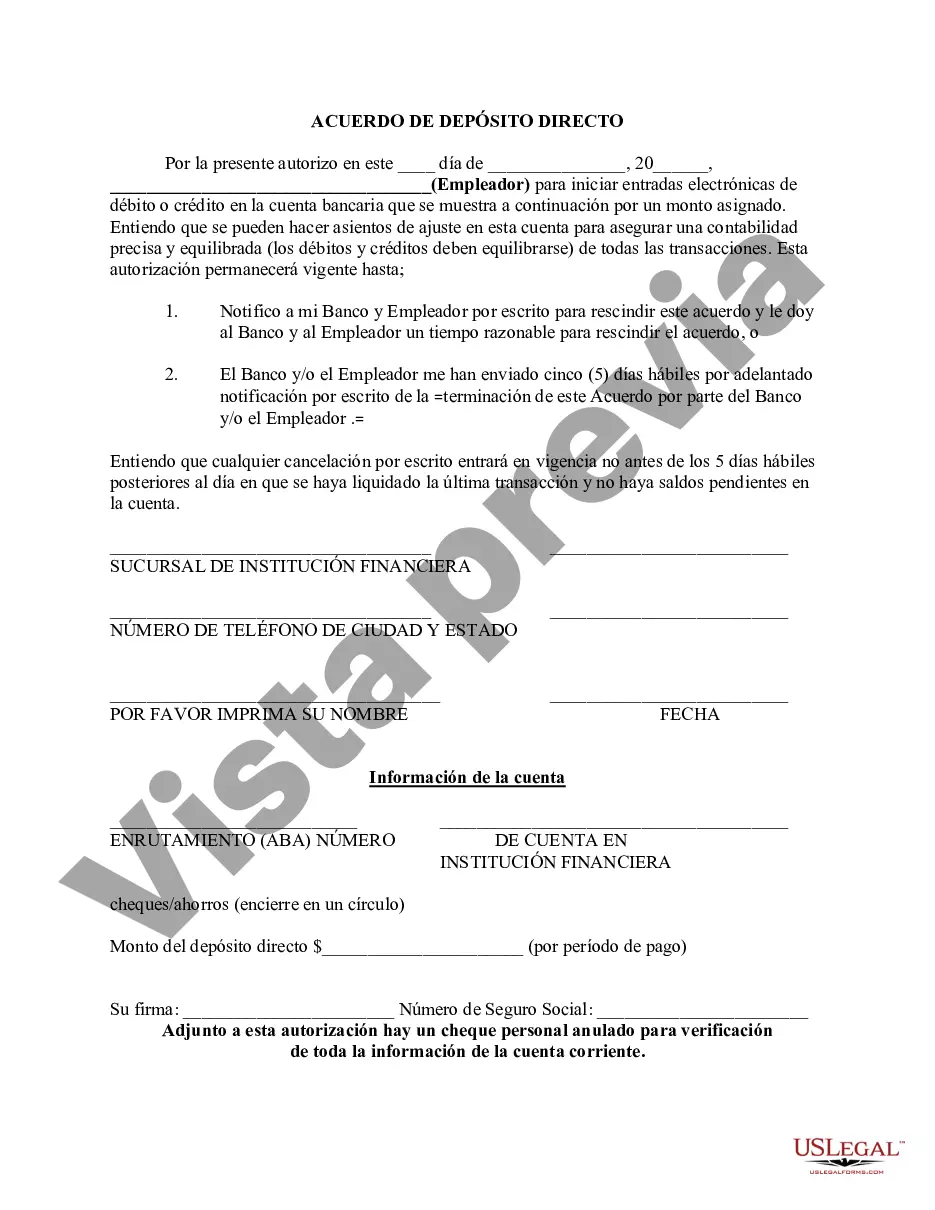

Title: Chicago, Illinois: Understanding the Direct Deposit Form for IRS Introduction: Chicago, Illinois, serves as a bustling hub and metropolis, attracting individuals and businesses from various sectors. To navigate the tax system efficiently, the Direct Deposit Form for IRS has become an essential tool for taxpayers in the Windy City. In this article, we will delve into the details of the Chicago, Illinois Direct Deposit Form for IRS, its significance, process, and explore any potential variations. Key Phrases/Keywords: Chicago, Illinois, Direct Deposit Form, IRS, tax system, taxpayers, Windy City, significance, process, variations. 1. Importance of the Chicago, Illinois Direct Deposit Form for IRS: The Chicago, Illinois Direct Deposit Form for IRS is a crucial document that allows taxpayers to receive their tax refunds or make payments electronically. This streamlined process ensures greater convenience, enhanced security, and faster transactions for residents of the city. 2. Understanding the Process: The Chicago, Illinois Direct Deposit Form for IRS simplifies the transaction process by allowing taxpayers to input their banking information accurately. This includes the account number and routing number of the financial institution where the refund or payment should be directed. The form eliminates the need for paper checks, promoting a more eco-friendly approach. 3. Benefits and Advantages: By utilizing the Chicago, Illinois Direct Deposit Form for IRS, taxpayers enjoy several advantages. Firstly, the electronic transfer minimizes the risk of mail-related delays, lost checks, or theft. Additionally, it enables taxpayers to have immediate access to funds without the hassle of depositing physical checks manually. 4. Potential Types of Chicago, Illinois Direct Deposit Form for IRS: While the core purpose and process of the Chicago, Illinois Direct Deposit Form for IRS remain consistent, there may be variations concerning the specific form used for different tax-related circumstances. Common types of Chicago, Illinois Direct Deposit Forms for IRS include: a. Tax Refund Direct Deposit Form: This form is used to receive tax refunds directly into a taxpayer's bank account. b. Estimated Tax Payment Direct Deposit Form: Suited for self-employed individuals or those who make quarterly estimated tax payments, this form allows direct deposit of their payments to the IRS. c. Business Tax Direct Deposit Form: Designed for businesses, this form facilitates IRS transactions related to payroll taxes, corporate taxes, or other tax obligations. Conclusion: The Chicago, Illinois Direct Deposit Form for IRS is a vital tool for taxpayers in the Windy City. By leveraging this form, individuals and businesses can effortlessly receive tax refunds or make payments securely and promptly. It eliminates the reliance on physical checks, ensuring electronic deposits that expedite transactions and reduce the risk of potential issues. Note: The exact types of Chicago, Illinois Direct Deposit Forms for IRS may vary based on the IRS's updates and requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Formulario de depósito directo para el IRS - Direct Deposit Form for IRS

Description

How to fill out Chicago Illinois Formulario De Depósito Directo Para El IRS?

Preparing documents for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft Chicago Direct Deposit Form for IRS without expert assistance.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Chicago Direct Deposit Form for IRS on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Chicago Direct Deposit Form for IRS:

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that suits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any situation with just a few clicks!

Form popularity

FAQ

El IRS emite mas de nueve de cada diez reembolsos en menos de 21 dias. Los contribuyentes que utilizaron el deposito directo para sus declaraciones de impuestos tambien recibieron sus pagos de estimulo mas rapidamente.

Como cambiar de cheque en papel a deposito directo Lo hacen al ingresar su numero de ruta bancaria y numero de cuenta e indicar si es una cuenta corriente o de ahorros. El IRS insta a cualquier familia que reciba cheques a considerar cambiar a la velocidad y conveniencia del deposito directo.

Si enviaste tu declaracion por correo y optaste por recibir un cheque de papel, tendras que esperar hasta unas ocho semanas para que llegue.

En general, los contribuyentes deben pagar al menos el 90 por ciento (sin embargo, vea el Alivio de Multas de 2018, a continuacion) de sus impuestos durante todo el ano mediante retenciones, pagos de impuestos estimados o adicionales, o una combinacion de ambos.

Pagar directamente desde una cuenta corriente o de ahorros (Pago directo) (solo para individuos). Pagar electronicamente en linea o por telefono utilizando el Sistema de Pago Electronico del Impuesto Federal (EFTPS, por sus siglas en ingles) (se requiere inscripcion). Pagar por cheque, giro o tarjeta de debito/credito.

Averigue si el IRS recibio su declaracion de impuestos Use la herramienta para verificar el estado de su reembolso del Servicio de Impuestos Internos (IRS, sigla en ingles) Llame al IRS al 1-800-829-1040 (presione 2 para espanol).Chequee la informacion de su cuenta del IRS.

Asegurese de que su cheque o giro incluya la siguiente informacion: Su nombre y direccion. Numero de telefono durante el dia. Numero de Seguro Social (el numero de Seguro Social que muestre en primer lugar si es una declaracion conjunta) o numero de identificacion del empleador. Ano tributario.

Los contribuyentes deben pagar su impuesto sobre el ingreso federal a mas tardar el 17 de mayo de 2021, para evitar intereses y multas. El IRS insta a los contribuyentes a quienes se les debe un reembolso a presentar tan pronto como sea posible.

El pagador llena una forma con los detalles necesarios y envia una copia al IRS, reportando pagos hechos durante el ano. En algunos casos, se debe enviar una copia tu agencia tributaria estatal. El pagador es responsable de llenar el Formulario 1099 apropiado y enviartelo a ti.

Usted es elegible para el Deposito Directo si se le debe un reembolso de impuestos federales y si usted tiene una cuenta financiera. Usted debe seleccionar Deposito Directo en su formulario de impuestos o software e incluir su numero de cuenta financiera y numero de ruta (routing number).