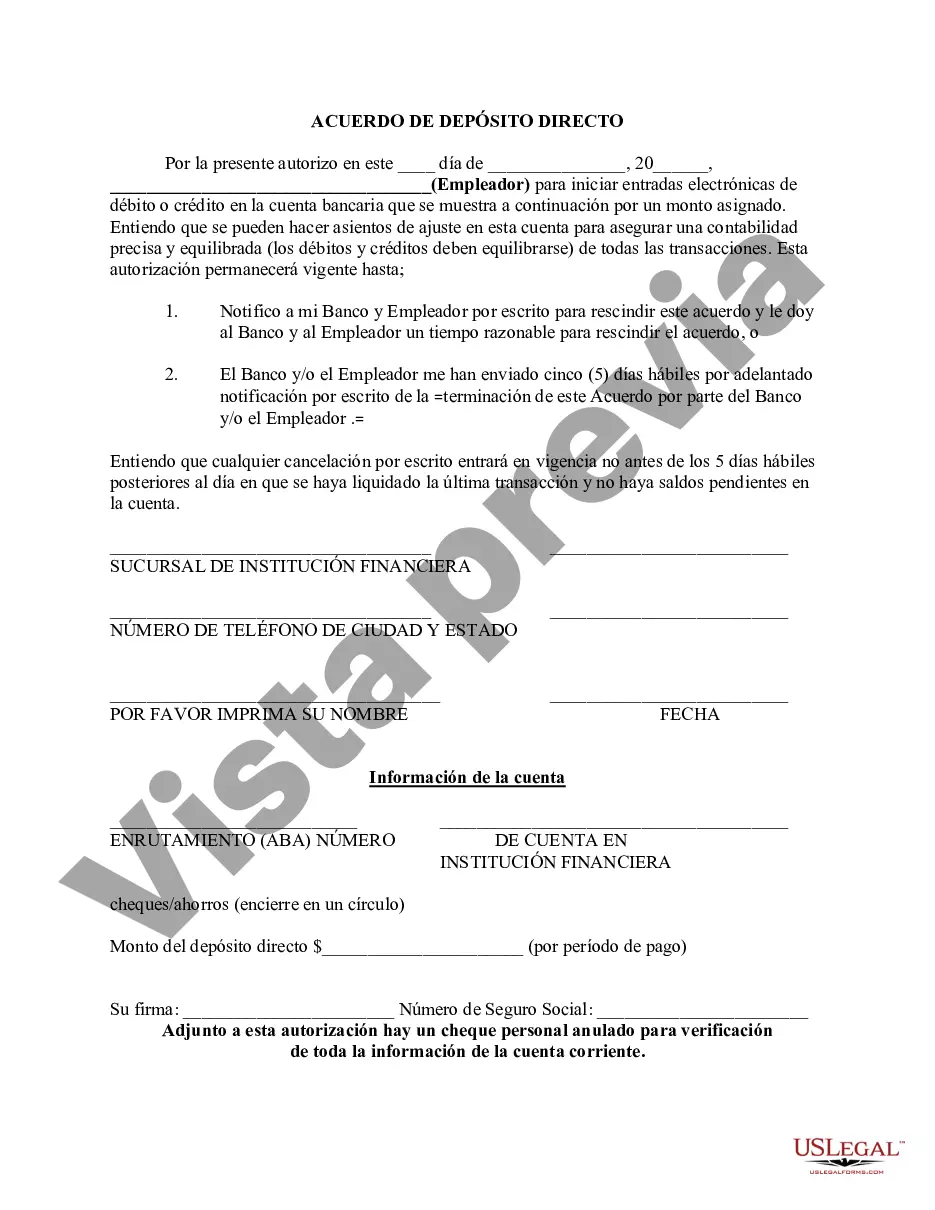

Collin Texas Direct Deposit Form for IRS is a specific form that individuals residing in Collin County, Texas need to fill out in order to provide their banking information to the Internal Revenue Service (IRS) for the purpose of direct deposit. The direct deposit method allows taxpayers to receive their tax refunds or any other IRS payments directly into their bank accounts, eliminating the need for paper checks or manual transactions. The Collin Texas Direct Deposit Form for IRS ensures a secure and convenient way to receive funds, as the IRS can directly deposit the amount owed to the taxpayer's specified bank account. By choosing direct deposit, individuals can expect to receive their tax refunds more quickly, usually within a few weeks, compared to waiting for a paper check to arrive in the mail. While there may not be different types of Collin Texas Direct Deposit Form for IRS, it is essential to use the correct form specified for tax-related purposes in Collin County, Texas. The IRS provides a standard form called Form 8888 — Allocation of Refund (Including Savings Bond Purchases) which is used nationwide to set up direct deposit of tax refunds. However, it is recommended to consult the Collin County Tax Office or the IRS website to ascertain any specific local requirements or additional forms that may be necessary when submitting the Collin Texas Direct Deposit Form for IRS. Keywords: Collin Texas, direct deposit, form, IRS, tax refund, banking information, secure, convenient, Collin County Tax Office, Form 8888, local requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Como Redactar Una Carta Para El Irs - Direct Deposit Form for IRS

Description

How to fill out Collin Texas Formulario De Depósito Directo Para El IRS?

If you need to find a trustworthy legal form supplier to find the Collin Direct Deposit Form for IRS, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of learning resources, and dedicated support make it easy to get and complete various paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply type to look for or browse Collin Direct Deposit Form for IRS, either by a keyword or by the state/county the document is created for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Collin Direct Deposit Form for IRS template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be immediately ready for download once the payment is completed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less costly and more affordable. Create your first business, arrange your advance care planning, create a real estate contract, or complete the Collin Direct Deposit Form for IRS - all from the convenience of your sofa.

Join US Legal Forms now!