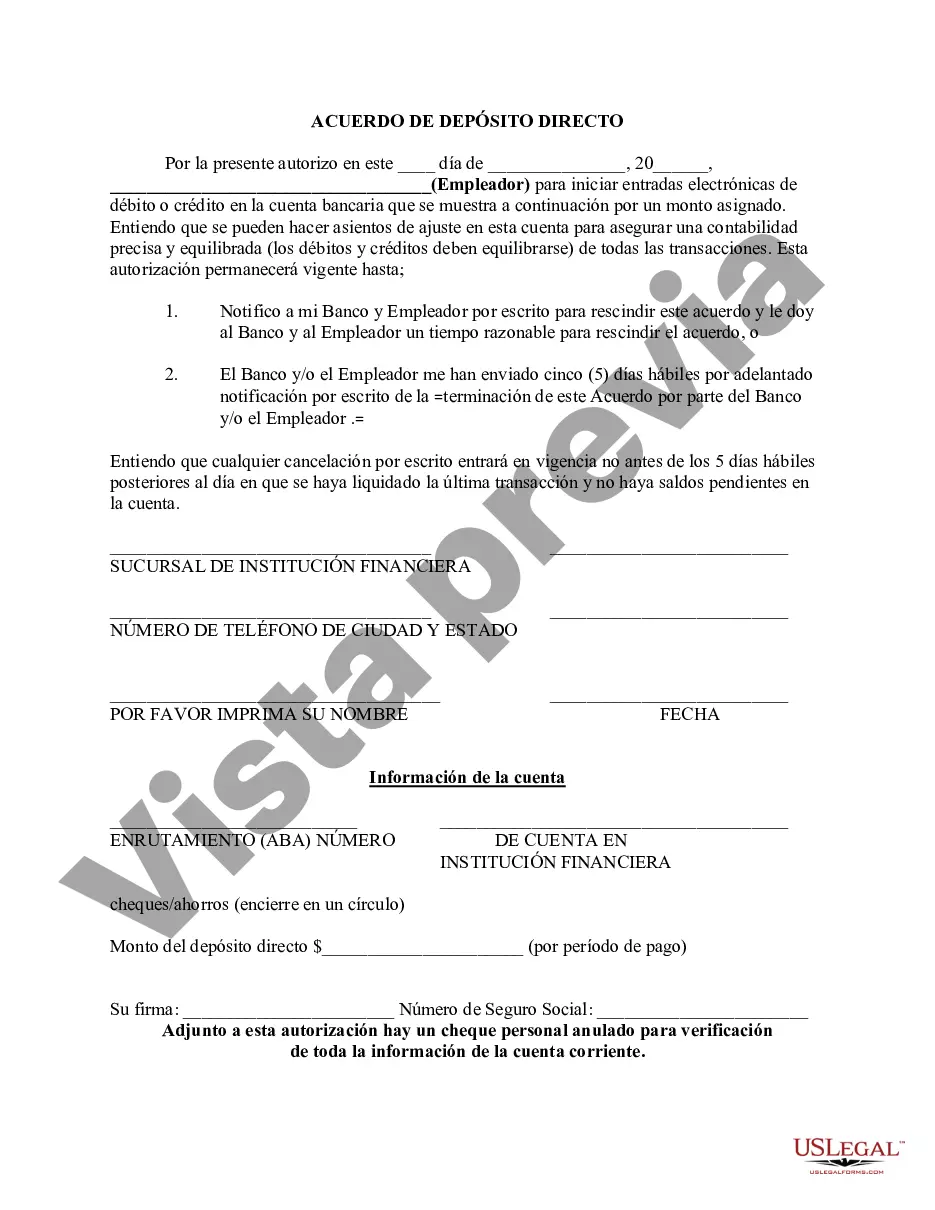

The Suffolk New York Direct Deposit Form for Employees is an essential document that allows employees to authorize their employer to deposit their paychecks directly into their chosen bank account. This form eliminates the need for physical checks and provides a convenient and secure method of receiving payments. By completing this form, employees ensure that their wages are automatically deposited into their preferred bank account on each pay date, saving them time and effort. There are several types of Suffolk New York Direct Deposit Forms for Employees, depending on the specific requirements of the organization. Some common variations include: 1. Standard Direct Deposit Form: This is the most basic form used by employers in Suffolk County, New York. It requires employees to provide their personal details, such as their full name, address, Social Security number, and bank account information, including the bank's name, routing number, and account number. 2. Multiple Account Direct Deposit Form: Some employees may prefer to split their earnings across multiple accounts. This type of form allows them to specify the different bank accounts in which they want their wages to be deposited. It typically requires employees to provide the same personal details as the standard form, along with the details of each bank account they wish to use. 3. Percentage Allocation Direct Deposit Form: This form is beneficial for employees who want to allocate a certain percentage of their earnings to different bank accounts. For instance, an employee may choose to deposit 70% of their paycheck in their savings account and the remaining 30% in their checking account. This form allows employees to input the chosen percentage for each designated account, along with the usual personal and bank account information. 4. Allocation by Dollar Amount Direct Deposit Form: In this type of form, employees can allocate a specific dollar amount to each bank account they wish to use. For example, an employee may request $500 to be deposited into their primary account and $300 into a secondary account. The form requires employees to provide the personal details and bank account information, along with the specific dollar allocation for each account. Regardless of the specific type, the Suffolk New York Direct Deposit Form for Employees serves as an agreement between the employee and employer, ensuring seamless and hassle-free payment transfers. The utilization of this form streamlines payroll processing and offers a secure and reliable method for employees to receive their wages.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Como Llenar Un Cheque De Chase - Direct Deposit Form for Employees

Description

How to fill out Suffolk New York Formulario De Depósito Directo Para Empleados?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any personal or business objective utilized in your county, including the Suffolk Direct Deposit Form for Employees.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Suffolk Direct Deposit Form for Employees will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to obtain the Suffolk Direct Deposit Form for Employees:

- Ensure you have opened the proper page with your localised form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Suffolk Direct Deposit Form for Employees on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!