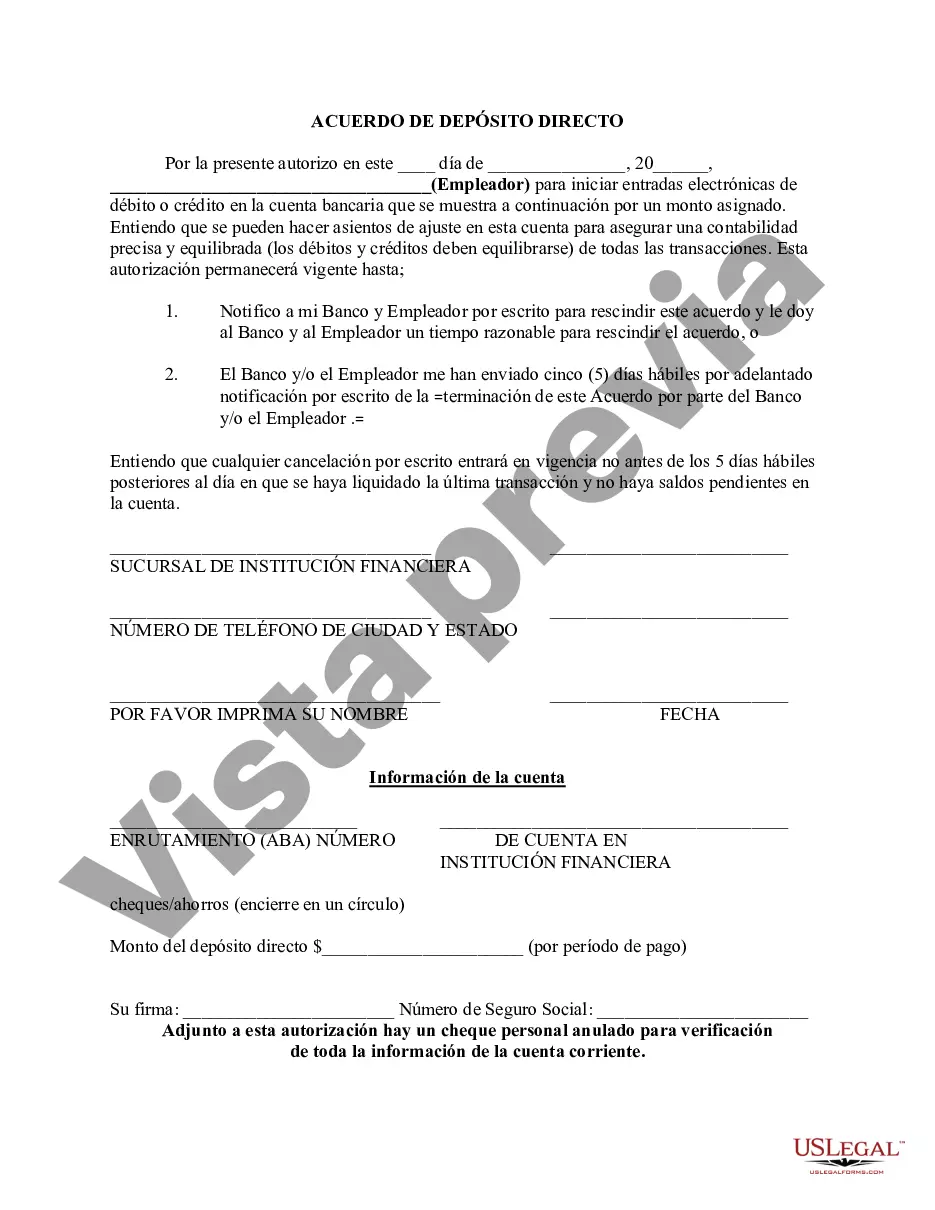

Sacramento California Direct Deposit Form for Employees serves as a crucial legal document through which employees authorize their employers to deposit their salaries directly into their bank accounts. This form eliminates the need for physical checks and provides a convenient and efficient method for employees to receive their wages. The Sacramento California Direct Deposit Form for Employees complies with state regulations and ensures all necessary information is collected accurately. It consists of various sections that require employees to fill in essential details such as their name, address, social security number, and contact information. Additionally, they will provide their bank account information, including the bank name, account number, and routing number. To ensure a smooth process, it is important to choose the correct type of Sacramento California Direct Deposit Form for Employees based on the employment circumstances. Here are some common forms: 1. Standard Direct Deposit Form: This is the most commonly used direct deposit form, suitable for regular employees with a fixed salary or hourly wage. It authorizes the employer to deposit the entire payment amount directly into the employee's bank account. 2. Partial Direct Deposit Form: In cases where employees wish to allocate a portion of their wages to multiple bank accounts, they can utilize this form. It allows them to specify the amount or percentage of their salary to be deposited into each designated account. 3. Temporary Direct Deposit Form: This form is applicable for temporary employees or those working on a contract basis. It enables them to receive their wages through direct deposit for a specific duration or project period. 4. Reimbursement Direct Deposit Form: If employees are entitled to expense reimbursements, they can utilize this form to authorize direct deposit for quick and seamless reimbursement processing. It ensures that their reimbursements are deposited directly into their bank accounts, eliminating the need for physical checks. 5. Multiple Direct Deposit Form: This form is useful for employees who wish to split their salary into multiple accounts, with separate amounts going to each designated account. It provides flexibility for managing finances and allocating funds to various financial goals, such as savings, bill payments, or investments. Regardless of the type of Sacramento California Direct Deposit Form for Employees used, employers must handle these documents with utmost confidentiality to protect employees' sensitive personal and financial information. Following the submission of the form, employees can expect their salaries to be deposited directly into their bank accounts on the designated payday, ensuring a hassle-free and secure payment process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sacramento California Formulario de depósito directo para empleados - Direct Deposit Form for Employees

Description

How to fill out Sacramento California Formulario De Depósito Directo Para Empleados?

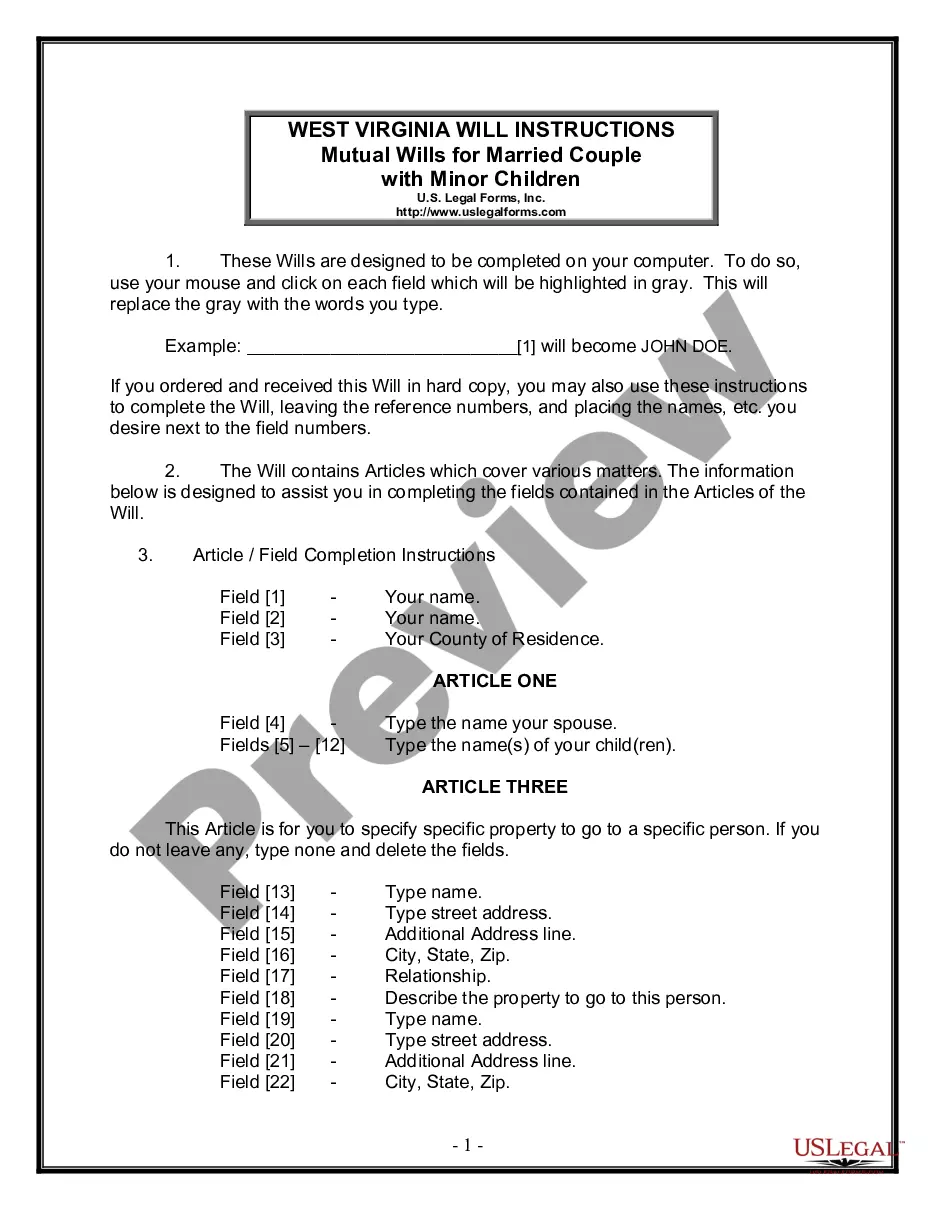

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Sacramento Direct Deposit Form for Employees, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Sacramento Direct Deposit Form for Employees from the My Forms tab.

For new users, it's necessary to make some more steps to get the Sacramento Direct Deposit Form for Employees:

- Take a look at the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!