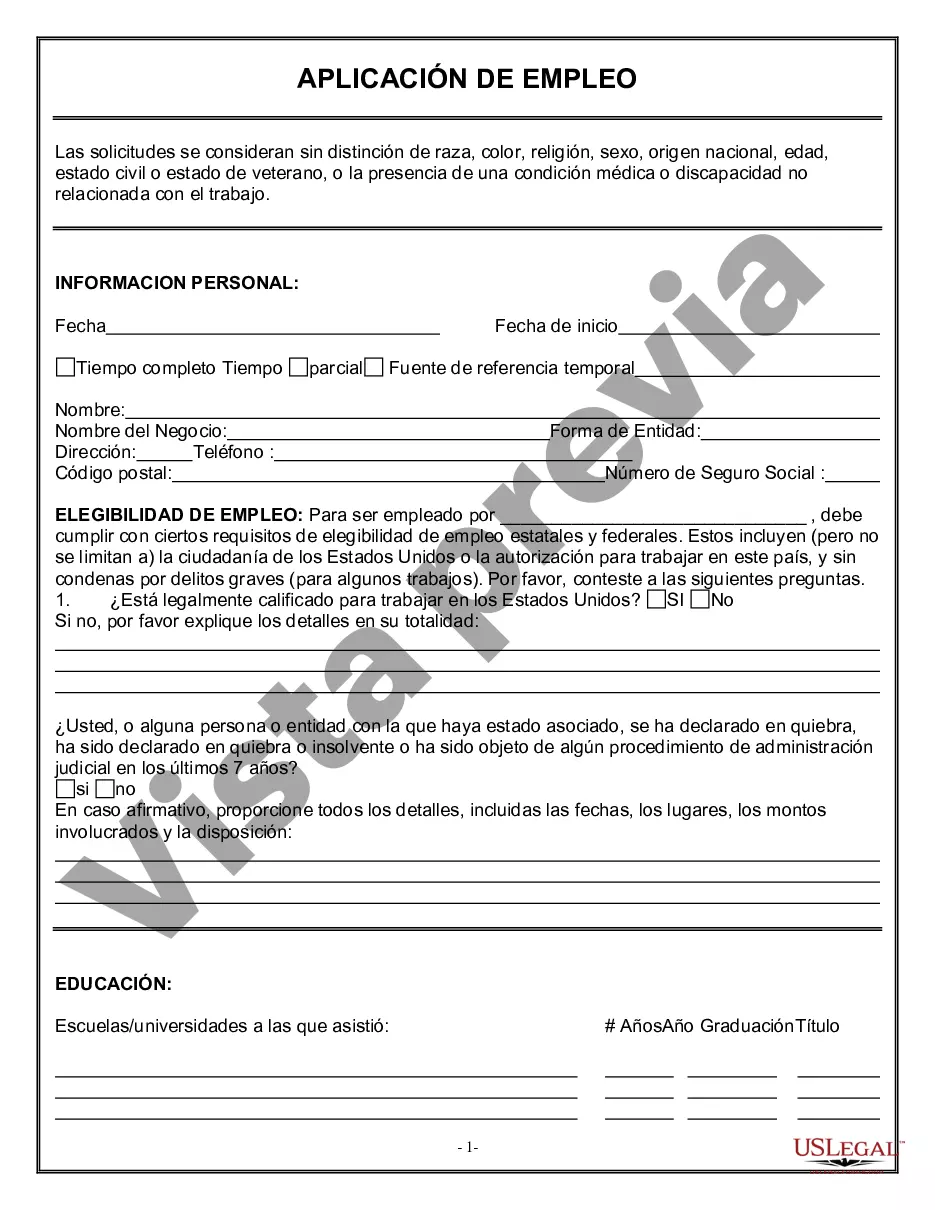

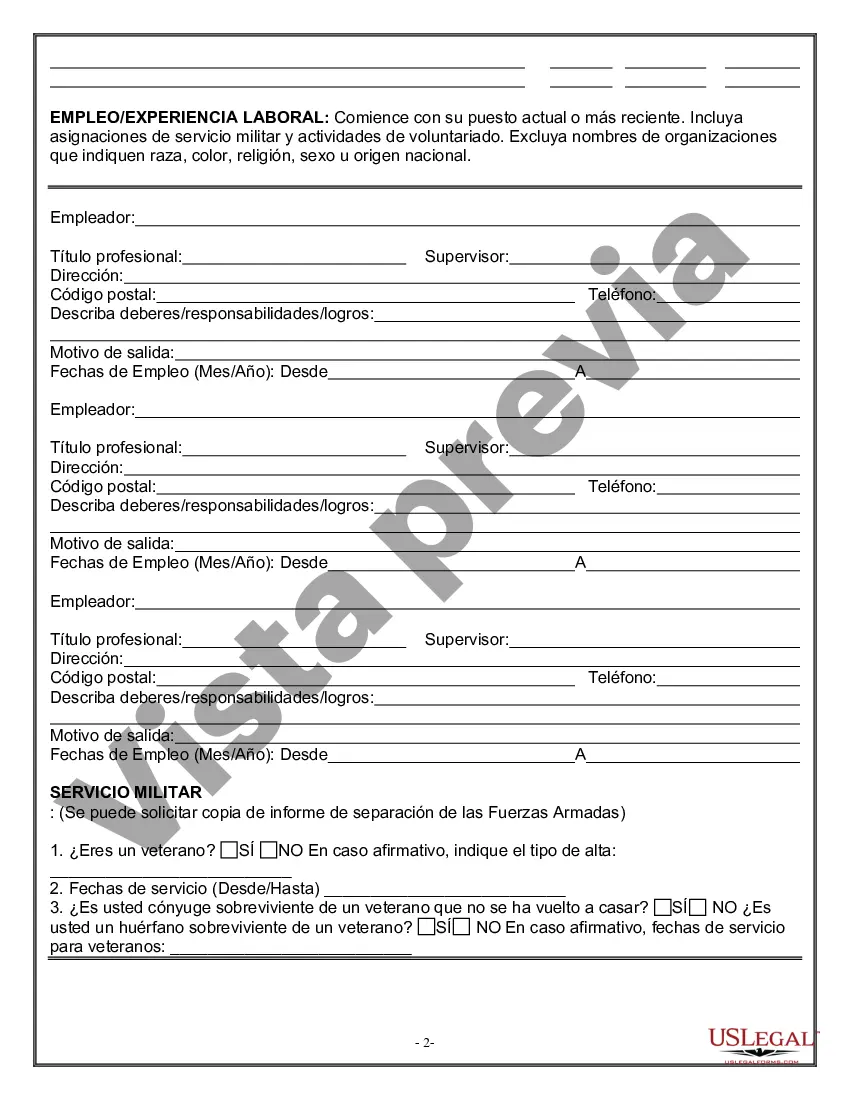

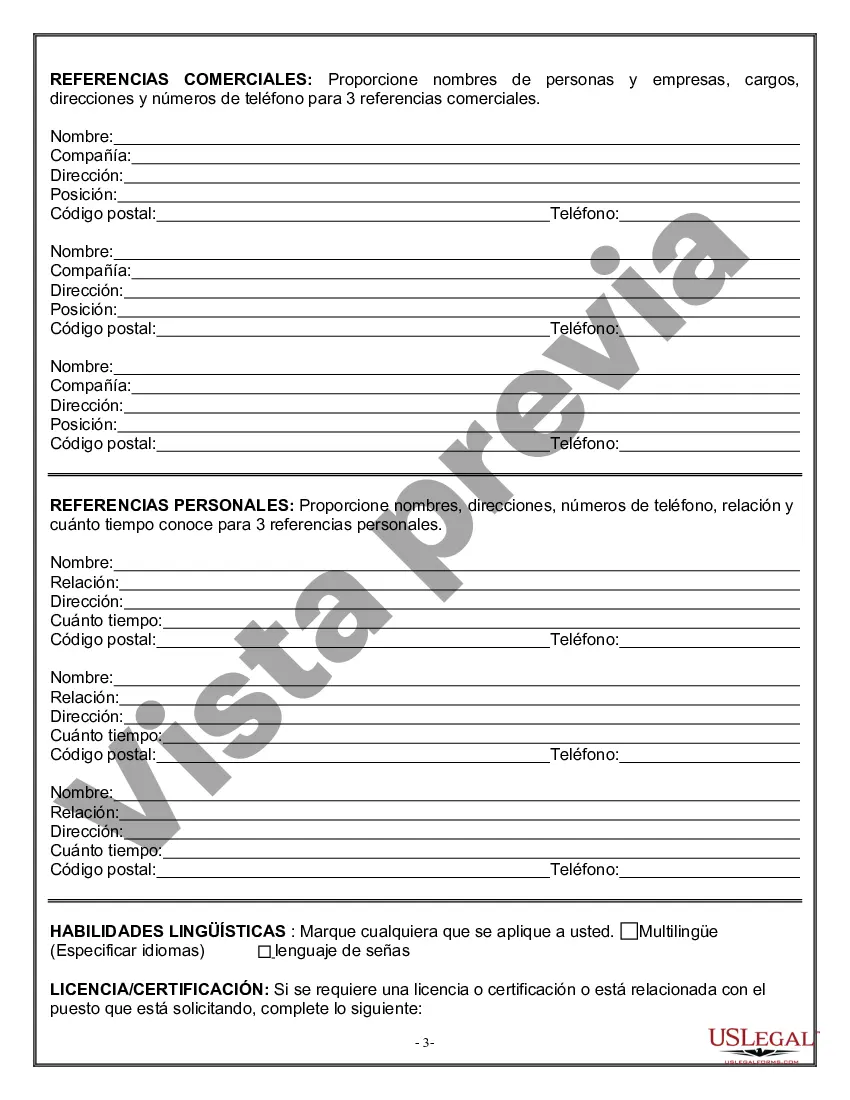

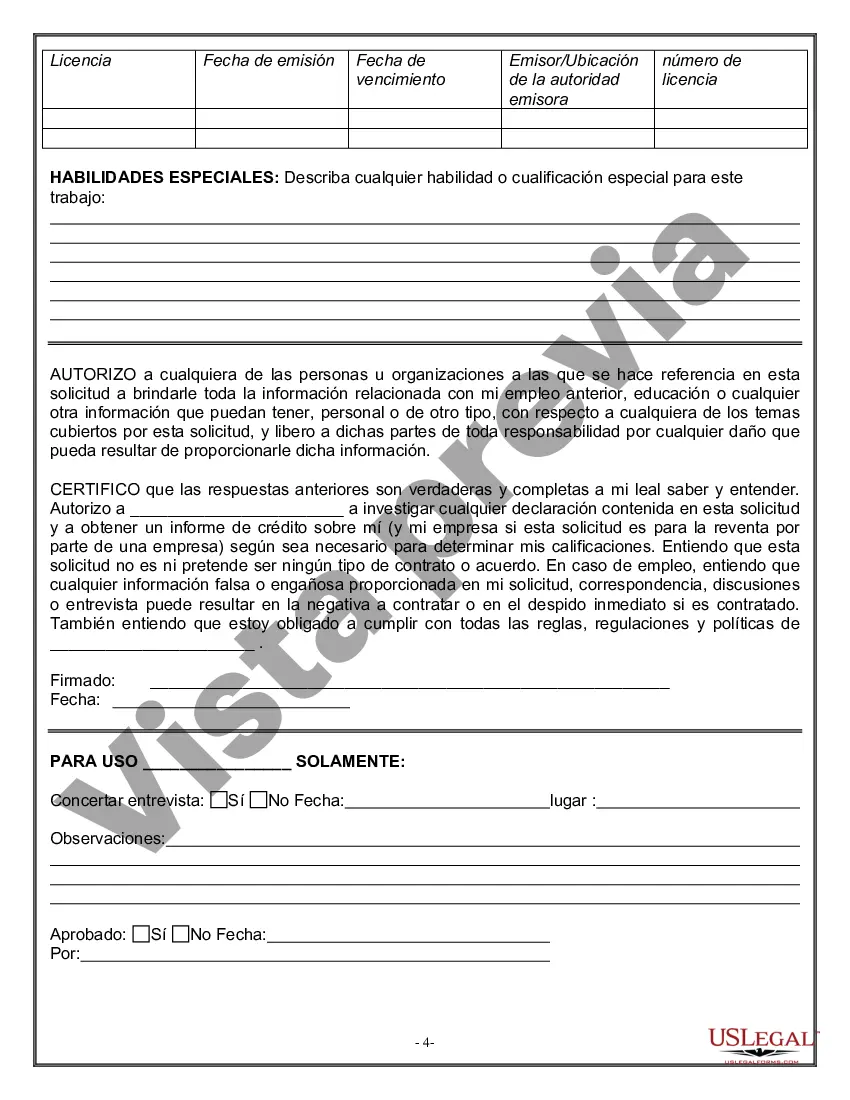

Harris Texas Employment Application for Accountant is a comprehensive document designed to capture detailed information about applicants seeking accounting positions within the Harris Texas jurisdiction. This application form allows candidates to showcase their skills, qualifications, and experience to be considered for various accounting roles available in the Harris Texas workforce. The Harris Texas Employment Application for Accountant covers various sections to create a well-rounded profile of each applicant. Some key sections include: 1. Personal Information: Applicants must provide their full name, contact details, address, and other relevant personal information. 2. Education and Certification: This section allows individuals to list their educational background, including degrees, certifications, and any additional professional qualifications related to accounting. Keywords in this section might include "Bachelor's Degree," "CPA certification," or "Accounting coursework." 3. Work Experience: Candidates can detail their previous employment history, specifying the organizations they worked for, job titles held, dates of employment, and key responsibilities. Relevant keywords for this section may include "financial analysis," "auditing," "bookkeeping," or "tax preparation." 4. Technical Skills: This section focuses on the specialized skills and software proficiency that applicants possess and can bring to an accounting role. Keywords like "QuickBooks," "MS Excel," "financial modeling," "GAAP" (Generally Accepted Accounting Principles), or "tax software" are relevant here. 5. Professional References: Applicants are typically required to provide references from previous supervisors or colleagues who can vouch for their skills and work ethic. Keywords might include "CPA mentor," "former manager," or "accounting professor." 6. Additional Questions: Some Harris Texas Employment Applications for Accountant may include specific questions to gauge an applicant's suitability for the role or their knowledge of local accounting procedures. These can range from questions about state tax laws to inquiries about familiarity with industry-specific regulations. Additionally, different types of Harris Texas Employment Applications for Accountant may exist based on the specific accounting positions available within the Harris Texas jurisdiction. Some common variations might include: 1. Staff Accountant Application: Tailored for entry-level accounting positions, this application often focuses on educational qualifications, coursework, and the ability to assist with key financial tasks. 2. Senior Accountant Application: Designed for more experienced candidates, this application may emphasize a proven track record, advanced certifications (such as Certified Management Accountant), leadership skills, and expertise in handling complex accounting functions. 3. Government Accounting Application: Specifically geared towards candidates interested in accounting roles within the government sector, this application might emphasize knowledge of governmental accounting standards and regulations, familiarity with specific accounting software used in government agencies, and experience with public sector financial reporting. By using relevant keywords throughout the Harris Texas Employment Application for Accountant, both applicants and hiring managers can effectively assess qualifications, ensuring the best fit for accounting positions in the Harris Texas job market.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Solicitud de Empleo para Contador - Employment Application for Accountant

Description

How to fill out Harris Texas Solicitud De Empleo Para Contador?

Do you need to quickly create a legally-binding Harris Employment Application for Accountant or probably any other form to handle your personal or business affairs? You can select one of the two options: contact a professional to write a legal document for you or draft it completely on your own. Luckily, there's a third solution - US Legal Forms. It will help you get professionally written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-compliant form templates, including Harris Employment Application for Accountant and form packages. We provide templates for an array of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the needed template without extra hassles.

- To start with, double-check if the Harris Employment Application for Accountant is adapted to your state's or county's laws.

- In case the form comes with a desciption, make sure to check what it's intended for.

- Start the searching process again if the template isn’t what you were seeking by using the search bar in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Harris Employment Application for Accountant template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Additionally, the templates we provide are updated by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!