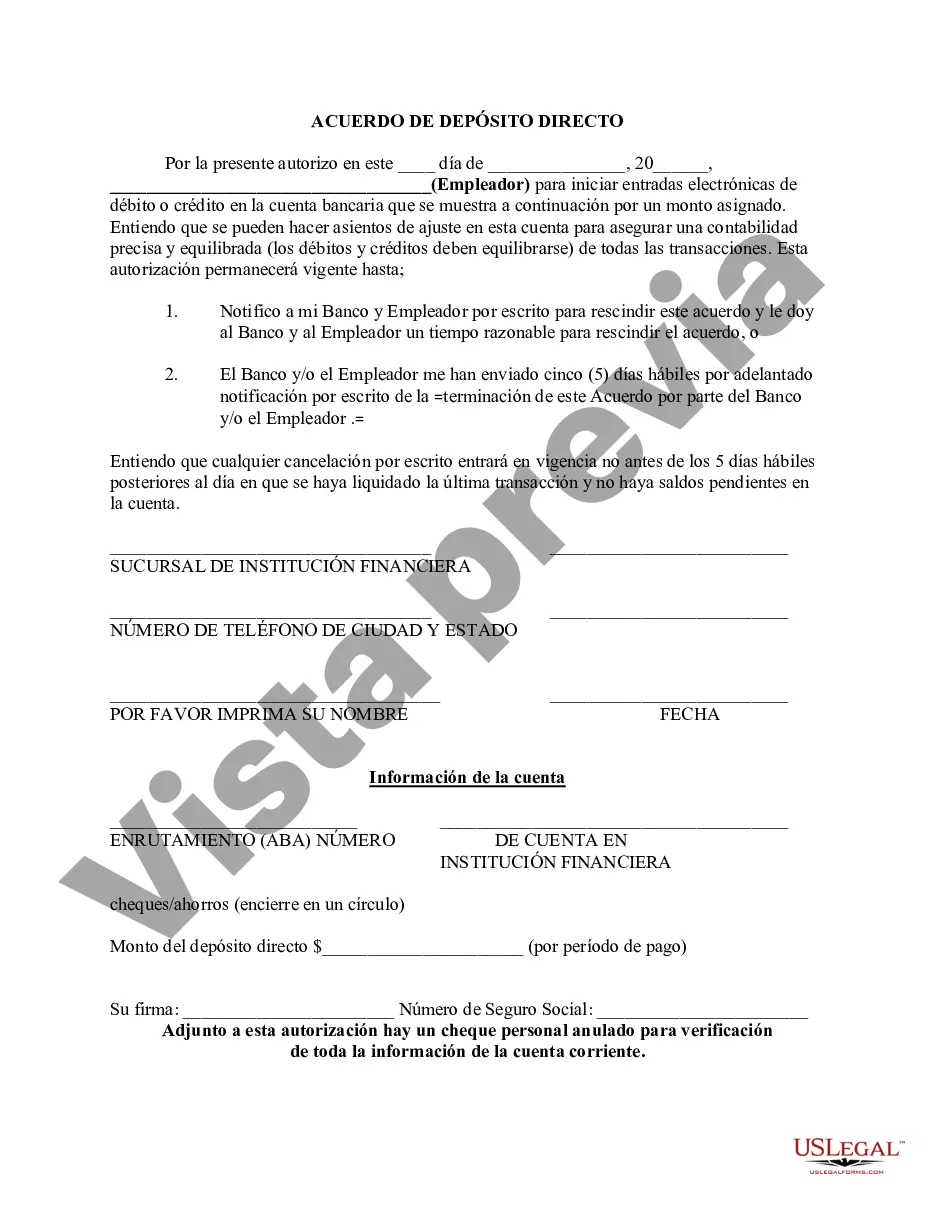

San Antonio, Texas, Direct Deposit Form for Chase: The San Antonio, Texas, Direct Deposit Form for Chase is an essential document that enables Chase bank customers in the San Antonio area to conveniently set up direct deposit for their banking transactions. Direct deposit is a secure and time-saving method that allows individuals to receive their earnings, including salaries, pensions, government benefits, or any regular payments, directly into their Chase bank accounts. By utilizing the San Antonio, Texas, Direct Deposit Form for Chase, customers can eliminate the hassle of physical checks and waiting in long lines to deposit funds manually. The form serves as an authorization, instructing the payer to directly deposit funds into the specified Chase account on a recurring basis. The San Antonio, Texas, Direct Deposit Form for Chase includes several sections that need to be filled out accurately. These typically include: 1. Personal Information: This section requires the account holder to provide their full legal name, address, contact details, and social security number to ensure proper identification. 2. Account Information: Here, individuals are required to enter their Chase bank account number and routing number. These details can be found on Chase bank statements or checks. 3. Deposit Details: This section requires specific information about the depositor, such as the name and address of the organization or employer initiating the direct deposit, along with their contact details. 4. Deposit Type: The form may also include options for different types of deposits, such as payroll, government benefits, dividends, or other sources of income. Customers can select the applicable deposit type based on their requirements. 5. Signature and Date: To finalize the process, the form typically includes a space for the account holder's signature and the date when the form is completed. It is important to note that while the general layout and content of the San Antonio, Texas, Direct Deposit Form are standard, there may be minor variations or updates based on Chase's internal policies or specific local requirements. Therefore, it is advisable to obtain the official form directly from a Chase branch in San Antonio or their website to ensure accuracy and compliance. Different types of San Antonio, Texas, Direct Deposit Forms for Chase may exist to cater to diverse banking needs. These can include forms tailored for specific industries, such as healthcare, education, or government services, where unique routing numbers or additional information may be required. Chase may also have different formats for personal and business accounts. It is always recommended consulting with a Chase representative or visit their website to obtain the appropriate form for a specific deposit type or account.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Formulario de depósito directo para Chase - Direct Deposit Form for Chase

Description

How to fill out San Antonio Texas Formulario De Depósito Directo Para Chase?

Whether you plan to open your business, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you need to prepare specific paperwork meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business case. All files are grouped by state and area of use, so opting for a copy like San Antonio Direct Deposit Form for Chase is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few additional steps to get the San Antonio Direct Deposit Form for Chase. Adhere to the guidelines below:

- Make certain the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Antonio Direct Deposit Form for Chase in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!