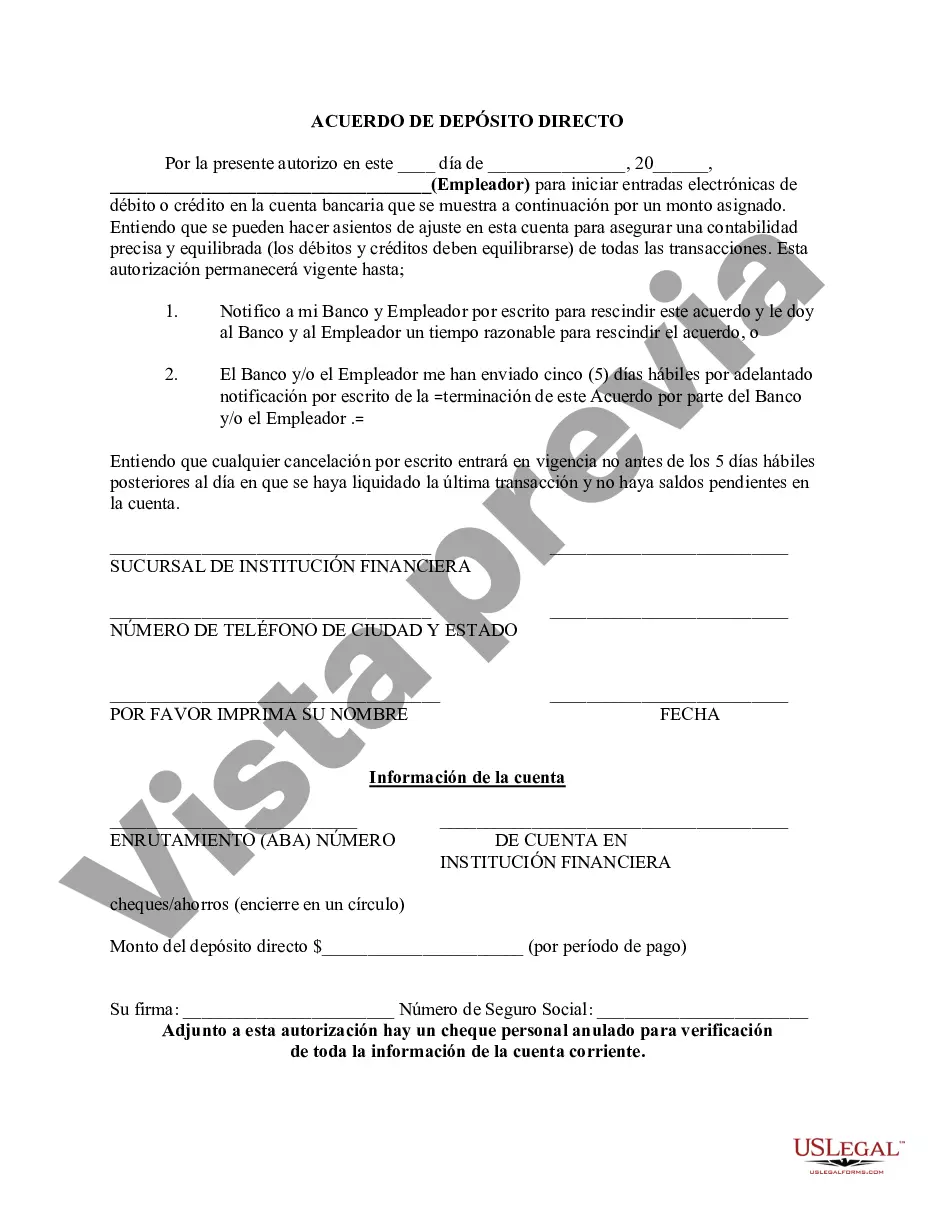

The Queens, New York Direct Deposit Form for Employer is a document that enables employers and employees in Queens, New York, to authorize electronic deposits of payroll funds directly into a specified bank account. This form eliminates the need for physical paychecks and ensures prompt payment to employees. Direct deposit offers numerous benefits such as convenience, security, and time savings for both employers and employees. The Queens, New York Direct Deposit Form for Employer typically includes several sections to be completed by the employer, employee, and the financial institution. It gathers vital information such as the employee's name, address, social security number, bank name, routing number, and account number. These details ensure accurate and secure transfers of funds. There may be various types of Queens, New York Direct Deposit Forms for Employers based on different situations or requirements. Some examples include: 1. New Hire Direct Deposit Form: This form is used when a new employee in Queens, New York, wishes to enroll in the direct deposit program for payroll funds. It collects the necessary information to set up the electronic transfer of wages. 2. Change/Update Direct Deposit Form: This form is used when an employee wants to modify their existing direct deposit information. It can be utilized to update bank details, change account numbers, or switch to a different financial institution. 3. Cancellation of Direct Deposit Form: If an employee in Queens, New York, wishes to discontinue the direct deposit service, this form is used to cancel the existing arrangement. The employee may prefer physical paychecks or opt for alternative payment methods. 4. Termination Direct Deposit Form: When an employee leaves the company or is terminated, this form is used to ensure the final paycheck is directly deposited into the appropriate bank account listed by the employee. Employers must adhere to specific requirements and guidelines mandated by federal and state laws while implementing direct deposit programs. Employees should carefully fill out the Queens, New York Direct Deposit Form for Employers, ensuring accuracy and thoroughness. By doing so, they can enjoy the benefits of this convenient and reliable method of payment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Formulario de depósito directo para el empleador - Direct Deposit Form for Employer

Description

How to fill out Queens New York Formulario De Depósito Directo Para El Empleador?

Creating documents, like Queens Direct Deposit Form for Employer, to manage your legal affairs is a challenging and time-consumming task. Many circumstances require an attorney’s participation, which also makes this task expensive. Nevertheless, you can take your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms crafted for different cases and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Queens Direct Deposit Form for Employer form. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before downloading Queens Direct Deposit Form for Employer:

- Ensure that your document is compliant with your state/county since the rules for writing legal paperwork may differ from one state another.

- Discover more information about the form by previewing it or going through a quick intro. If the Queens Direct Deposit Form for Employer isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to begin utilizing our service and download the document.

- Everything looks great on your side? Click the Buy now button and choose the subscription option.

- Select the payment gateway and enter your payment details.

- Your template is ready to go. You can go ahead and download it.

It’s easy to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!