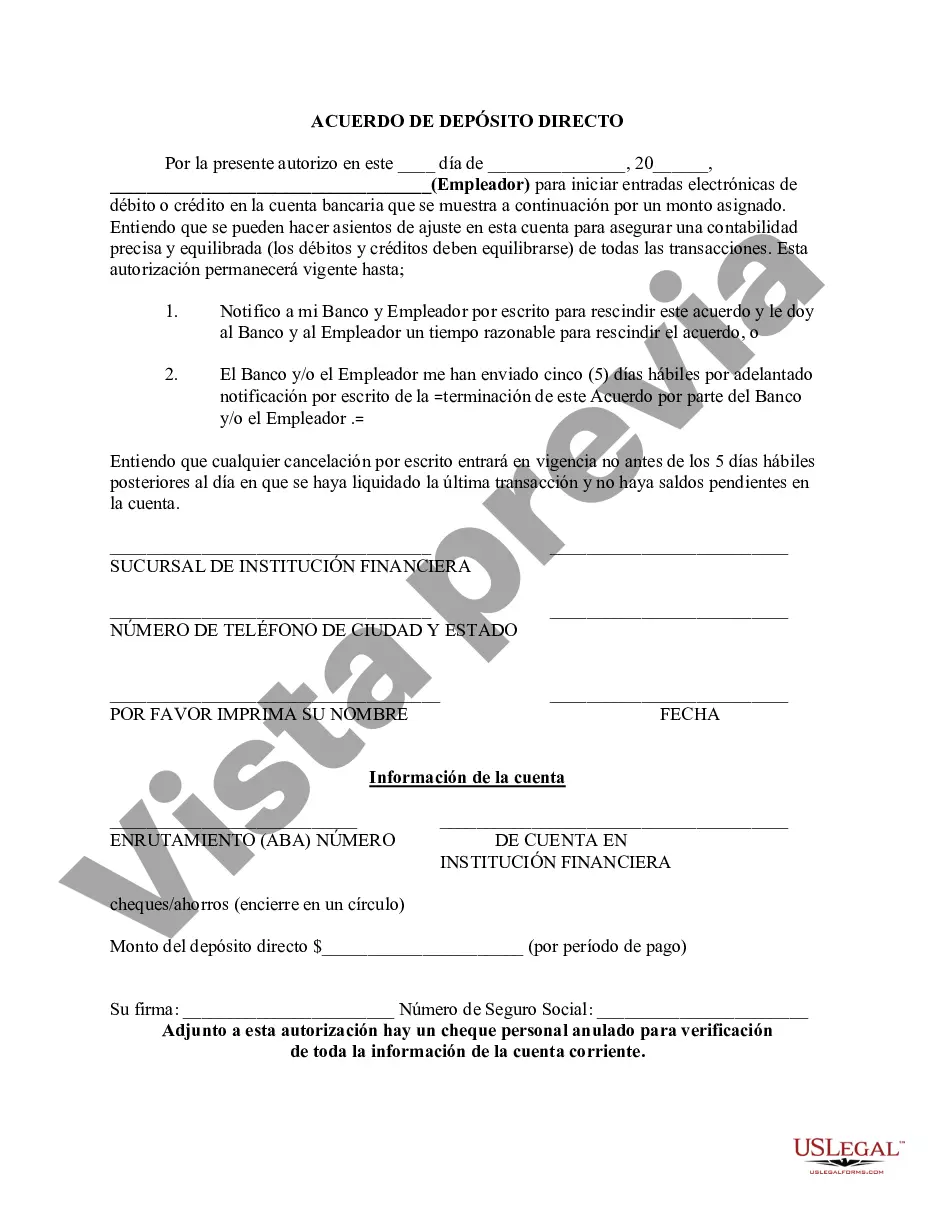

Cook Illinois Direct Deposit Form for Employer is a document that facilitates the electronic transfer of an employee's wages directly into their designated bank account. This form offers a convenient and secure method of payment, eliminating the need for physical checks or cash transactions. By completing this form, employees authorize their employer, Cook Illinois, to deposit their earnings directly into the bank account specified. Keywords: Cook Illinois, Direct Deposit Form, employer, electronic transfer, wages, bank account, payment, convenient, secure, physical checks, cash transactions, employees, authorize, deposit, earnings. Different types of Cook Illinois Direct Deposit Forms for Employers may include: 1. Cook Illinois New Employee Direct Deposit Form: This form is used by newly hired employees to set up their direct deposit payment method. It requires the employee to provide their personal information, such as name, address, social security number, and bank account details. 2. Cook Illinois Existing Employee Direct Deposit Form: This form is used by employees who are already receiving their wages through direct deposit but need to update their bank account information. It allows employees to change their existing account details or switch to a different bank. 3. Cook Illinois Direct Deposit Cancellation Form: This form is utilized by employees who wish to terminate their direct deposit. By completing this form, employees request to stop the electronic transfer of their wages and opt for an alternative payment method, such as receiving physical checks. 4. Cook Illinois Additional Direct Deposit Form: This form is used by employees who want to split their wages between multiple bank accounts. It allows employees to designate specific amounts or percentages of their earnings to be deposited into each respective account. 5. Cook Illinois Direct Deposit Authorization Form: This form serves as an agreement between the employer and employee. Employees authorize Cook Illinois to initiate the electronic transfer of their wages into their bank account, acknowledging their consent and understanding of the direct deposit process. By utilizing Cook Illinois Direct Deposit Forms for Employers, both employees and the company benefit from a streamlined payment system, enhanced security, and the convenience of timely and automatic fund transfers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Formulario de depósito directo para el empleador - Direct Deposit Form for Employer

Description

How to fill out Cook Illinois Formulario De Depósito Directo Para El Empleador?

Draftwing paperwork, like Cook Direct Deposit Form for Employer, to manage your legal affairs is a challenging and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents intended for a variety of cases and life situations. We make sure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Cook Direct Deposit Form for Employer template. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as simple! Here’s what you need to do before getting Cook Direct Deposit Form for Employer:

- Make sure that your document is specific to your state/county since the rules for writing legal documents may vary from one state another.

- Find out more about the form by previewing it or going through a quick intro. If the Cook Direct Deposit Form for Employer isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin using our service and get the document.

- Everything looks good on your side? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your template is ready to go. You can go ahead and download it.

It’s easy to locate and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!