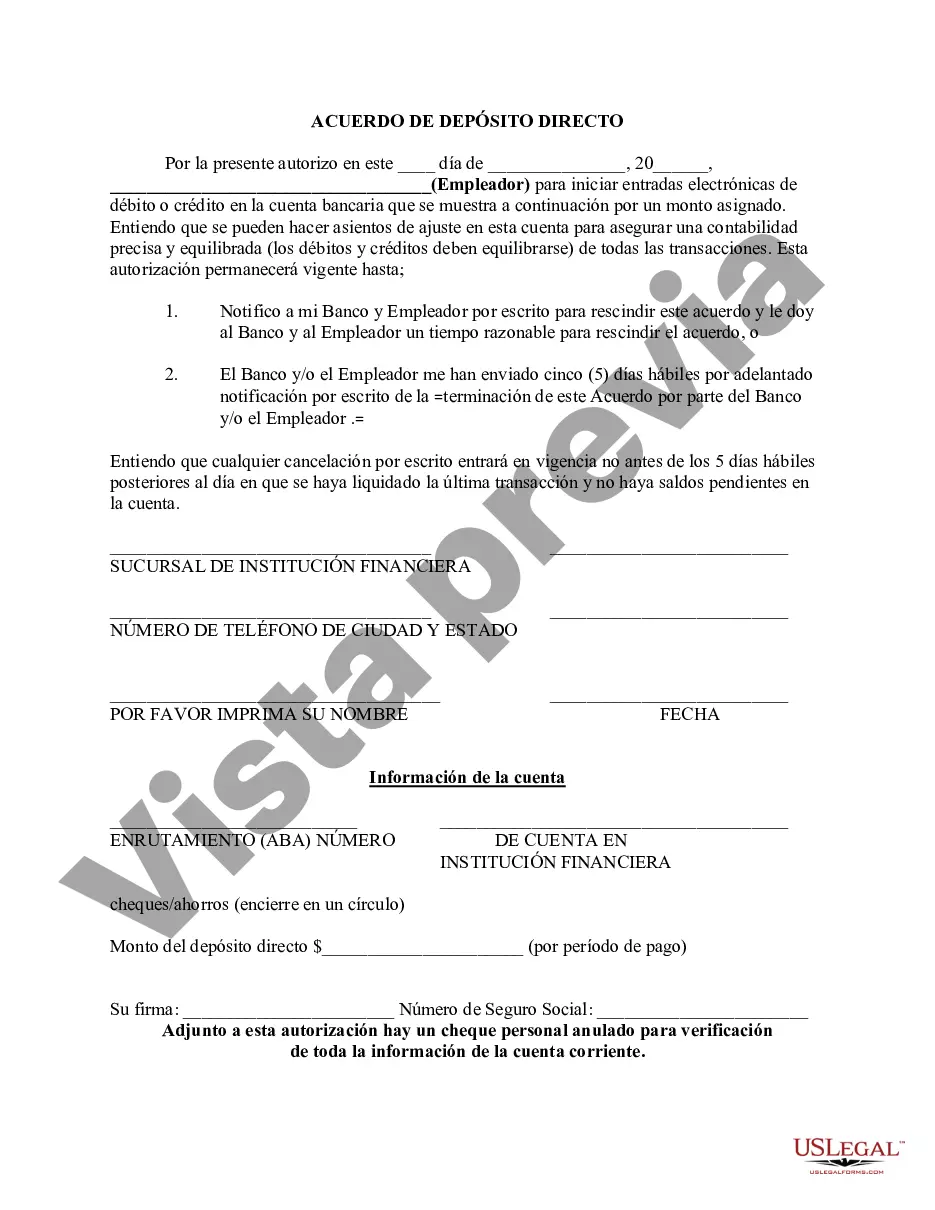

Franklin Ohio Direct Deposit Form for Employees is a crucial document that enables employees to experience the ease and efficiency of receiving their wages conveniently and securely. The form is filled out by employees to authorize their employer to deposit their wages directly into their bank account electronically. This system eliminates the need for traditional paper checks and provides employees with a more efficient and faster way of accessing their hard-earned money. The Franklin Ohio Direct Deposit Form for Employees requires essential information such as the employee's full name, employee identification number, bank account number, and routing number. Additionally, employees need to provide information about the financial institution where they hold their account to ensure seamless transfers. The process of filling out this form is relatively simple. Employees must accurately input their personal and banking details onto the form. It is crucial to double-check and verify all information before submitting it to avoid any delays in processing the direct deposit. Different types of Franklin Ohio Direct Deposit Forms for Employees may exist based on specific categories, such as: 1. Regular Direct Deposit Form: This type of form is used by employees who receive a fixed salary or wages on a regular basis. It ensures that the employee's salary is directly deposited into their bank account at the agreed-upon intervals, whether weekly, bi-weekly, or monthly. 2. Bonus Direct Deposit Form: In addition to their regular salary, some employees may be eligible to receive bonuses or incentive payments. This form allows them to authorize direct deposit for these additional earnings, ensuring timely and secure transfers. 3. Reimbursement Direct Deposit Form: Employees who incur expenses on behalf of the company may need to be reimbursed for these costs. Using this form, they can provide their bank details to facilitate direct deposit reimbursement, eliminating the need for paper checks or manual payment processing. 4. Final Paycheck Direct Deposit Form: When an employee leaves the company, they are entitled to their final paycheck. This form enables employees to arrange for direct deposit to their bank account, making it convenient for both the employee and the employer to complete the payment process after their departure. Regardless of the specific type, the Franklin Ohio Direct Deposit Form for Employees plays a significant role in streamlining the payroll process, ensuring accurate and timely wage payments. By opting for direct deposit, employees enjoy the advantages of accessing their funds immediately, avoiding the hassle of cashing or depositing checks, and minimizing the risk of lost or stolen payments.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Formulario de depósito directo para empleados - Direct Deposit Form for Employees

Description

How to fill out Franklin Ohio Formulario De Depósito Directo Para Empleados?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a lawyer to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Franklin Direct Deposit Form for Employees, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario accumulated all in one place. Therefore, if you need the latest version of the Franklin Direct Deposit Form for Employees, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Franklin Direct Deposit Form for Employees:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Franklin Direct Deposit Form for Employees and download it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!