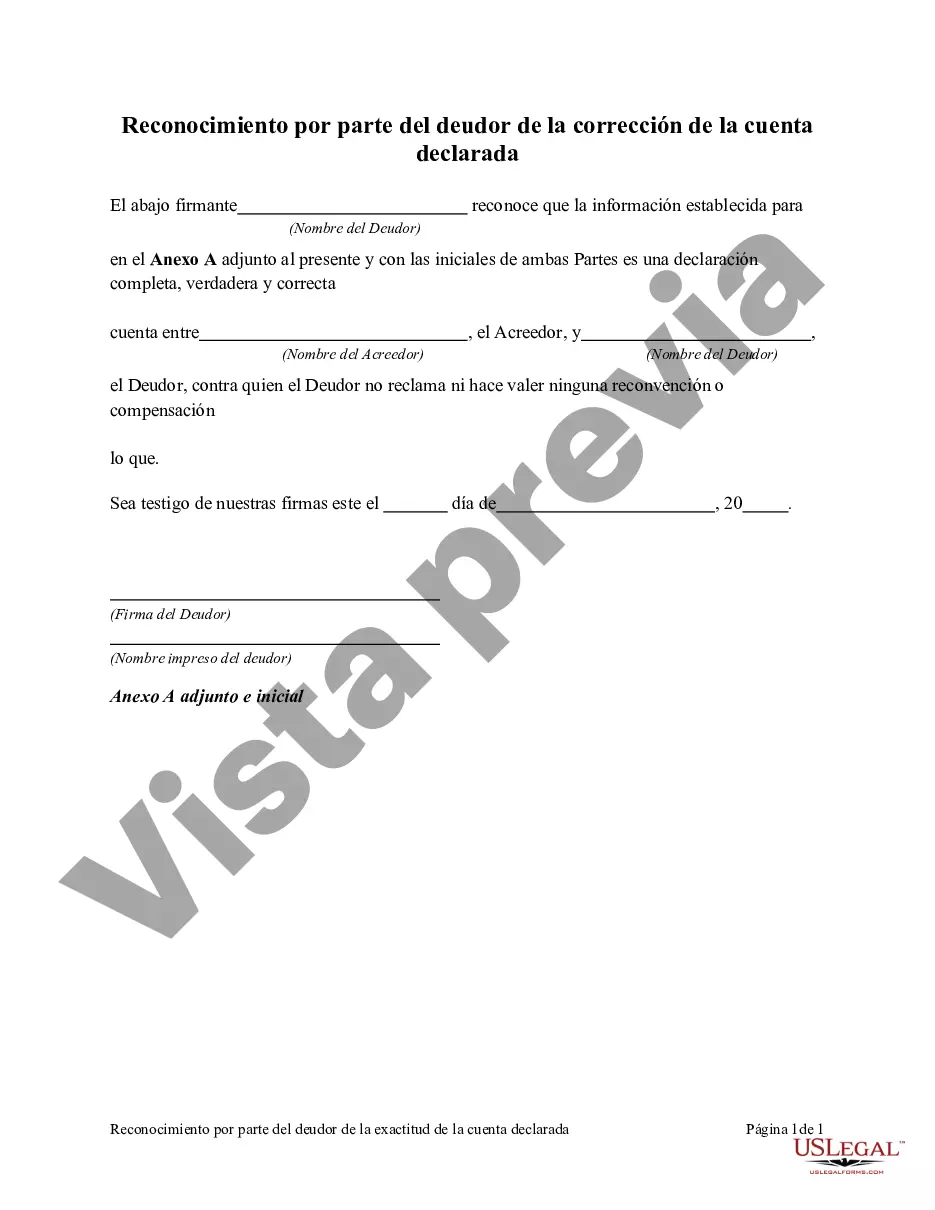

- Take a look at the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!