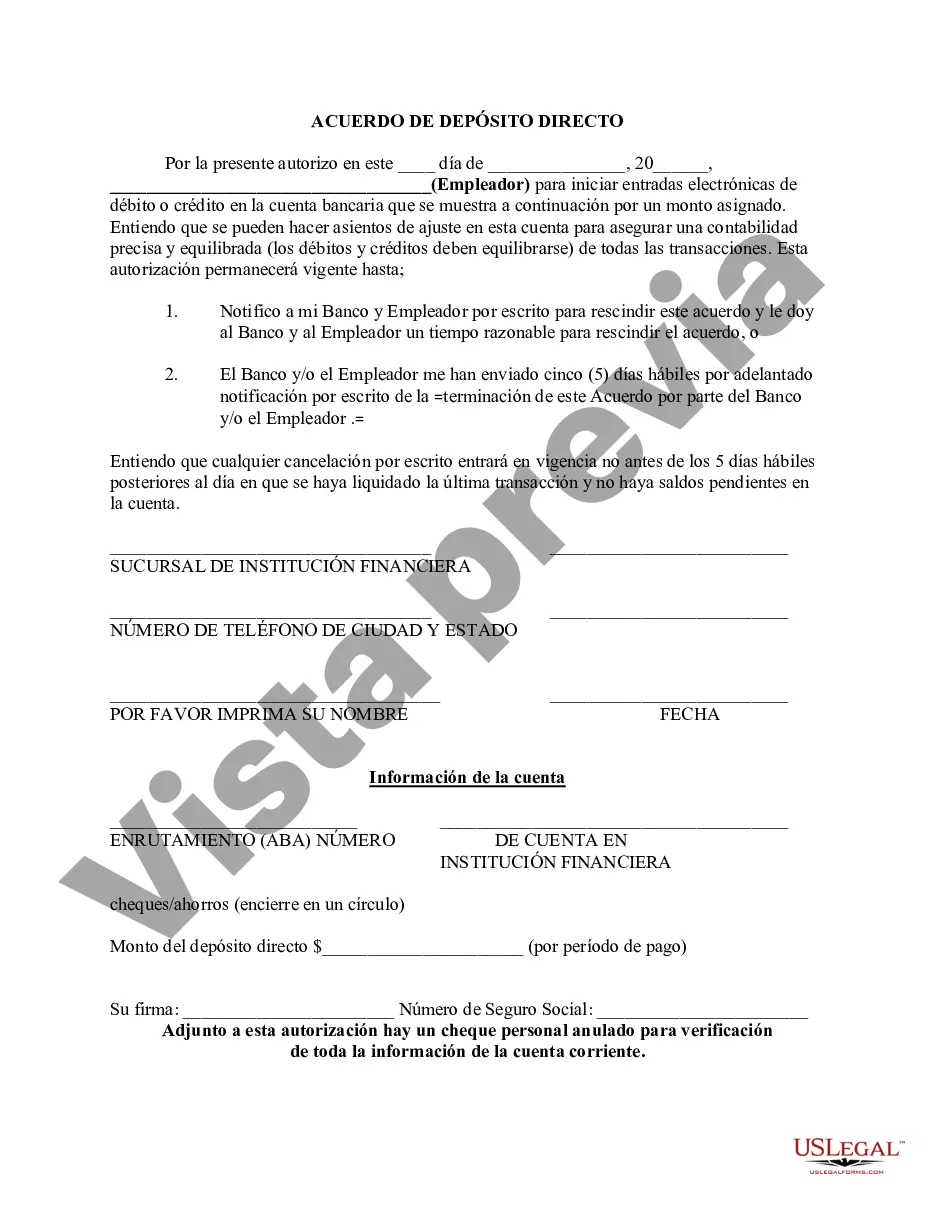

Philadelphia Pennsylvania Direct Deposit Form for Chase is a document provided by Chase Bank that enables its customers in Philadelphia, Pennsylvania, to set up direct deposit for their bank accounts. Direct deposit is an electronic payment method that allows individuals to receive their regular income, such as salary, pension, or government benefits, directly into their bank account. This form is used to provide accurate and essential information required to establish direct deposit. It serves as a convenient and efficient way for Chase customers to receive their funds in a timely manner without the need for physical checks or visiting a bank branch. By completing this form, customers can authorize their employer or any other eligible organization to deposit their payments directly into their Chase bank account. The Philadelphia Pennsylvania Direct Deposit Form for Chase typically consists of the following sections: 1. Personal Information: This section requires the individual's full name, address, contact details, and Social Security Number. It is crucial to provide accurate information to ensure the direct deposit is correctly processed. 2. Bank Account Details: Customers need to specify the Chase bank account in which they want their funds deposited. This includes the account number, account type (checking or savings), and the Chase routing number, which is specific to the branch or region. 3. Payment Information: This section requires details about the source of the direct deposit, such as the employer's name and address, or the government agency responsible for the payments. This information helps Chase identify and verify the origin of the funds. 4. Authorization: The individual must provide their signature, indicating their agreement to set up direct deposit and authorize Chase to receive and deposit funds into their bank account. By using the Philadelphia Pennsylvania Direct Deposit Form for Chase, customers can ensure a secure and seamless process for receiving their income. It eliminates the risk of lost or stolen checks, provides faster access to funds, and offers the convenience of automatic deposits. While there might not be different types of Philadelphia Pennsylvania Direct Deposit Forms specific to Chase Bank, the form may vary slightly depending on the purpose of the direct deposit. For example, forms for government benefit payments may have additional fields required by the specific agency responsible for disbursing those funds. In conclusion, the Philadelphia Pennsylvania Direct Deposit Form for Chase is an essential document for Chase Bank customers in the region who wish to set up direct deposit for their accounts. It streamlines the process of receiving regular income, promoting convenience, and offering a secure and efficient means of managing finances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Formulario de depósito directo para Chase - Direct Deposit Form for Chase

Description

How to fill out Philadelphia Pennsylvania Formulario De Depósito Directo Para Chase?

How much time does it usually take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Philadelphia Direct Deposit Form for Chase suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often expensive. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. In addition to the Philadelphia Direct Deposit Form for Chase, here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Specialists verify all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can retain the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Philadelphia Direct Deposit Form for Chase:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Philadelphia Direct Deposit Form for Chase.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!