Oakland, Michigan is a county located in the southeastern part of the state. It is home to various cities and townships, including the city of Pontiac, as well as several unincorporated communities. Situated within the Detroit metropolitan area, Oakland offers a mix of suburban and rural landscapes, making it an attractive place to live and work. One essential document that plays a crucial role in financial transactions and debt management is the "Acknowledgment by Debtor of Correctness of Account Stated." This acknowledgment is a legal agreement between a debtor and a creditor, typically used to validate the accuracy and completeness of an account statement. In Oakland, Michigan, there are different types of Acknowledgment by Debtor of Correctness of the Account Stated, depending on the specific nature of the transaction or debt. Some common variations include: 1. Personal Loan Account Stated Acknowledgment: This type of acknowledgment is used when an individual borrows money from a creditor, such as a bank or a private lender. The debtor acknowledges that the account statement provided by the creditor accurately reflects the amount owed, interest rates, repayment terms, and any additional charges or fees. 2. Credit Card Account Stated Acknowledgment: In situations where a person holds a credit card issued by a financial institution or credit card company, they may be required to acknowledge the correctness of their account statement. This acknowledgment confirms that the debtor agrees with the information provided, including the outstanding balance, transactions, interest rates, and any other relevant details. 3. Business Credit Account Stated Acknowledgment: This acknowledgment is commonly used in the business world, where a company or organization may have credit accounts with suppliers or vendors. By signing this agreement, the debtor acknowledges the accuracy of the monthly or periodic account statements provided by the creditor, ensuring that all invoices, payments, and credits are properly accounted for. It is important for debtors in Oakland, Michigan, to carefully review their account statements and understand the terms and conditions outlined within the Acknowledgment by Debtor of Correctness of Account Stated. By signing this document, debtors accept responsibility for the accuracy of the information provided and may be held liable for any discrepancies or misrepresentations. In conclusion, Oakland, Michigan, offers a diverse suburban and rural environment in the heart of Southeast Michigan. When it comes to managing debts and financial transactions, an Acknowledgment by Debtor of Correctness of Account Stated is a vital document that allows both debtors and creditors to validate the accuracy and integrity of account statements. Different types of this acknowledgment exist, depending on the nature of the debt or transaction. It is crucial for debtors to understand the importance of reviewing their statements and signing these acknowledgments to avoid any potential financial disputes or misunderstandings.

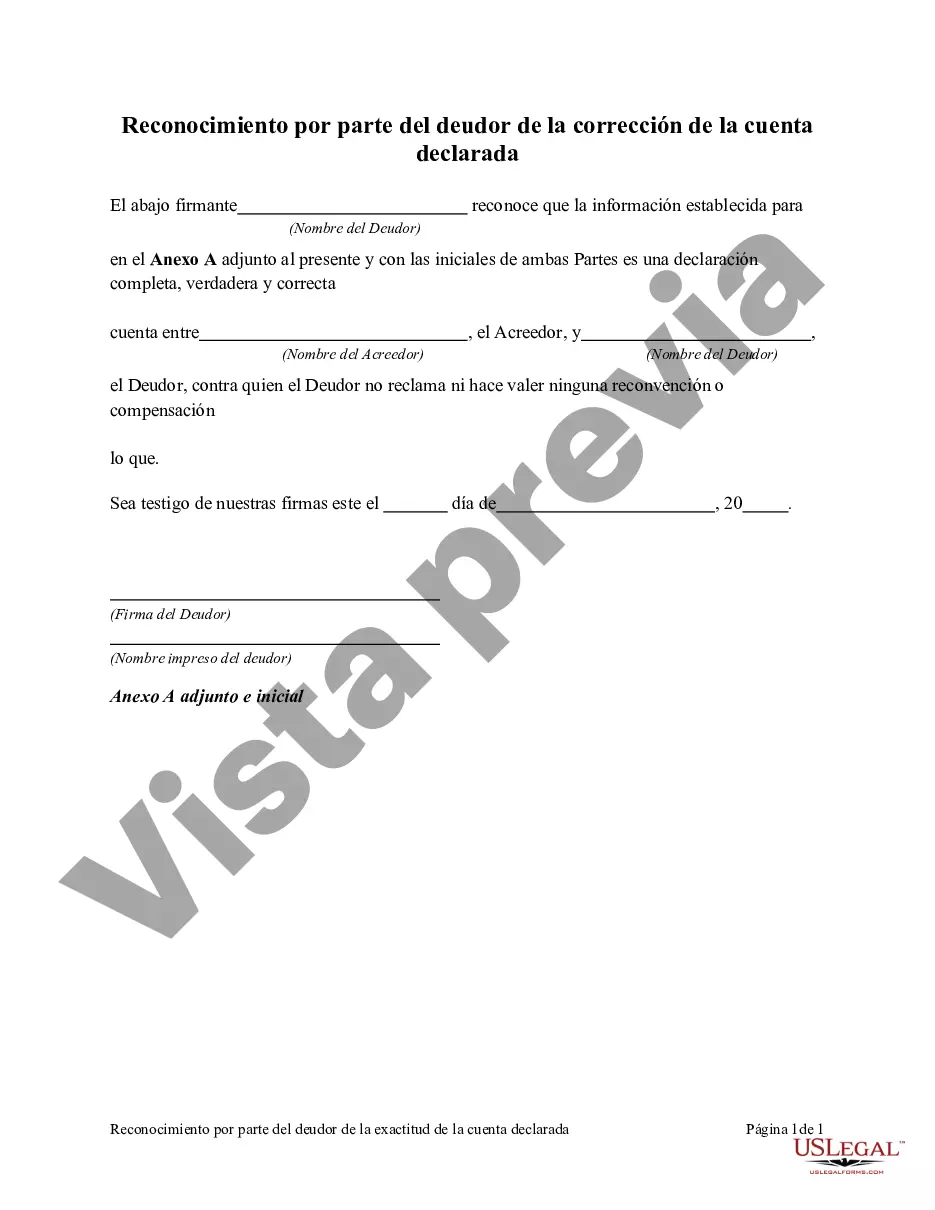

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Reconocimiento por parte del deudor de la corrección de la cuenta declarada - Acknowledgment by Debtor of Correctness of Account Stated

Description

How to fill out Oakland Michigan Reconocimiento Por Parte Del Deudor De La Corrección De La Cuenta Declarada?

If you need to get a trustworthy legal paperwork provider to get the Oakland Acknowledgment by Debtor of Correctness of Account Stated, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can search from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of learning resources, and dedicated support team make it simple to find and execute various documents.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply type to look for or browse Oakland Acknowledgment by Debtor of Correctness of Account Stated, either by a keyword or by the state/county the document is created for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Oakland Acknowledgment by Debtor of Correctness of Account Stated template and check the form's preview and description (if available). If you're confident about the template’s language, go ahead and click Buy now. Register an account and select a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes these tasks less expensive and more reasonably priced. Create your first company, arrange your advance care planning, create a real estate agreement, or complete the Oakland Acknowledgment by Debtor of Correctness of Account Stated - all from the convenience of your home.

Sign up for US Legal Forms now!