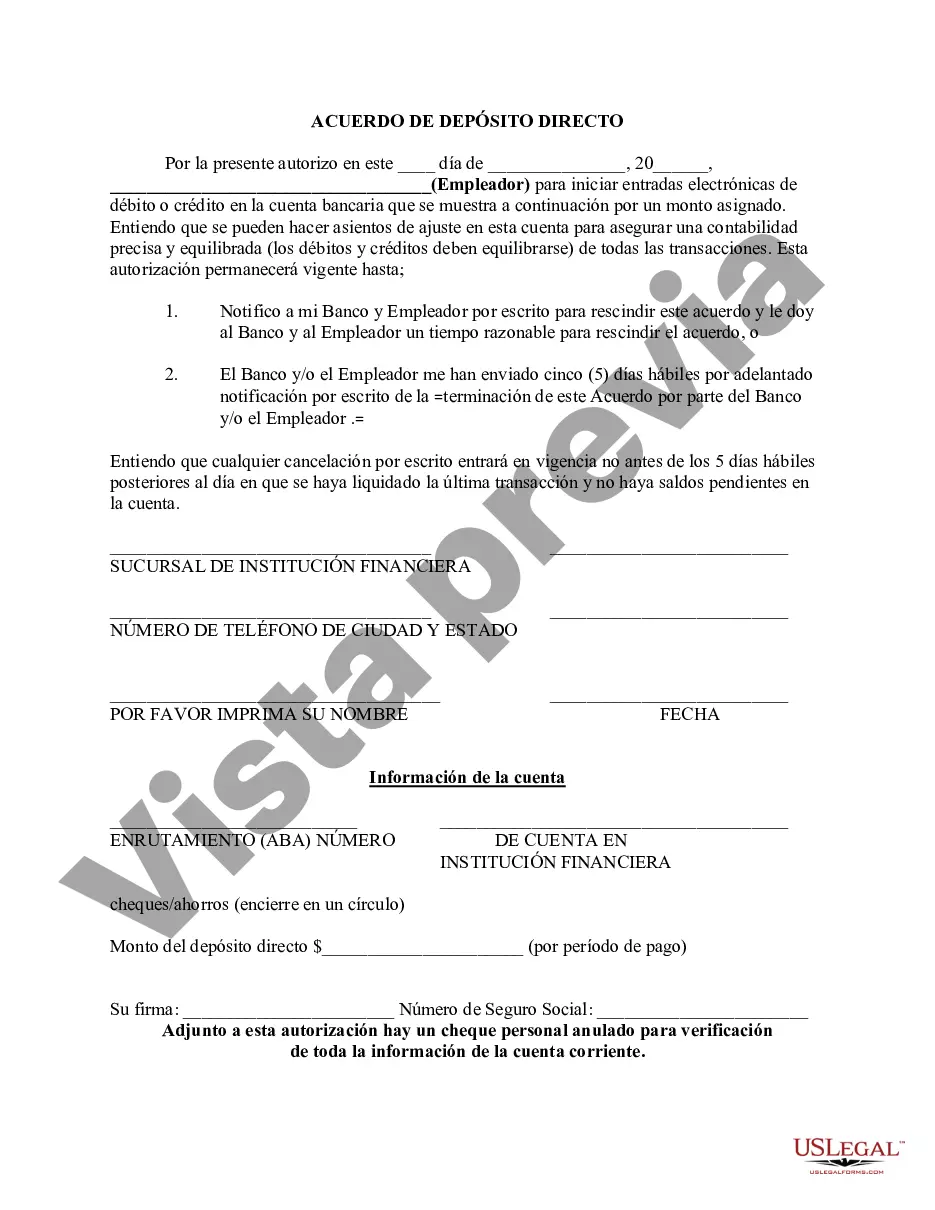

Philadelphia Pennsylvania Direct Deposit Form for Employees is a crucial document that allows employers in the city of Philadelphia, Pennsylvania, to initiate direct deposit payments to their employees' bank accounts. It simplifies the payroll management process by automating the transfer of funds directly into the employees' designated bank accounts. This electronic payment method is safe, convenient, and ensures employees receive their wages on time. The Philadelphia Pennsylvania Direct Deposit Form for Employees typically consists of various sections that require specific information. It includes the employer's information, such as the company's name, address, and contact details. The employee is required to provide their personal details, such as their full name, address, social security number, and identification number. In addition to personal information, the form also captures the bank details necessary to facilitate the direct deposit. Employees must provide the name of their financial institution, the bank's routing number, and their account number. This information guarantees that the funds are deposited accurately and securely into the correct bank account. Philadelphia Pennsylvania has different types of Direct Deposit Forms for Employees, depending on the nature of employment or industry. Some common variations include: 1. Regular Employee Direct Deposit Form: This form is for full-time or part-time employees who receive a fixed salary or wages on a regular basis. 2. Contractor Direct Deposit Form: Contractors or freelancers who work on a project basis and are not permanent employees may require a specific direct deposit form. This form caters to their unique payment structure. 3. Temporary Employee Direct Deposit Form: Temporary employees, such as seasonal or interns, may require a separate direct deposit form to reflect their temporary status. 4. Government Employee Direct Deposit Form: This form is used for government employees working in Philadelphia, ensuring the efficient transfer of their salaries or wages. The Philadelphia Pennsylvania Direct Deposit Form for Employees streamlines the payment process, eliminates the need for paper checks, and reduces the risk of lost or stolen wages. It offers the convenience of timely payments, allowing employees to access their funds without delay. Employers also benefit from this automated system by reducing administrative work, ensuring accuracy in wage payments, and enhancing overall payroll efficiency.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Formulario de depósito directo para empleados - Direct Deposit Form for Employees

Description

How to fill out Philadelphia Pennsylvania Formulario De Depósito Directo Para Empleados?

Whether you plan to start your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Philadelphia Direct Deposit Form for Employees is fast and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you several additional steps to obtain the Philadelphia Direct Deposit Form for Employees. Follow the instructions below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the file when you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Philadelphia Direct Deposit Form for Employees in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!