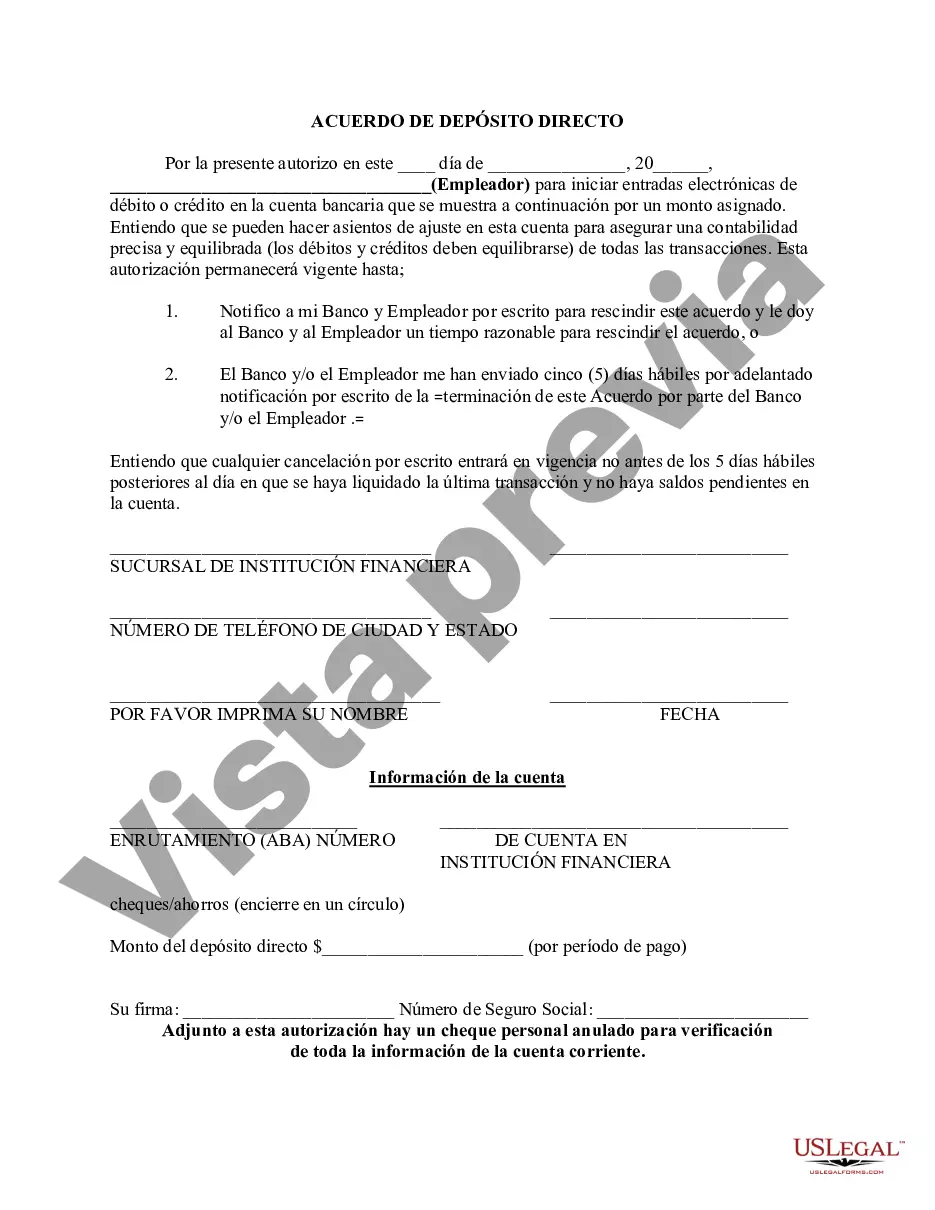

Dallas Texas Direct Deposit Form for IRS is a crucial document used to facilitate taxpayer refunds through electronic means. It allows individuals or businesses in Dallas, Texas, to securely provide their bank information to the Internal Revenue Service (IRS) for direct deposits. Direct deposit ensures quick and convenient transactions, eliminating the need for paper checks. The Dallas Texas Direct Deposit Form for IRS offers different types depending on the purpose of the deposit. Here are some commonly used forms related to IRS direct deposit in Dallas, Texas: 1. Form 8888: This form allows taxpayers to split their refunds into multiple accounts (up to three) or to allocate their refund towards purchasing US savings bonds. 2. Form 8889: Specifically tailored for taxpayers with Health Savings Accounts (HSA), this form allows them to request direct deposit of HSA distributions or tax refunds into their HSA. 3. Form 9465: This installment agreement request form authorizes the IRS to directly withdraw monthly installment payments from a taxpayer's bank account, known as a Direct Debit Installment Agreement. 4. Form 8821: Although not directly related to direct deposit, it enables taxpayers to designate a third party (such as a tax professional) to receive copies of their tax notices and correspondences. This form can be helpful when seeking assistance for direct deposit processes related to IRS refunds. By utilizing the Dallas Texas Direct Deposit Form for IRS, taxpayers can enjoy an array of benefits. The direct deposit service eliminates the hassle of waiting for and cashing physical checks. Additionally, it minimizes the chance of checks getting lost in the mail or delayed due to incorrect mailing addresses. Taxpayers can expect faster refunds, with the IRS typically depositing funds within 21 days of receiving an accurate and complete tax return. To complete the form, taxpayers are required to provide their personal information, such as name, address, and social security number. Additionally, they must accurately enter their bank account details, ensuring that the routing and account numbers are correct to avoid any delays or errors. In conclusion, the Dallas Texas Direct Deposit Form for IRS is an essential tool for taxpayers residing in Dallas, Texas, who want to receive their tax refunds electronically. It offers various types, including Form 8888 for splitting refunds, Form 8889 for HSA-related transactions, Form 9465 for installment agreements, and Form 8821 to authorize third-party access to tax notices. Utilizing direct deposit streamlines the refund process, providing convenience, security, and speed for taxpayers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Formulario de depósito directo para el IRS - Direct Deposit Form for IRS

Description

How to fill out Dallas Texas Formulario De Depósito Directo Para El IRS?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare formal documentation that differs throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any individual or business objective utilized in your county, including the Dallas Direct Deposit Form for IRS.

Locating templates on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Dallas Direct Deposit Form for IRS will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to get the Dallas Direct Deposit Form for IRS:

- Ensure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Dallas Direct Deposit Form for IRS on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!