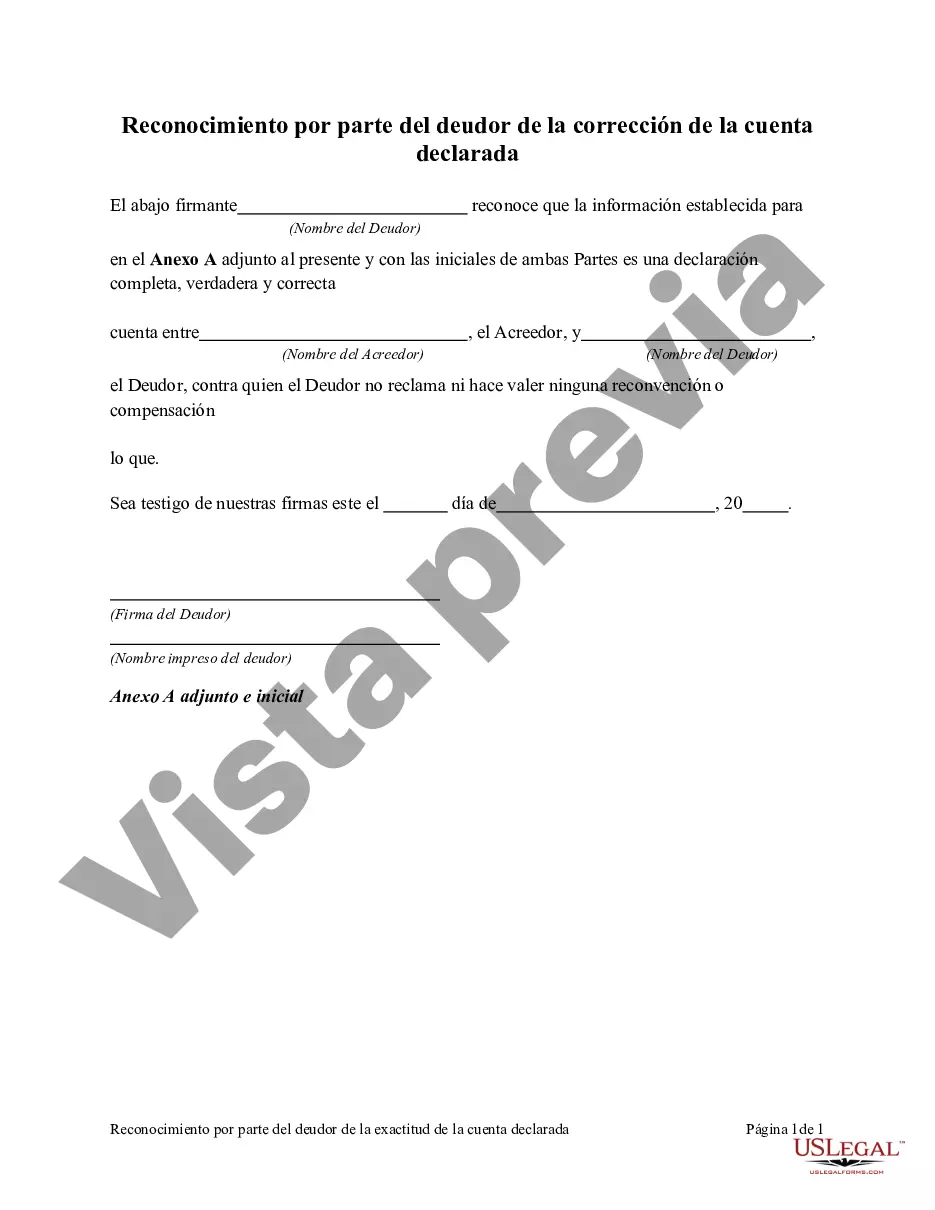

San Jose, California — Acknowledgment by Debtor of Correctness of Account Stated San Jose, California is a vibrant city located in the heart of Silicon Valley. Known for its technological innovations, diverse population, and thriving economy, San Jose offers residents and visitors a plethora of attractions and opportunities. In the realm of legal documentation, one important form that individuals or businesses may come across is the "Acknowledgment by Debtor of Correctness of Account Stated." This document is used to confirm and accept the accuracy of an account statement presented by a creditor. It serves as a legally binding acknowledgment that the debtor has reviewed the provided account statement and finds it to be correct in terms of balance, charges, and any other relevant details. The purpose of an acknowledgment by debtor of correctness of account stated is to establish transparency and avoid any potential disputes between debtors and creditors. By signing this document, the debtor acknowledges that they have carefully reviewed the account statement and that they accept the accuracy of the stated balance or charges. In San Jose, California, various types of "Acknowledgment by Debtor of Correctness of Account Stated" documents may exist, depending on the specific situation or industry. For example: 1. Personal Loan Acknowledgment: This type of acknowledgment is used when an individual borrows money from a lender and acknowledges the correctness of the account statement related to the loan, including principal, interest, and any fees. 2. Credit Card Statement Acknowledgment: Credit card companies often require debtors to acknowledge the accuracy of their monthly account statements. This ensures that both parties are in agreement regarding the charges made on the credit card, outstanding balance, and due dates. 3. Business Invoice Acknowledgment: In commercial transactions, when businesses provide products or services on credit, the debtor may be required to acknowledge the correctness of the account statement or invoice. This acknowledgment confirms that the debtor has reviewed the charges and agrees with the stated amount. Whether it is for personal loans, credit card statements, or business invoices, the "Acknowledgment by Debtor of Correctness of Account Stated" plays a crucial role in establishing a transparent and concise understanding between debtors and creditors. San Jose, California, being a city with a strong foundation in technology and commerce, ensures the availability of accurate and legally binding documents to protect both parties involved in financial transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Reconocimiento por parte del deudor de la corrección de la cuenta declarada - Acknowledgment by Debtor of Correctness of Account Stated

Description

How to fill out San Jose California Reconocimiento Por Parte Del Deudor De La Corrección De La Cuenta Declarada?

Whether you plan to open your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like San Jose Acknowledgment by Debtor of Correctness of Account Stated is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to obtain the San Jose Acknowledgment by Debtor of Correctness of Account Stated. Follow the guide below:

- Make sure the sample meets your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the file when you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Jose Acknowledgment by Debtor of Correctness of Account Stated in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!