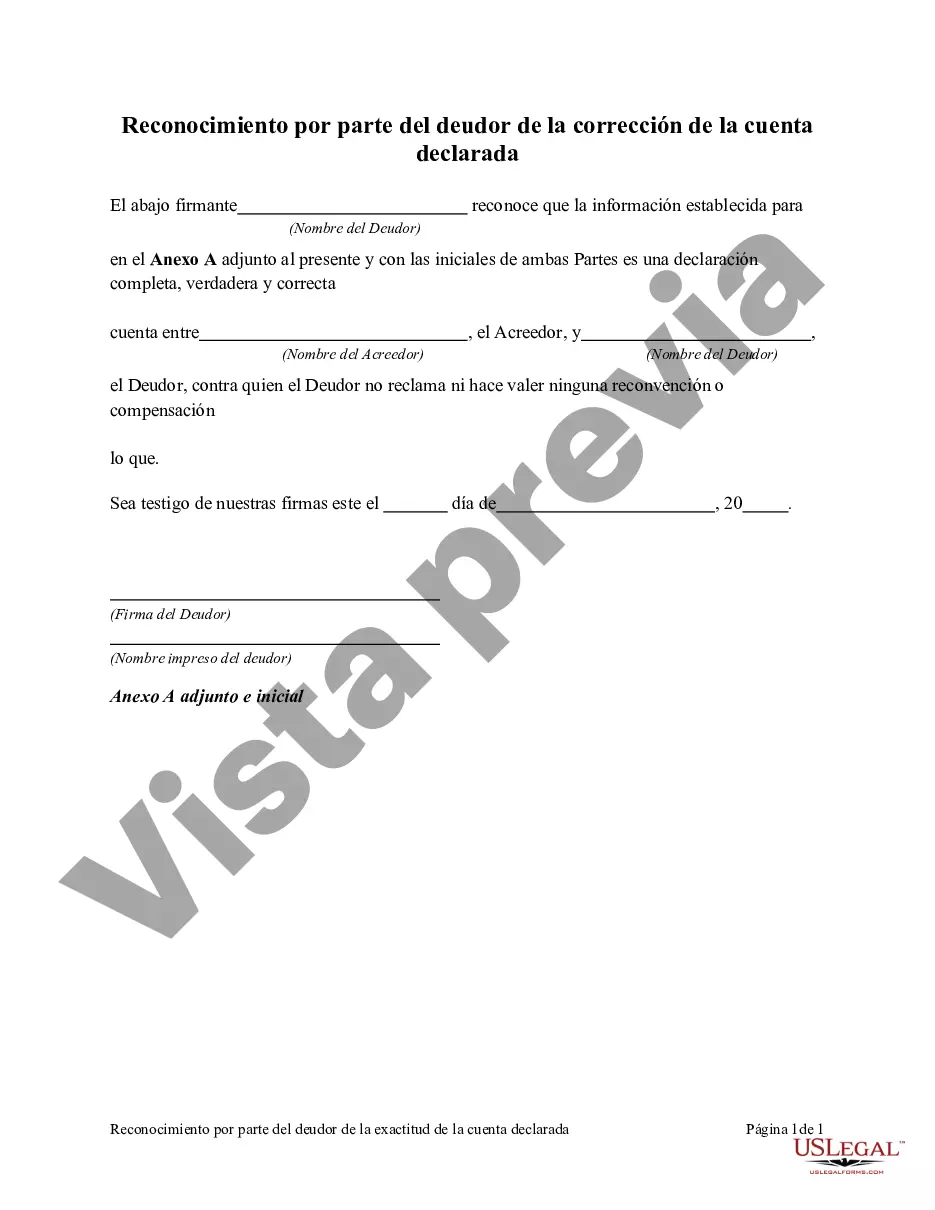

Travis Texas Acknowledgment by Debtor of Correctness of Account Stated is a legal document commonly used in the state of Texas. It is crucial in debt collection and financial transactions, as it verifies the accuracy and correctness of the account stated by the creditor. This acknowledgment serves as an official declaration by the debtor, affirming that they have reviewed the account statement provided by the creditor and believe it to be accurate and complete. By signing this document, the debtor agrees that they owe the stated amount and that the creditor's records are correct. There are different types of Travis Texas Acknowledgment by Debtor of Correctness of Account Stated, including: 1. Individual Debtor: This type of acknowledgment is used when an individual is the debtor. It requires the individual's full legal name, signature, and date of acknowledgment. 2. Corporate Debtor: When a business entity is the debtor, a corporate acknowledgment is used. It involves providing the company's legal name, signature of an authorized representative, and the date of acknowledgment. 3. Joint Debtor: In cases where multiple debtors are involved, a joint acknowledgment is required. All debtors must sign the document, indicating their agreement to the correctness of the account stated. Keywords: Travis Texas, Acknowledgment by Debtor, Correctness of Account Stated, legal document, debt collection, financial transactions, accuracy, completeness, creditor, account statement, debtor, signed, individual, corporate, joint.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Reconocimiento por parte del deudor de la corrección de la cuenta declarada - Acknowledgment by Debtor of Correctness of Account Stated

Description

How to fill out Travis Texas Reconocimiento Por Parte Del Deudor De La Corrección De La Cuenta Declarada?

Preparing paperwork for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to generate Travis Acknowledgment by Debtor of Correctness of Account Stated without professional help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Travis Acknowledgment by Debtor of Correctness of Account Stated by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Travis Acknowledgment by Debtor of Correctness of Account Stated:

- Look through the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any situation with just a few clicks!