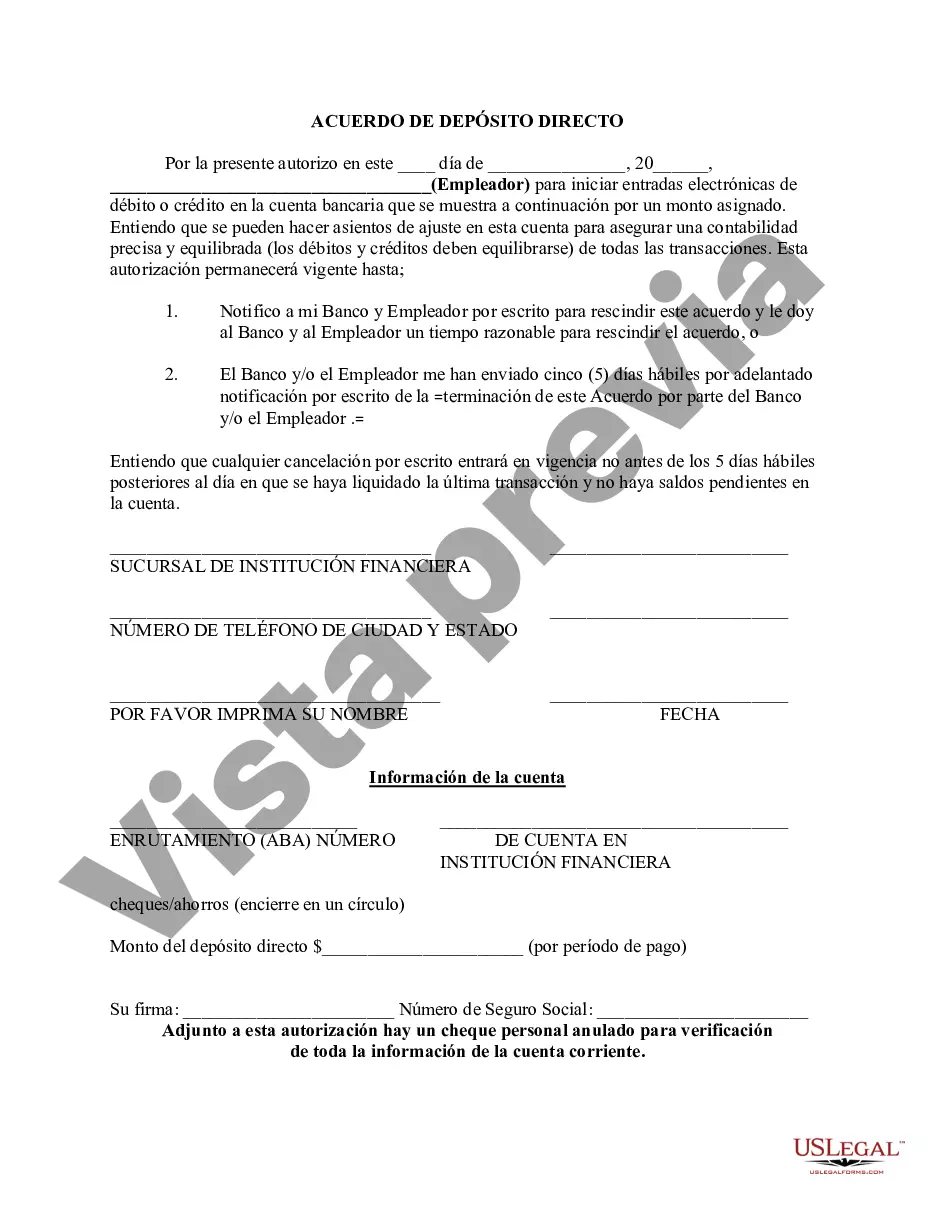

Chicago Illinois Direct Deposit Form for OAS is an essential document that allows individuals who receive the Old Age Security (OAS) benefits to securely receive their payments directly into their bank accounts, eliminating the need for physical checks or cash handling. This process ensures convenience, reliability, and timely payment transfers. The Chicago Illinois Direct Deposit Form for OAS is primarily used by OAS beneficiaries living within the designated Chicago, Illinois region. By filling out this form, individuals can authorize the government to deposit their OAS benefits directly into their bank accounts instead of receiving paper checks through traditional mail delivery methods. This form simplifies the payment process while also giving beneficiaries more control over how they access their funds. There are several types of Chicago Illinois Direct Deposit Form for OAS, each designed to accommodate different financial institutions and account types. Some common types include: 1. Regular Direct Deposit Form: This standard form is utilized by most OAS beneficiaries who hold personal checking or savings accounts at major banks or credit unions in Chicago, Illinois, allowing them to receive their OAS benefits electronically. 2. Joint Account Direct Deposit Form: Designed for OAS beneficiaries who share a joint bank account, this form requires signatures from all account holders to authorize the direct deposit of OAS payments. 3. Credit Union Direct Deposit Form: Specifically catered for individuals holding accounts at credit unions in Chicago, Illinois, this form streamlines the process of receiving OAS benefits by enabling electronic fund transfers between the government and credit union accounts. 4. Specialized Business Account Direct Deposit Form: Tailored for OAS beneficiaries who possess business accounts, this form enables direct deposits into their business checking accounts, ensuring seamless integration with their financial operations. Regardless of the type, the Chicago Illinois Direct Deposit Form for OAS typically requires individuals to provide their personal information, including Social Security Number, contact details, bank account number, and routing number. This information is vital to ensuring accurate and secure deposit transfers. It is important to note that the Chicago Illinois Direct Deposit Form for OAS is exclusive to OAS beneficiaries in the designated Chicago, Illinois region. Other regions and provinces in the United States may have their own specific forms, so it is crucial for individuals to utilize the appropriate form according to their place of residence. In conclusion, the Chicago Illinois Direct Deposit Form for OAS offers OAS beneficiaries residing in Chicago, Illinois a convenient and secure method of receiving their payments directly into their bank accounts. By eliminating the need for paper checks and offering different types tailored to various account situations, this form streamlines the payment process, ensuring reliable and timely fund transfers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Formulario de Depósito Directo para la OEA - Direct Deposit Form for OAS

Description

How to fill out Chicago Illinois Formulario De Depósito Directo Para La OEA?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Chicago Direct Deposit Form for OAS, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Chicago Direct Deposit Form for OAS from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Chicago Direct Deposit Form for OAS:

- Take a look at the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template when you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!