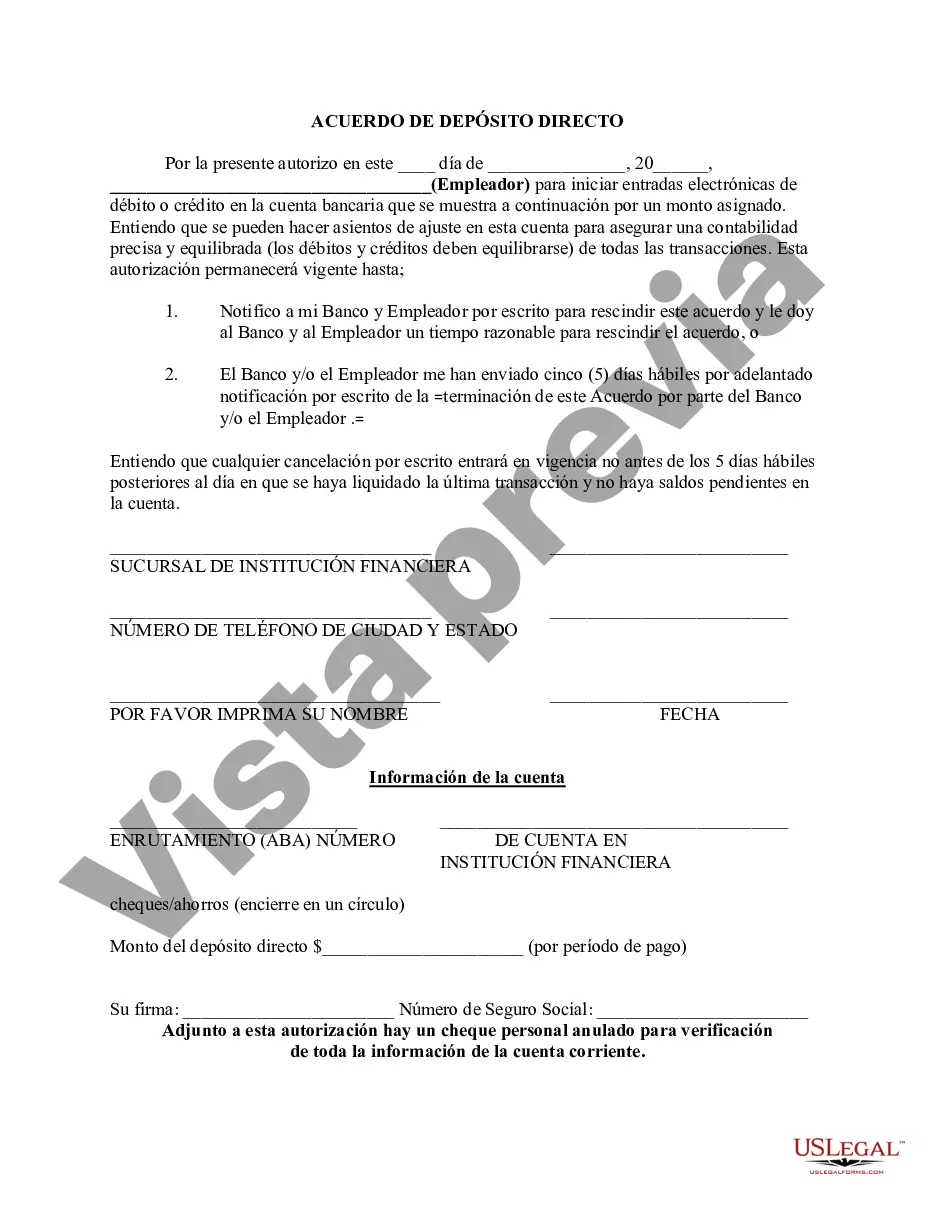

Chicago Illinois Direct Deposit Form for Chase is a document that allows Chase bank account holders in the city of Chicago, Illinois, to conveniently set up and manage their direct deposit transactions. Direct deposit is a popular banking service that enables individuals to have their recurring payments, such as salaries, government benefits, or pension payments, automatically transferred into their bank accounts. By utilizing the Chicago Illinois Direct Deposit Form for Chase, customers can authorize their employers, government agencies, or other payment providers to deposit funds directly into their Chase accounts. The Seattle Direct Deposit Form for Chase comes in different variations to cater to the various needs of Chase customers in Chicago, Illinois. Some commonly encountered types of Chicago Illinois Direct Deposit Form for Chase may include: 1. Regular Direct Deposit Form: This form is used for individuals who want to set up a standard direct deposit from their employer or any other organization that offers this payment option. It requires the customer to provide their account information, such as the account number and routing number, along with their personal details and employer information. 2. Government Benefits Direct Deposit Form: As the name suggests, this form is specifically designed for customers who receive government benefits, such as Social Security or unemployment compensation. The form may have additional sections requiring the customer to provide specific details related to their benefit program, such as the benefit authorization number or claim ID. 3. Pension Direct Deposit Form: This form is designed for individuals who receive pension payments from their former employers or retirement programs. It generally requires the customer to input details related to their pension provider, the pension account number, and any other specific information related to their pension plan. 4. Additional Income Direct Deposit Form: This form is used for customers who receive additional income from sources other than their regular employment or government benefits. It can be used to set up direct deposits for rental income, freelance payments, or any other recurring income source. Regardless of the specific form type, all Chicago Illinois Direct Deposit Forms for Chase generally require the customer's account information, personal details, and the necessary information about the payment source. These forms play a vital role in ensuring a hassle-free and automated process of receiving funds directly into the customers' Chase bank accounts, eliminating the need for manual cashing of checks or visiting the bank for deposits. By setting up direct deposit, customers can enjoy the convenience of having their funds readily available, increasing their financial efficiency and flexibility.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Formulario de depósito directo para Chase - Direct Deposit Form for Chase

Description

How to fill out Chicago Illinois Formulario De Depósito Directo Para Chase?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business objective utilized in your county, including the Chicago Direct Deposit Form for Chase.

Locating templates on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Chicago Direct Deposit Form for Chase will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to obtain the Chicago Direct Deposit Form for Chase:

- Make sure you have opened the proper page with your local form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Chicago Direct Deposit Form for Chase on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!