Wake North Carolina Acknowledgment by Debtor of Correctness of Account Stated is a legally binding document that serves as proof that the debtor acknowledges the accuracy and correctness of an account statement provided by the creditor. This acknowledgment is crucial when it comes to resolving disputes and ensuring transparency in financial transactions. The Wake North Carolina Acknowledgment by Debtor of Correctness of Account Stated is typically used in situations where a creditor and debtor have an ongoing business relationship, such as a vendor and customer or a lender and borrower. By signing this document, the debtor confirms that they have reviewed the account statement and agree that it accurately reflects their financial obligations. This acknowledgment can be used for various types of accounts, including but not limited to: 1. Commercial accounts: This refers to accounts established between businesses or commercial entities. It ensures that both parties are aware of the correct financial standing and any outstanding debts or credits. 2. Personal accounts: This type of acknowledgment is used for accounts between individuals or a person and a business. It confirms the accuracy of financial transactions, including loans, credit card statements, or any other personal debts. 3. Mortgage accounts: In the context of mortgages, this acknowledgment is crucial for keeping track of mortgage payments, interest rates, and outstanding balances. 4. Student loan accounts: This document is used to verify the correctness of account statements related to student loans, ensuring that students or borrowers are aware of their repayment obligations and any changes in interest rates or payment schedules. The Wake North Carolina Acknowledgment by Debtor of Correctness of Account Stated is a powerful tool to establish accountability and maintain transparency in financial transactions. It provides both creditors and debtors with legal protection in case disputes arise regarding account accuracy or payment obligations. It is crucial for both parties to ensure that they thoroughly review the account statement before signing the acknowledgment, as it will serve as evidence of their agreement to the stated terms.

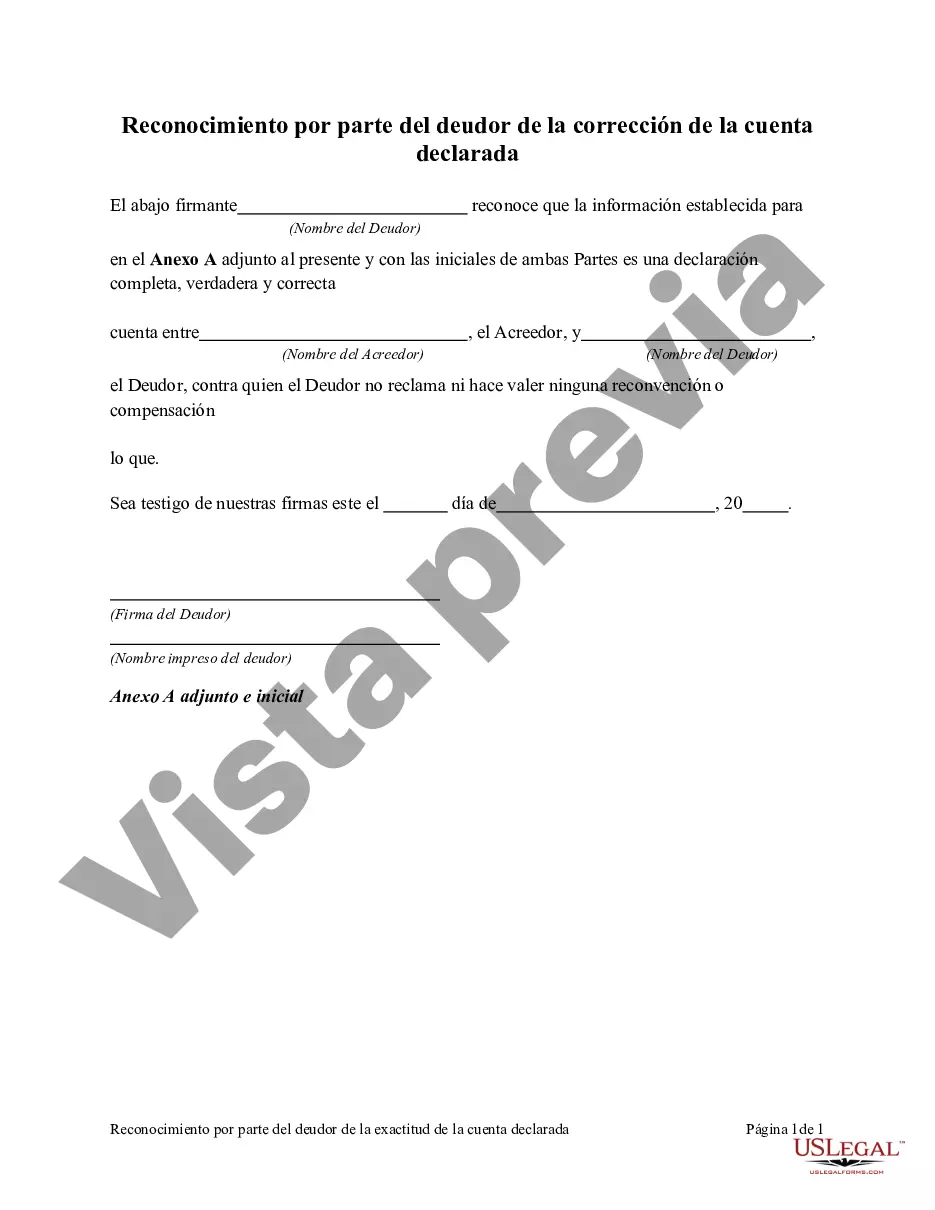

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Reconocimiento por parte del deudor de la corrección de la cuenta declarada - Acknowledgment by Debtor of Correctness of Account Stated

Description

How to fill out Wake North Carolina Reconocimiento Por Parte Del Deudor De La Corrección De La Cuenta Declarada?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a legal professional to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Wake Acknowledgment by Debtor of Correctness of Account Stated, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Consequently, if you need the latest version of the Wake Acknowledgment by Debtor of Correctness of Account Stated, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Wake Acknowledgment by Debtor of Correctness of Account Stated:

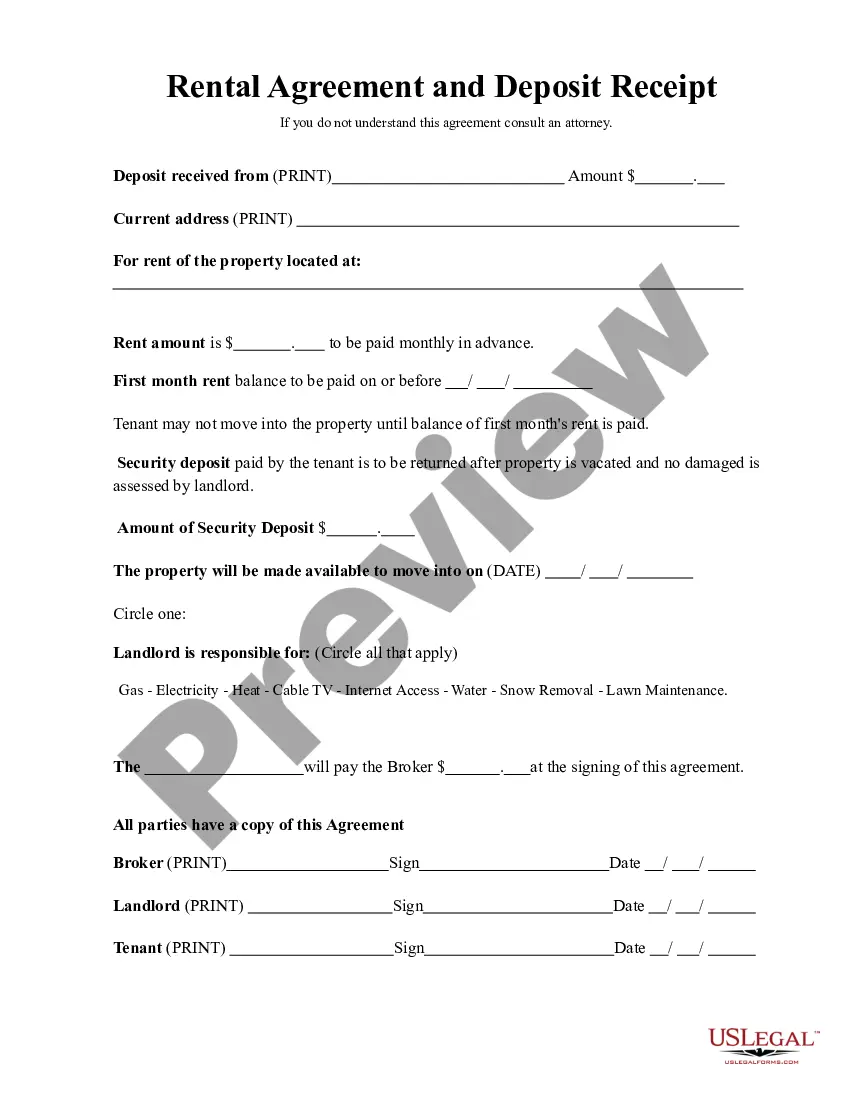

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Wake Acknowledgment by Debtor of Correctness of Account Stated and download it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!