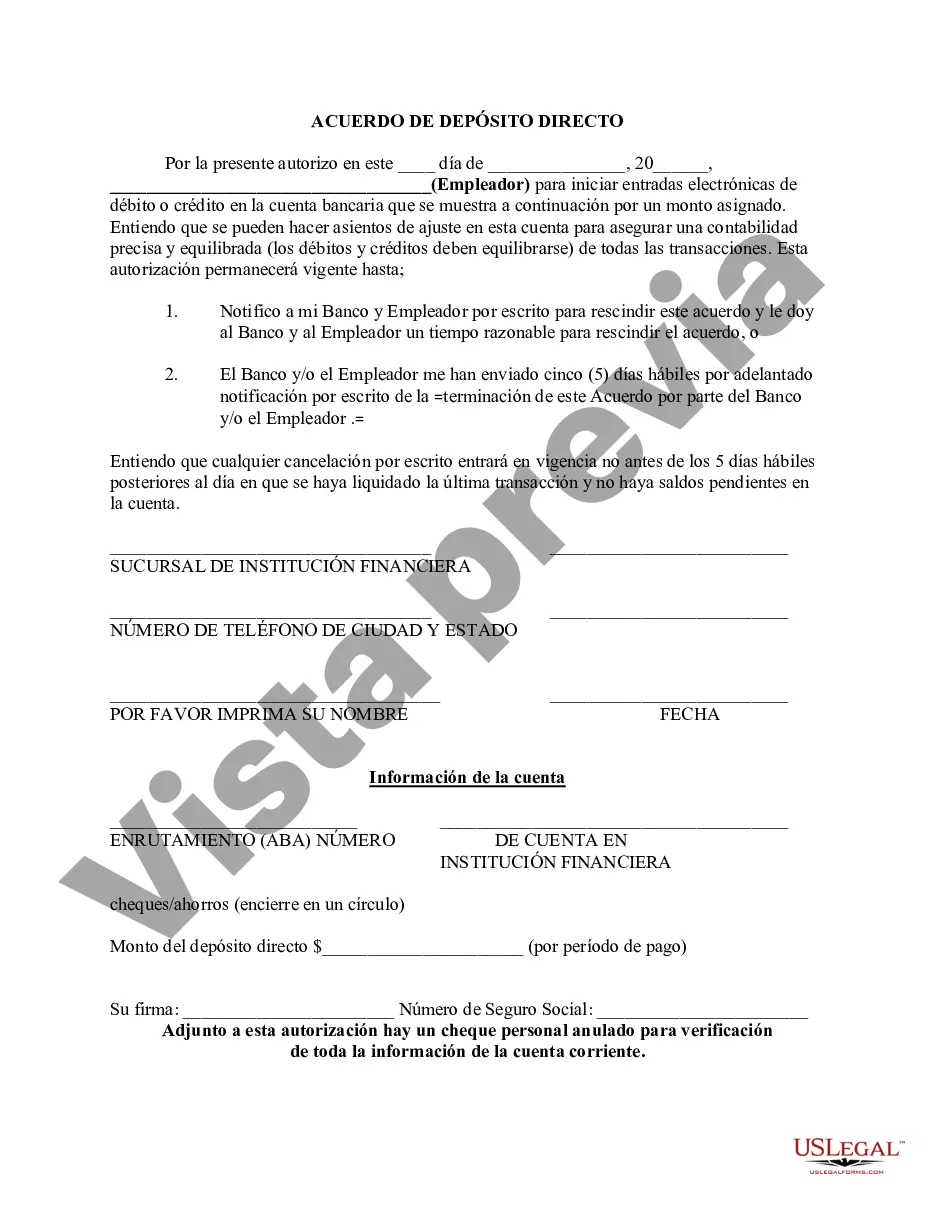

Salt Lake Utah Direct Deposit Form for Chase is a document designed for individuals who have a Chase bank account in Salt Lake City, Utah and wish to set up a direct deposit service. This form allows account holders to authorize their employer or other sources of income to deposit funds directly into their Chase account, eliminating the need for physical checks or cash deposits. The Salt Lake Utah Direct Deposit Form for Chase includes several sections that need to be completed accurately in order to ensure a successful direct deposit setup. These sections typically include: 1. Personal Information: Account holders are required to provide their full name, address, social security number, and contact information. This information is necessary for the identification and verification of the account holder. 2. Chase Account Details: Individuals need to provide their Chase account number and routing number. This information can be found on their checks or by contacting the bank directly. It is crucial to double-check these details to prevent any errors in the direct deposit process. 3. Employer Information: The form requires the account holder to provide their employer's name, address, phone number, and any other relevant details. This information enables Chase to authenticate the employer and ensure the direct deposit is received from a valid source. 4. Deposit Allocation: Account holders may have the option to distribute their funds to different Chase accounts if they hold multiple accounts. In this section, individuals can specify the percentage or specific dollar amounts they wish to allocate to each account associated with their direct deposit. 5. Signature and Authorization: In order for the Salt Lake Utah Direct Deposit Form for Chase to be valid, the account holder must sign and date the form. By doing so, they are authorizing Chase to process their direct deposit and make changes to their account as necessary. It is worth noting that while the general structure and information required on the Salt Lake Utah Direct Deposit Form for Chase remains consistent, there might be slight variations or updates based on specific needs or policies. For example, there may be different versions for business accounts, government employees, or individuals receiving benefit payments. It is crucial for account holders to use the appropriate form that aligns with their specific circumstances and to consult with a Chase representative if there are any questions or concerns.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Formulario de depósito directo para Chase - Direct Deposit Form for Chase

Description

How to fill out Salt Lake Utah Formulario De Depósito Directo Para Chase?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Salt Lake Direct Deposit Form for Chase, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Salt Lake Direct Deposit Form for Chase from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Salt Lake Direct Deposit Form for Chase:

- Take a look at the page content to make sure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the document when you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!