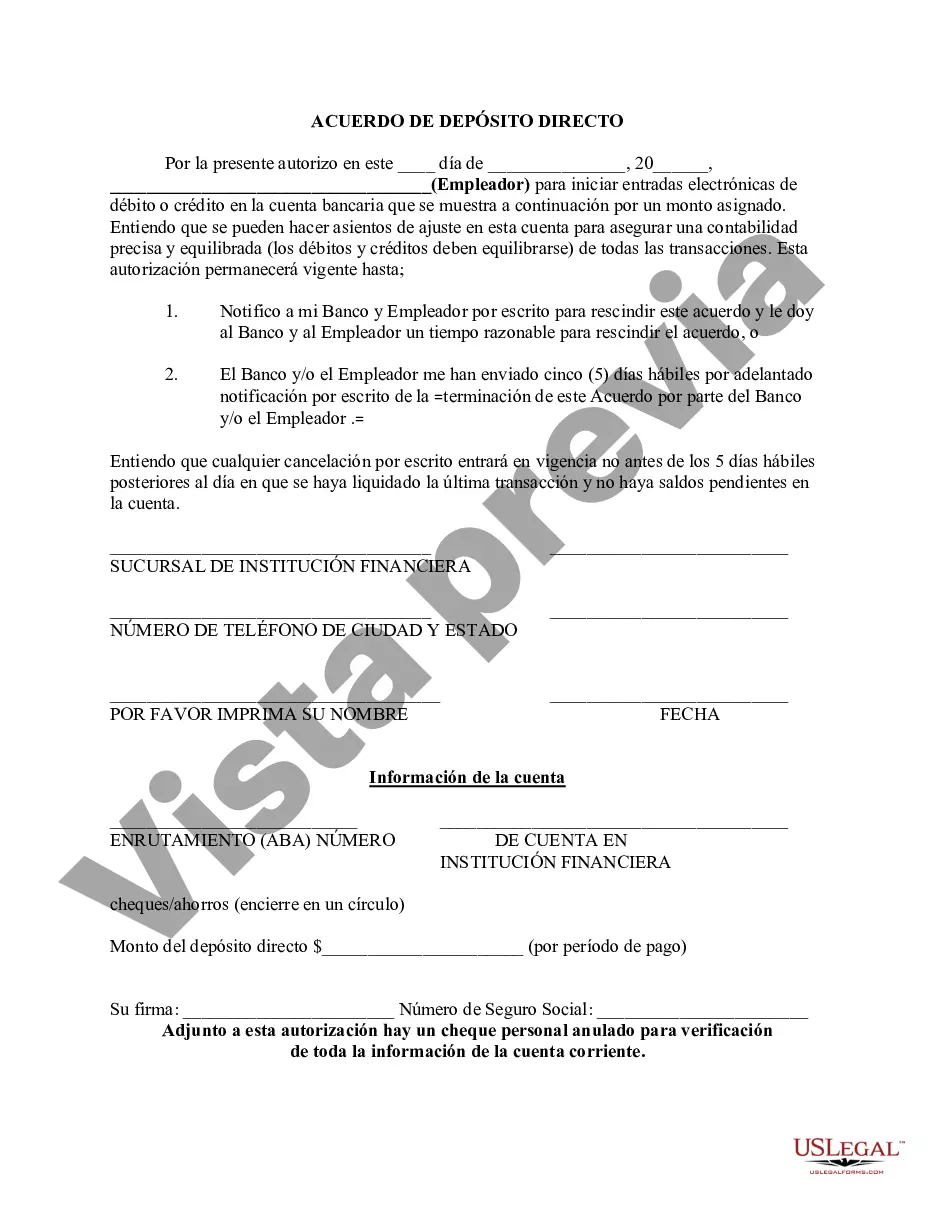

Chicago Illinois Formulario de depósito directo para cheque de estímulo - Direct Deposit Form for Stimulus Check

Description

How to fill out Formulario De Depósito Directo Para Cheque De Estímulo?

Drafting documents, such as the Chicago Direct Deposit Form for Stimulus Payment, to handle your legal matters is a challenging and time-consuming endeavor.

Numerous cases necessitate an attorney’s participation, which also renders this task quite expensive.

However, you can take your legal matters into your own hands and manage them independently.

Have you misplaced your document? No problem. You can locate it in the My documents section of your account - accessible on both desktop and mobile.

- US Legal Forms is here to assist.

- Our website offers more than 85,000 legal templates designed for various situations and life events.

- We ensure that every document adheres to the regulations of each state, relieving you of concerns regarding potential legal complications related to compliance.

- If you're already acquainted with our site and have a subscription with US, you are aware of how straightforward it is to obtain the Chicago Direct Deposit Form for Stimulus Payment form.

- Simply Log In to your account, download the form, and customize it to suit your needs.

Form popularity

FAQ

Pagar directamente desde una cuenta corriente o de ahorros (Pago directo) (solo para individuos). Pagar electronicamente en linea o por telefono utilizando el Sistema de Pago Electronico del Impuesto Federal (EFTPS, por sus siglas en ingles) (se requiere inscripcion). Pagar por cheque, giro o tarjeta de debito/credito.

Debe presentar una declaracion de impuestos federal de 2020 para solicitar un cheque de estimulo para su hogar. Si nunca ha presentado impuestos antes, tendra obtener un Numero de Identificacion Personal del Contribuyente (ITIN).

Usted es elegible para el Deposito Directo si se le debe un reembolso de impuestos federales y si usted tiene una cuenta financiera. Usted debe seleccionar Deposito Directo en su formulario de impuestos o software e incluir su numero de cuenta financiera y numero de ruta (routing number).

Los contribuyentes deben comunicarse con el IRS al 800-829-1040 o llamar al numero de telefono que figura en su factura o aviso para analizar otras opciones. Mas informacion: IRS.gov/Pagos. Solicitud electronica para el plan de pagos a plazos.

En general, los contribuyentes deben pagar al menos el 90 por ciento (sin embargo, vea el Alivio de Multas de 2018, a continuacion) de sus impuestos durante todo el ano mediante retenciones, pagos de impuestos estimados o adicionales, o una combinacion de ambos.

El IRS emite mas de nueve de cada diez reembolsos en menos de 21 dias. Los contribuyentes que utilizaron el deposito directo para sus declaraciones de impuestos tambien recibieron sus pagos de estimulo mas rapidamente.

Los contribuyentes deben pagar su impuesto sobre el ingreso federal a mas tardar el 17 de mayo de 2021, para evitar intereses y multas. El IRS insta a los contribuyentes a quienes se les debe un reembolso a presentar tan pronto como sea posible.

Asegurese de que su cheque o giro incluya la siguiente informacion: Su nombre y direccion. Numero de telefono durante el dia. Numero de Seguro Social (el numero de Seguro Social que muestre en primer lugar si es una declaracion conjunta) o numero de identificacion del empleador. Ano tributario.

En general, el IRS anticipa que la mayoria de los contribuyentes recibiran su reembolso dentro de los 21 dias posteriores a la presentacion electronica, el uso del deposito directo y si no hay problemas con su declaracion de impuestos.

Como cambiar de cheque en papel a deposito directo Lo hacen al ingresar su numero de ruta bancaria y numero de cuenta e indicar si es una cuenta corriente o de ahorros. El IRS insta a cualquier familia que reciba cheques a considerar cambiar a la velocidad y conveniencia del deposito directo.