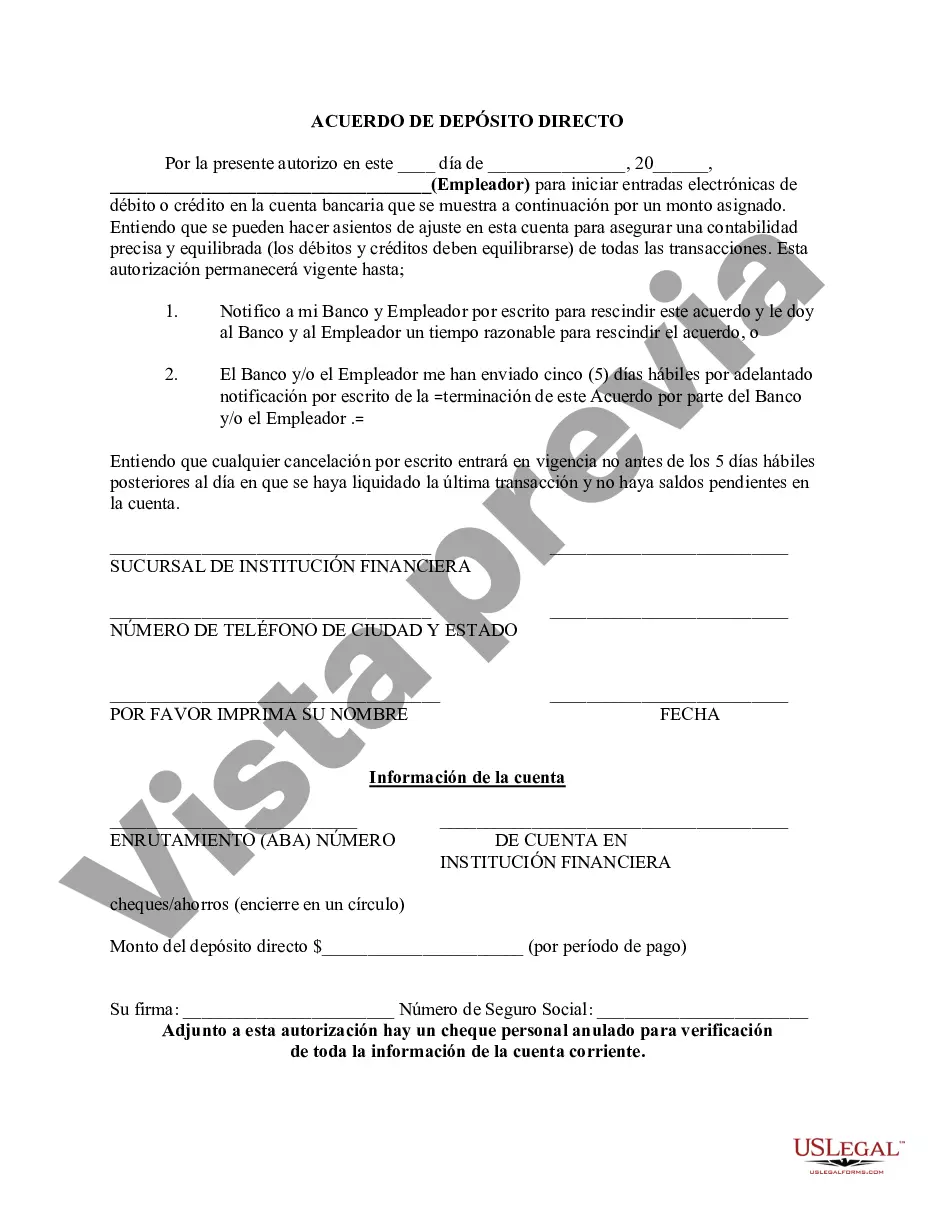

Chicago Illinois Direct Deposit Form for Employer is a document that facilitates streamlined payment processes between employers and their employees. It is a vital tool that ensures accurate and timely direct deposits into employees' bank accounts, eliminating the need for physical checks. This article aims to provide a detailed description of the Chicago Illinois Direct Deposit Form for Employer and its various types. The Chicago Illinois Direct Deposit Form for Employer enables employers in the city to efficiently pay their employees through a secure and efficient electronic funds transfer system. By completing this form, employers can authorize their financial institution to deposit employee wages directly into their designated bank accounts. The direct deposit form typically requires important information such as employee name, address, social security number, bank name, routing number, and account number. It is essential for employers to ensure the accuracy of the information provided to avoid payment delays or errors. Different types of Chicago Illinois Direct Deposit Forms for Employers vary based on the specific needs and requirements of businesses and organizations. Some common variations may include: 1. Standard Direct Deposit Form: This is the most common type of direct deposit form used by employers in Chicago, Illinois. It allows employees to authorize their employer to deposit their wages into their primary bank account. 2. Split Direct Deposit Form: This form is ideal for employees who want to divide their paycheck and allocate a certain percentage or fixed amount to multiple bank accounts. This could be useful for individuals who want to separate savings, bills, and other expenses. 3. Change/Drop Direct Deposit Form: Employers use this form when an employee wants to modify their existing direct deposit arrangement. It caters to cases where an employee switches banks, changes account numbers, or faces any relevant update. 4. Bonus Direct Deposit Form: This specialized form facilitates the direct deposit of bonuses, commissions, or other additional payments separate from regular wages. Employees can specify the amount and whether it should be deposited into their primary account or a different account. Employers in Chicago, Illinois are advised to consult their financial institution or human resources department for specific direct deposit forms that fulfill their unique requirements. Compliance with federal and state regulations regarding direct deposit is crucial to ensure legality and security. In conclusion, the Chicago Illinois Direct Deposit Form for Employer is a crucial document that facilitates efficient payment processes between employers and employees. It streamlines payment procedures, eliminates the need for physical checks, and enables employees to receive their wages directly into their bank accounts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Formulario de depósito directo para el empleador - Direct Deposit Form for Employer

Description

How to fill out Chicago Illinois Formulario De Depósito Directo Para El Empleador?

How much time does it typically take you to draft a legal document? Considering that every state has its laws and regulations for every life situation, finding a Chicago Direct Deposit Form for Employer suiting all regional requirements can be stressful, and ordering it from a professional attorney is often costly. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Apart from the Chicago Direct Deposit Form for Employer, here you can find any specific document to run your business or individual deeds, complying with your regional requirements. Specialists verify all samples for their validity, so you can be certain to prepare your paperwork correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can pick the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Chicago Direct Deposit Form for Employer:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Chicago Direct Deposit Form for Employer.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!