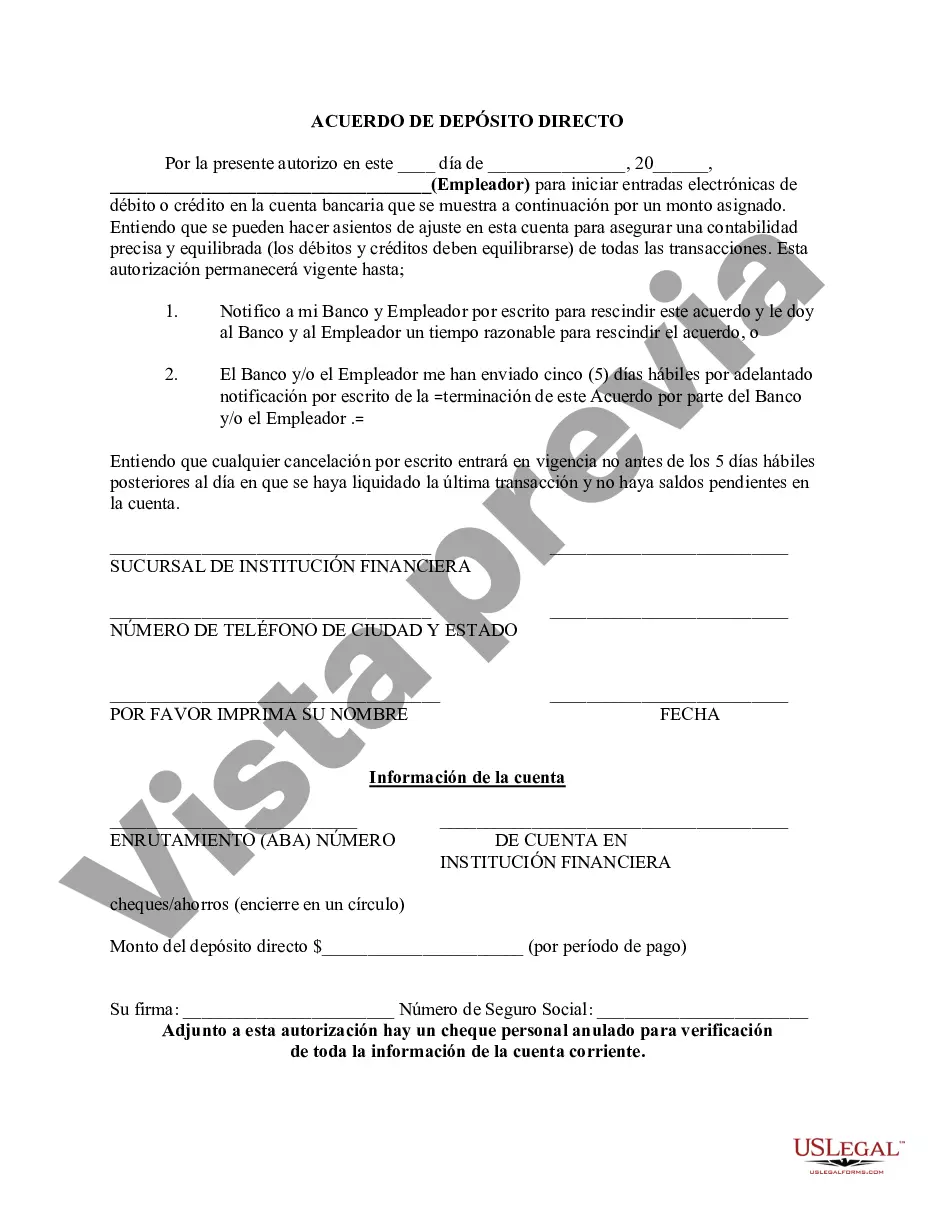

San Antonio, Texas Direct Deposit Form for Employer is a crucial document that facilitates the electronic transfer of employee paychecks or other payments directly into their bank accounts. This form eliminates the need for paper checks and provides a convenient and efficient way for employers to distribute funds. The San Antonio, Texas Direct Deposit Form for Employer typically requires essential information, including the employee's name, address, social security number, bank account number, routing number, and the type of account (checking or savings). Employers may also request additional details such as the employee's email address or phone number to ensure effective communication. There may be different variations or types of the San Antonio, Texas Direct Deposit Form for Employer, depending on the specific needs and preferences of the employer or the financial institution involved. Some forms may include sections for the employee to designate a portion of their paycheck to be deposited into multiple accounts, allowing for savings or investment allocations. Another type of form could be designed for employers who offer the option of payroll card programs. With this form, employees who do not have bank accounts can receive their wages on a payroll card, acting as a prepaid debit card, which can be used for purchases or cash withdrawals. Furthermore, some San Antonio, Texas Direct Deposit Forms for Employers might have provisions for employees to opt for a partial direct deposit, where only a portion of their paycheck is deposited into their bank account while the remaining amount is received as a physical check. It is important for both employers and employees to understand the regulations and limitations associated with direct deposit transactions, such as any applicable fees or minimum balance requirements set by the bank or financial institution. In conclusion, the San Antonio, Texas Direct Deposit Form for Employer streamlines the payment process for companies and ensures that employees receive their wages efficiently and securely. By opting for direct deposit, employers can save time and reduce administrative costs, while employees benefit from the convenience of having immediate access to their funds.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Formulario de depósito directo para el empleador - Direct Deposit Form for Employer

Description

How to fill out San Antonio Texas Formulario De Depósito Directo Para El Empleador?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a legal professional to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the San Antonio Direct Deposit Form for Employer, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Therefore, if you need the latest version of the San Antonio Direct Deposit Form for Employer, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Antonio Direct Deposit Form for Employer:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the file format for your San Antonio Direct Deposit Form for Employer and download it.

When finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!