Mecklenburg North Carolina Acknowledgment by Debtor of Correctness of Account Stated is a legal document that is used to confirm the accuracy and legitimacy of an account statement presented by a creditor to a debtor. This acknowledgment serves as a formal recognition by the debtor that the account statement provided is true and correct. In Mecklenburg County, North Carolina, the Acknowledgment by Debtor of Correctness of Account Stated is recognized and governed by state laws and regulations. It is an essential document in various situations, including financial transactions, loan agreements, credit card debts, and business dealings. This acknowledgment provides legal protection to both parties involved in the transaction. By signing it, the debtor accepts the responsibility for reviewing the account statement thoroughly and ensuring its accuracy before validating its correctness. It also implies that the debtor agrees to settle any outstanding debts or discrepancies mentioned within the account statement. There are different types of Mecklenburg North Carolina Acknowledgment by Debtor of Correctness of Account Stated, depending on the specific terms and conditions of the agreement. Some of these variations may include: 1. Commercial Account Acknowledgment: This type of acknowledgment is used in commercial transactions between businesses or individuals engaged in commercial activities. It confirms the correctness of an account statement related to business expenses, invoices, or outstanding payments. 2. Personal Loan Account Acknowledgment: In cases where an individual borrows money from another person or financial institution, this acknowledgment verifies the accuracy of the account statement containing loan details, interest rates, repayment terms, and any additional charges. 3. Credit Card Statement Acknowledgment: When credit cardholders receive their monthly statements, signing this acknowledgment ensures that they have reviewed and agreed with the correctness of the account statement, including charges, interest fees, and payment due dates. It is important for both parties to understand the implications of signing the Mecklenburg North Carolina Acknowledgment by Debtor of Correctness of Account Stated. By doing so, the debtor accepts the responsibility for any inaccuracies or discrepancies found within the account statement, unless they inform the creditor in writing within a specified timeframe. Before signing any acknowledgment, it is crucial for the debtor to carefully examine the account statement and seek legal advice if needed. This ensures that the debtor fully understands the terms, charges, and obligations described in the account statement before accepting them by acknowledgment. In conclusion, the Mecklenburg North Carolina Acknowledgment by Debtor of Correctness of Account Stated is a legal document used to confirm the accuracy of an account statement. It is crucial for debtors to be aware of the terms and conditions within the specific type of acknowledgment they are signing to protect their rights and interests.

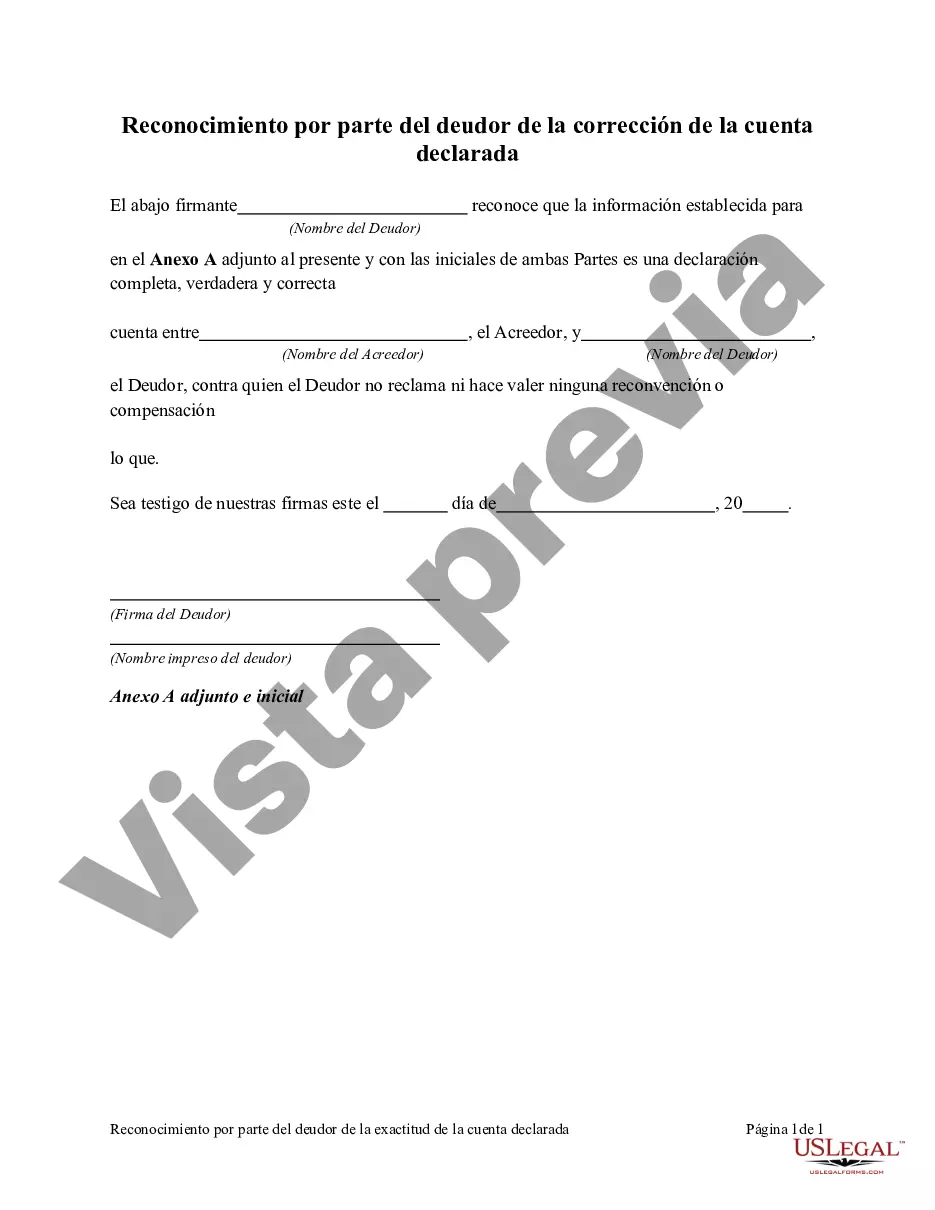

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Reconocimiento por parte del deudor de la corrección de la cuenta declarada - Acknowledgment by Debtor of Correctness of Account Stated

Description

How to fill out Mecklenburg North Carolina Reconocimiento Por Parte Del Deudor De La Corrección De La Cuenta Declarada?

If you need to get a trustworthy legal paperwork supplier to obtain the Mecklenburg Acknowledgment by Debtor of Correctness of Account Stated, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can select from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of learning materials, and dedicated support make it simple to find and complete different documents.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply type to search or browse Mecklenburg Acknowledgment by Debtor of Correctness of Account Stated, either by a keyword or by the state/county the document is created for. After finding the required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Mecklenburg Acknowledgment by Debtor of Correctness of Account Stated template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription option. The template will be instantly ready for download once the payment is processed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes these tasks less expensive and more reasonably priced. Set up your first business, organize your advance care planning, draft a real estate contract, or execute the Mecklenburg Acknowledgment by Debtor of Correctness of Account Stated - all from the convenience of your home.

Join US Legal Forms now!