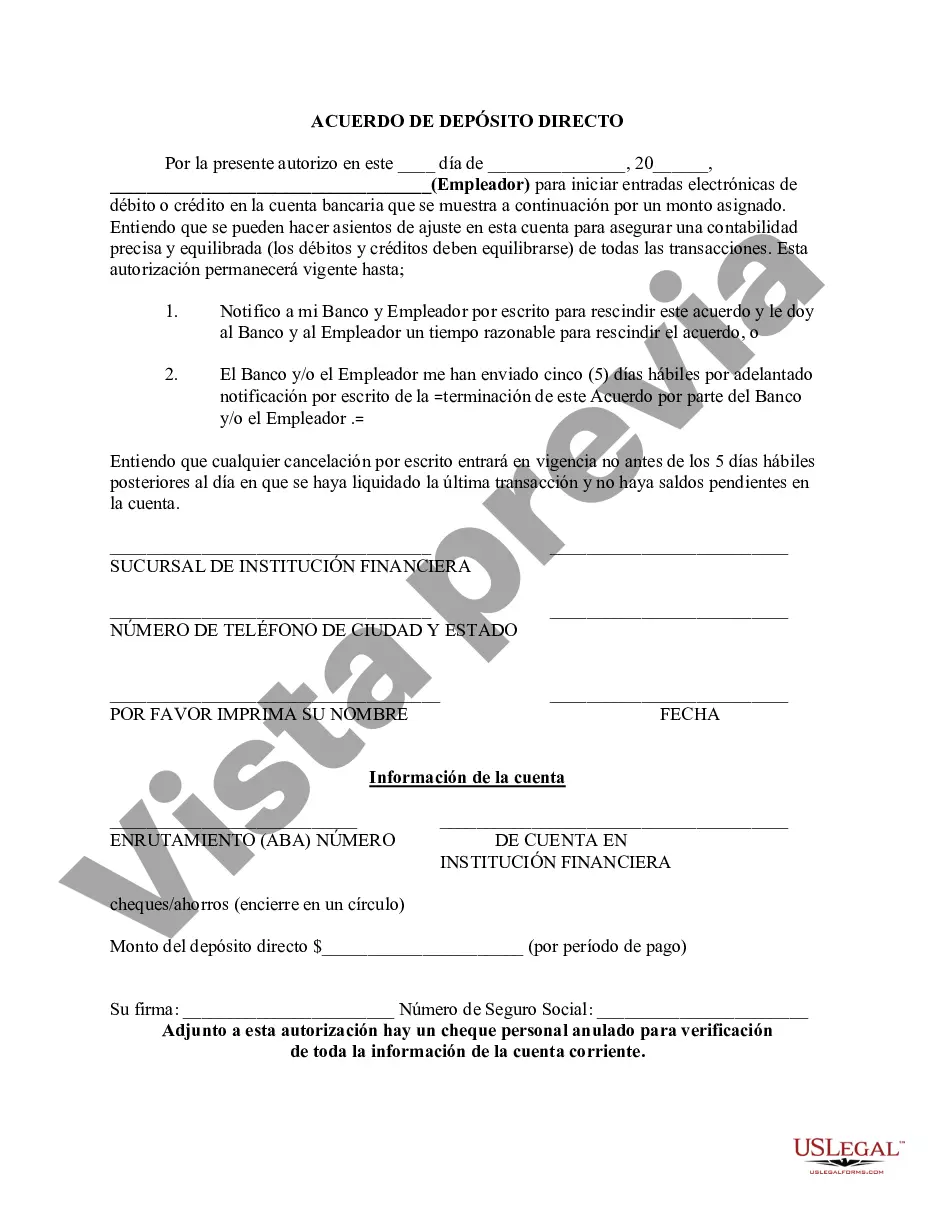

The Franklin Ohio Direct Deposit Form for Employer is a crucial document required by employers and employees in the State of Ohio. This form allows employers to electronically deposit employees' paychecks directly into their bank accounts, offering a convenient and secure method of payment. Direct deposit eliminates the need for employees to manually cash or deposit paper checks, resulting in time and cost savings for both parties involved. By implementing direct deposit, employers can streamline their payroll processes and enhance efficiency. This form ensures that employees receive their wages on time while minimizing the risk of lost or stolen checks. Additionally, direct deposit also eliminates the need for employees to make frequent trips to the bank, enhancing convenience and providing immediate access to funds. The Franklin Ohio Direct Deposit Form for Employer typically consists of several sections that collect essential information. These sections may include: 1. Employee Information: This section gathers details about the employee, such as their name, address, phone number, and Social Security number. It ensures accurate identification and proper allocation of funds. 2. Financial Institution Details: This section requires the employee to provide information about their banking institution, including the bank's name, address, routing number, and account number. This data is essential for initiating the electronic fund transfers securely. 3. Deposit Allocation: In this section, employees may have the option to allocate their wages across multiple accounts, such as checking and savings. This allows them to manage their finances efficiently by directing funds to different purposes. 4. Authorization and Signature: To authorize the direct deposit process, employees must sign and date the form. This signature serves as consent for the employer to deposit wages into the designated bank account. It is worth noting that while the general content of the Franklin Ohio Direct Deposit Form for Employer remains similar, there may be slight variations based on different employers or organizations. Some employers may have their personalized versions of the form, including their logos and additional fields for specific information. In conclusion, the Franklin Ohio Direct Deposit Form for Employer is a vital document that facilitates the electronic transfer of employee wages to their bank accounts. It offers numerous advantages for both employers and employees, including convenience, security, and efficiency. Using this form, employers can simplify their payroll processes while ensuring timely and accurate payments for their workforce.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Formulario de depósito directo para el empleador - Direct Deposit Form for Employer

Description

How to fill out Franklin Ohio Formulario De Depósito Directo Para El Empleador?

Preparing papers for the business or personal needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to create Franklin Direct Deposit Form for Employer without expert assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Franklin Direct Deposit Form for Employer on your own, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Franklin Direct Deposit Form for Employer:

- Look through the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that suits your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any scenario with just a few clicks!